how to buyauto insurance

for 18 year olds

With the teenage years comes many firsts, like first jobs, dates, school dances and a lot more. Of course, there is also the first car, which is going to need to be insured.

Unfortunately, when you are a young driver or buying insurance to cover a young driver, you may be subjected to higher insurance rates, because insurance companies consider teen drivers a bigger risk to insure.

If you are looking to buy auto insurance for an 18 year old, or any teenager, you should shop around to make sure you are getting the best deals, as prices tend to fluctuate for this age range.

Why are Younger Drivers So Hard to Insure?

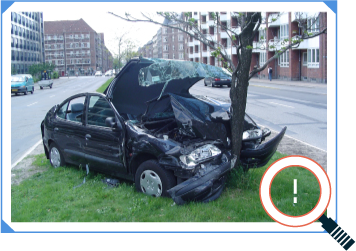

The main reason why it is so expensive to buy insurance for teenagers is because they lack the driving experience that older drivers have. Of course, just because a driver is young does not mean that they are going to be a dangerous or irresponsible driver, but insurance companies consider the demographic high-risk first and foremost. Getting them to look past things like accident rates, crashes, and other implications for young drivers isn’t really an option.

The problem is that teenage drivers have to be able to prove that they are good drivers, and without having years of experience on the road for insurance companies to examine, this can be quite difficult to do. It is difficult to locate a cheap car insurance rate without much of a driving history.

How to Save Money on Auto Insurance

There are some actions that teen drivers can take to lower their auto insurance premiums:

-

Take a driver’s education class

One of the first things a teen should do is take a driver training course. If these programs are not offered at the young driver’s high school, then you can contact your local Department of Motor Vehicles to find out where you can take the course. These courses teach you how to drive safely and defensively, and help give you the tools to navigate the road with other experienced drivers.

Being able to show a completed driver’s education course can help you save money when you want to buy auto insurance for an 18-year-old driver.

-

Use your parents’ insurance

If possible, a young driver should forego a separate policy and have their name added to their parents’ auto insurance policy. If a teen is going to be driving their own vehicle, make sure that your insurance covers the basic minimum amount of liability that is required by the state, as well as additional coverage if possible. More than likely, the teen will enjoy the same coverage that their parents enjoy.

If the young driver is just going to be driving one of their parents’ vehicles for the time being, the teen just needs to make sure they are named on the policy. Not only will this help whoever is paying for the coverage save money now, but it will also help when it comes time for the teen to get auto insurance in their own name, because they will have already had insurance coverage.

-

Buy a “safe” vehicle

The safer the vehicle you own, the less expensive your insurance rates are going to be. If a young driver is driving around in a flashy sports car, this is not going to be good for your rates. This is because the sportier the vehicle, the more expensive insurance coverage is going to be. Insurance for teen drivers is already fairly sparse when it comes to affordable prices, so you will most likely want an effective, but cheap vehicle to ensure you find the cheapest insurance available.

It is much less expensive to have a sensible sedan than a two-door model that reaches high speeds. You may not look as cool, but you will feel pretty cool when you have more money than your friends do because you are saving money on your insurance premiums. Vehicle type isn’t always an indicator of someone’s driving habits, but some vehicles are considered better for safe driving. Typically though, an expensive vehicle will save less overall on the cost of auto insurance.

-

Get good grades

Many insurance companies will offer discounts for students to those who maintain a certain grade level. So by staying focused and doing well in school, a teenager is not only helping their future college prospects, but they are also getting good auto insurance rates because of the offered discount for students. Maintaining good grades can ensure you have an affordable option when it’s time to address insurance costs.

-

Be a safe driver

If a driver gets their driver’s license at 16, then by the time they are 18, they have had two years of driving experience. As long as they have been able to maintain a clean record, that will help them prove to insurance companies that they have safe driving habits.

As a person gets older and ages out of this higher risk age group, you can expect cheaper insurance rates, because the driver will have more experience on the road.

Setting the Ground Rules

If you are a parent, you need to set certain ground rules for your teenager’s driving. When you want to buy auto insurance for 18 year olds, you need to make sure that you are not going to be wasting your money.

After all, your teen’s driving record and driving behaviors directly impact their insurance rates, and if you are paying to insure them then you may need to set some guidelines.

Here are some of the ways that you can help keep them safer while they are on the road:

Make sure they have plenty of road experience with a licensed driver before allowing them to be on the roads alone.

Enroll them in an approved driver training program so you know that they understand all of the rules of the road, and that they have the skills needed to anticipate and avoid accidents whenever possible.

Depending on the age of your teens, set curfews. Some counties and cities have their own curfew laws for new drivers. For example, in some areas, drivers between the ages of 16 and 18 cannot drive between the hours of midnight and 5 a.m. unless accompanied by a parent, guardian, or instructor.

Getting Good Insurance Rates for Young Drivers

Not all insurance companies offer the same products, rates, and insurance discounts, and it pays to shop around when you are going to buy auto insurance for an 18 year old.

You can get all kinds of free quotes online. If you fill out a short form letting us know what your particular insurance needs are, we can find and compare quotes from insurance providers near you. It only takes a few minutes, and you will find out which insurers in your area offer the best discounts for young drivers.