Third-Party

auto insurance

What is third-party car insurance?

| Things to Know | Source |

|---|---|

| Average rates for third party liability coverage are $40.66/mo or $487.88/yr | National Association of Insurance Commissioners |

| Minimum liability insurance is required in 47 states, but coverage levels vary by state | Insurance Information Institiute |

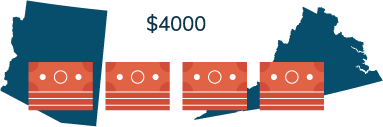

| New Hampshire, Arizona, and Virginia are the only state that do not require at least minimum liability coverage to legally drive, but you are still required to provide proof of financial responsibility | New Hampshire Department of Safety Division of Motor Vehicles, Arizona Department of Vehicle Insurance, Virginia Department of Motor Vehicles |

What is car insurance from a third party? Third-party auto insurance is the most basic form of car insurance, also known as third-party liability insurance. It is mandated (in some form) in almost every state of the U.S.

Third-party insurance protects individuals against the claims of another. You (the first party) purchase insurance through the insurance company (the second party), who will cover expenses when another person makes a claim against you (the third party).

If you’re wanting to buy third-party auto insurance online or want to learn more about 3rd-party car insurance claims or the claims process, keep reading. Knowing how to buy an auto insurance policy will save you a lot of trouble and money.

Third-party insurance covers you for the damage you cause (property or physical) to other drivers; it will pay for the medical coverage of the passengers and drivers of vehicles you damage, as well as the cost of the repairs to the vehicle you damaged.

Ready to find affordable third-party auto insurance rates? Enter your ZIP code above to use our free insurance quote comparison tool.

How does third-party auto insurance affect your coverage?

So you know third-party car insurance is required in most cases, but what does third-party car insurance cover? How does third-party car insurance work? What is the best third-party car insurance for your vehicle? Can you buy third-party insurance for a car online? Read through the next few sections to find out more.

What types of coverage does liability insurance include?

Bodily injury liability coverage – This covers pain and suffering as a result of medical bills, lost wages, and expenses as a result of the accident. It can also cover funeral expenses if the accident resulted in fatalities.

Property damage coverage – This covers the expenses accrued in repairing cars or other property damaged as a result of a collision in which you were at fault.

What’s not covered by third-party auto insurance?

Naturally, when we’re looking at what third-party insurance does cover, it’s also important to consider what is not covered. The three most important aspects of any accident that are not covered by third-party insurance are:

Is physical damage to your own car covered?

Unless the other driver is at fault and has insurance, you will not receive any money from insurance to have your own car repaired.

Third-party insurance will only pay out to a third party, and not to you. If you crash and there is not another driver involved (i.e. if you back into a tree or skid off the road), or if you cause an accident, then you will bear the full brunt of the costs.

Are medical payments and personal injury protection offered?

Like with physical damage, you are not covered personally by third-party insurance. That means that if you incur large medical expenses as a result of the physical injuries, you will need to pay them fully out of pocket (again, unless the accident was caused by someone else and they have third-party insurance).

Are uninsured motorist collisions covered?

Unfortunately, not all drivers have insurance, and some are uninsured. If someone hits you without insurance, you won’t receive any money from your third-party insurance company to cover the need for physical damage or medical expenses.

What is the cost of third-party auto insurance?

Just like with traditional car insurance, your rates will vary based on a number of factors, including what coverage level you choose and your driving history.

The very nature of third-party car insurance means that you will save money since you are only choosing liability coverage. Alternatives to liability-only coverage include collision, comprehensive, personal injury protection, and uninsured motorist coverages.

What are the requirements to get third-party auto insurance?

There are no significant differences in requirements to sign up for third-party insurance. Just like with traditional car insurance, you will have to provide your information, your vehicle information, and information for any additional drivers. Your rates will be based on the same factors as regular auto insurance, such as age, gender, and where you live.

Does financing a car require more than third-party insurance coverage?

Although it can be tempting to examine third-party car insurance as an option, you should also check what you are legally required to have. If you finance your car (such as with a lease or car loan), you will usually need more than just third-party insurance. How do you check third-party car insurance and the information regarding your policy? Contact your insurer.

The financing company wants to make sure that the car won’t be totaled without you being able to afford repairs, so they will usually demand collision car insurance.

Also, if you are planning on driving for a ride-share company, you may have to have more advanced insurance (although this varies among providers). Certainly, it is advisable if you have plans to transport passengers, due mainly to potential medical costs in the case of an accident for which you are deemed at fault.

What are the benefits of third-party auto insurance?

There are certainly pros and cons of third-party insurance. It will depend on your own personal circumstances, including how and why you use your car, as well as your financial situation. It’s worth fully examining both sides before you determine what the best option is for you:

Is auto insurance a legal requirement?

Naturally, the first thing to consider is what the legal requirement is for insurance. As mentioned above, financed vehicles and ride-share companies may have some requirements for you to have additional insurance. However, you should also check what each state requires as its minimum levels of coverage.

New Hampshire is the only U.S. state that does not require you to buy car insurance in order to drive, although it does demand that you are financially responsible enough to compensate those whom you injure and repair any damage.

-

- In effect, therefore, you will need to buy third-party insurance in NH unless you have extensive savings, and even then, you may be better off hedging by buying insurance.

-

Similarly, Arizona and Virginia require insurance unless you post a bond payment instead of insurance ($40,000 in Arizona).

Most states have a 25/50/25 rule, meaning you have to carry the following:

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $25,000 property damage liability per accident

The minimum varies from state to state, so be sure to check with your own state’s Department of Motor Vehicles to find the actual limits for your own state.

Will third-party auto insurance save you money?

Having third-party liability insurance is far cheaper than having any other form of insurance, such as collision or comprehensive. According to the National Association of Insurance Commissioners, the average savings of someone taking out third-party online insurance versus more comprehensive coverage is 50 percent or an average of $500 per year.

Of course, the low rates stem from a reduced amount of coverage, meaning that your insurer will pay fewer claims. However, if you’re looking purely at the cost, then taking out third-party-only is the best way to lower your auto insurance rates.

Take a look at this table to see the average cost to buy liability auto insurance coverage in each state, along with the minimum requirements in each state, as described by the Insurance Information Institute.

Minimum Liability Auto Insurance Requirements and Average Rates by State

| States | Insurance Required in the State | Minimum Liability Limits Required by the State | Average Annual Liability Insurance Rates in the State | Average Monthly Liability Insurance Rates in the State |

|---|---|---|---|---|

| North Dakota | BI & PD Liab, PIP, UM, UIM | 25/50/25 | $282.55 | $23.55 |

| South Dakota | BI & PD Liab, UM, UIM | 25/50/25 | $289.04 | $24.09 |

| Iowa | BI & PD Liab | 20/40/15 | $293.34 | $24.45 |

| Wyoming | BI & PD Liab | 25/50/20 | $323.38 | $26.95 |

| Maine | BI & PD Liab, UM, UIM, Medpay | 50/100/25 | $333.92 | $27.83 |

| Idaho | BI & PD Liab | 25/50/15 | $337.17 | $28.10 |

| Vermont | BI & PD Liab, UM, UIM | 25/50/10 | $340.98 | $28.42 |

| Kansas | BI & PD Liab, PIP | 25/50/25 | $342.33 | $28.53 |

| Nebraska | BI & PD Liab, UM, UIM | 25/50/25 | $349.07 | $29.09 |

| North Carolina | BI & PD Liab, UM, UIM | 30/60/25 | $357.59 | $29.80 |

| Wisconsin | BI & PD Liab, UM, Medpay | 25/50/10 | $359.84 | $29.99 |

| Indiana | BI & PD Liab | 25/50/25 | $372.44 | $31.04 |

| Alabama | BI & PD Liab | 25/50/25 | $372.57 | $31.05 |

| Ohio | BI & PD Liab | 25/50/25 | $376.16 | $31.35 |

| Arkansas | BI & PD Liab, PIP | 25/50/25 | $381.14 | $31.76 |

| Montana | BI & PD Liab | 25/50/20 | $387.77 | $32.31 |

| New Hampshire | FR only | 25/50/25 | $393.24 | $32.77 |

| Tennessee | BI & PD Liab | 25/50/15 | $397.73 | $33.14 |

| Missouri | BI & PD Liab, UM | 25/50/25 | $399.41 | $33.28 |

| Virginia | BI & PD Liab, UM, UIM | 25/50/20 | $413.12 | $34.43 |

| Illinois | BI & PD Liab, UM, UIM | 25/50/20 | $430.54 | $35.88 |

| Mississippi | BI & PD Liab | 25/50/25 | $437.38 | $36.45 |

| Minnesota | BI & PD Liab, PIP, UM, UIM | 30/60/10 | $439.58 | $36.63 |

| Oklahoma | BI & PD Liab | 25/50/25 | $441.57 | $36.80 |

| Hawaii | BI & PD Liab, PIP | 20/40/10 | $458.49 | $38.21 |

| New Mexico | BI & PD Liab | 25/50/10 | $462.21 | $38.52 |

| California | BI & PD Liab | 15/30/5 | $462.95 | $38.58 |

| Utah | BI & PD Liab, PIP | 25/65/15 | $471.26 | $39.27 |

| Colorado | BI & PD Liab | 25/50/15 | $477.10 | $39.76 |

| Arizona | BI & PD Liab | 15/30/10 | $488.59 | $40.72 |

| Georgia | BI & PD Liab | 25/50/25 | $490.64 | $40.89 |

| Pennsylvania | BI & PD Liab, PIP | 15/30/5 | $495.02 | $41.25 |

| South Carolina | BI & PD Liab, UM, UIM | 25/50/25 | $497.50 | $41.46 |

| Texas | BI & PD Liab, PIP | 30/60/25 | $498.44 | $41.54 |

| West Virginia | BI & PD Liab, UM, UIM | 25/50/25 | $501.44 | $41.79 |

| Kentucky | BI & PD Liab, PIP, UM, UIM | 25/50/25 | $518.91 | $43.24 |

| Alaska | BI & PD Liab | 50/100/25 | $547.34 | $45.61 |

| Oregon | BI & PD Liab, PIP, UM, UIM | 25/50/20 | $553.43 | $46.12 |

| Washington | BI & PD Liab | 25/50/10 | $568.92 | $47.41 |

| Massachusetts | BI & PD Liab, PIP | 20/40/5 | $587.75 | $48.98 |

| Maryland | BI & PD Liab, PIP, UM, UIM | 30/60/15 | $599.48 | $49.96 |

| District of Columbia | BI & PD Liab, UM | 25/50/10 | $628.09 | $52.34 |

| Connecticut | BI & PD Liab, UM, UIM | 25/50/20 | $633.95 | $52.83 |

| Nevada | BI & PD Liab | 25/50/20 | $647.07 | $53.92 |

| Rhode Island | BI & PD Liab | 25/50/25 | $720.06 | $60.01 |

| Michigan | BI & PD Liab, PIP | 20/40/10 | $722.04 | $60.17 |

| Louisiana | BI & PD Liab | 15/30/25 | $727.15 | $60.60 |

| Delaware | BI & PD Liab, PIP | 25/50/10 | $776.50 | $64.71 |

| New York | BI & PD Liab, PIP, UM, UIM | 25/50/10 | $784.98 | $65.42 |

| Florida | PD Liab, PIP | 10/20/10 | $845.05 | $70.42 |

| New Jersey | BI & PD Liab, PIP, UM, UIM | 15/30/5 | $865.55 | $72.13 |

Read more:

- Buy Cheap Delaware Auto Insurance

- Buy Cheap Hawaii Auto Insurance

- Buy Cheap Idaho Auto Insurance

- Buy Cheap Iowa Auto Insurance

- Buy Cheap Kentucky Auto Insurance

To help clarify the acronyms and abbreviations in the table, we’ve defined them below.

Minimum Liability Coverage Acronyms and Abbreviations

| Abbreviations | Meanings |

|---|---|

| BI | Bodiliy Injury |

| PD | Property Damage Liability |

| PIP | Personal Injury Protection |

| UM | Uninsured Motorist |

| UIM | Underinsured Motorist |

Make sure you meet at least the minimum requirements for auto insurance in your state to avoid penalties.

Does the type of car you drive affect your third-party auto insurance rates?

If you have a cheaper car, then having third-party only insurance may actually make financial sense. As a rule, look up the value of your car using an online service (it’s advised that you do this across at least two sites so that you have a range of options).

If the annual rate for comprehensive and collision insurance comes to more than 10 percent of the total value of the vehicle (if you were to sell it tomorrow) then you should only get third-party insurance. It’s simply not worth the added cost if you are not likely to require a major claim.

If you drive an older or a cheaper car and have savings that you could use to replace the vehicle with little financial burden, then third-party insurance may be a solid choice.

Will third-party auto insurance cover your car if it is totaled or stolen?

You may wonder what to do if your car is stolen or totaled. If you have full coverage auto insurance (i.e. comprehensive and collision) and your car is totaled or stolen, car insurance companies will pay out the full value of the car, which can allow you to pay off any loans, or buy a new car.

If you carry third-party liability insurance only, or have added collision and not comprehensive, theft will not be covered.

However, if your car has little financial value, the need for a full refund may not be worth the additional monthly payments. Think about what you would do if you lost your car suddenly – depending on how desperate your situation would be, you should consider whether you need the full insurance package.

Read more: 10 Most Stolen Vehicles in America

Will raising your deductible save you money on auto insurance?

If you have a solid driving history, with few or no accidents, then you could raise your auto insurance deductible by $1,000, remove collision coverage, and put the amount saved in a savings account for use if you have an accident.

The amount your rate will decrease by will, after a few years of doing this, normally be enough to buy a second-hand car that will keep you on the road if your car is totaled. If you’re an above-average driver (i.e. have had no claims in the past five years), you should consider this to be a viable option.

What are the downsides of third-party auto insurance?

If you do decide to cut your insurance coverage, you will (of course) be losing out on a wide range of insurance benefits. You should give serious consideration to whether the downsides are worthwhile.

Although it may seem tempting to save money in the short-term, if you do experience an accident, you will lose money, and often a lot of money, compared to having more extensive insurance.

Will third-party auto insurance cover repairs to your own car?

Probably the biggest omission that comes from cutting your car insurance down to third-party liability only is the fact that a third-party car insurance company will not pay for repairs to your car. This can make an accident a major financial penalty.

In 2013, the average claim for property damage from a car accident was $3,231. This is money that someone with collision insurance would receive, but someone with third-party liability only would not. Even more dramatically, the average claim for bodily injury was $15,443.

-

- Before you think about cutting your own insurance, you should give serious consideration to whether you could cover these amounts from your savings.

-

Will you be responsible for getting higher levels of auto insurance in a no-fault system?

The particular legal system within your own state will also play a major role in shaping the potential downsides of having third-party only insurance. There are two types of states when it comes to car insurance:

- Tort

- No-Fault

In a tort system, the driver who is found to be at fault pays for all damages. If you have third-party insurance and you are at fault, your insurance will cover all parts of the other driver’s damages (although, again, you personally will not receive any money).

No-fault states like Michigan generally require higher levels of insurance coverage as a result, although you should check your own state laws (on the DMV website) to see if this is potentially an option for you. (For more information, read our “Buying Michigan No-Fault Auto Insurance: What You Need To Know“)

Are passengers covered with third-party auto insurance?

If you regularly travel with passengers, then you should give serious consideration to buying more auto insurance than just basic third-party. In the event of motor vehicle crashes, sometimes the most basic third-party coverage will not cover injury to your passengers.

This, more than the cost of property damage, is the biggest expense occurring as a result of a crash – often costing three times as much as the cost of repairs to a car.

Does third-party auto insurance cover roadside assistance?

If you have a motor vehicle accident or a breakdown and require towing, most comprehensive insurance policies will cover towing.

However, third-party only doesn’t cover this, so you will need to pay this out of pocket. Needless to say, this can be a major expense. If you have an older or cheaper car, you may require towing more often than in a brand new car. An average cost of towing usually involves the following:

- Hook up fee

- Dollar charge per mile

- Local towing fee (or long-distance towing fee)

A tow of fewer than five miles can, therefore, end up costing $100 or more, and a tow of 40 miles can cost $300 or more.

Will you need to have savings if you get third-party auto insurance?

One of the biggest determinants of whether you should select a third-party insurance policy is whether you can afford a catastrophic incident financially. This is counter-intuitive, since cutting insurance saves money.

However, what you’re effectively cutting is the payout you would get or even owe if you were to have an accident. If you have saved up the value of your car, and would not be financially damaged too greatly by having to replace your car, then third-party insurance should be sufficient, particularly if you have a strong driving record.

You should think extremely carefully about your insurance policy before you decide to reduce it down to third-party only. There are auto insurance discounts available that can help save you money.

Although it may seem like you are saving money (and you certainly are in the short-term), the potential costs of an average $15,000 medical claim or costly damage to personal vehicles will soon eliminate any concept of money saved.

Counter-intuitively, reducing your coverage may be a better option if you are in a more stable financial position, and can afford to bear the out-of-pocket costs that would be paid by a claim. Third-party insurance is money saved — but at what cost?

How do third-party auto insurance claims work?

If insurance customers are in an accident, it is best to make sure you take pictures and try to remember as many details as possible. You could write these down along with the contact information, driver’s license number, vehicle registration, and insurance information for the other driver. You may also want to call the police and take down the officer’s name and badge number, as well as ask how to obtain a copy of the police report.

When a third-party must make a claim against you, they will go directly to your insurance company. Generally, the insurance company is able to handle everything and make a settlement on your behalf. However, it is best to contact your own insurance company right after an accident, regardless of who is at fault.

If damages or injuries exceed your insurance limits, the insurance company may also contact you to pay your out-of-pocket expenses.

If the situation is in reverse, and you were in an accident due to someone else’s fault, you must make a claim to their insurance company. If they do not have insurance (or not enough insurance), you may need to sue them for damages. However, if you have uninsured/underinsured motorist insurance, this should cover your expenses in place of the other party’s insurance.

When you make a claim against another driver, an insurance adjuster will want to see the details of the accident to determine who is at fault. If they determine that their insured is at-fault, they may send a check covering your damages to the repair shop or they may send you a reimbursement check.

You may want to seek out estimates from repair shops. While the insurance company may recommend that you use an in-network repair shop, you do not need to use them. However, you should ask about the procedure with each shop to see which is easiest or the best decision for you.

In states where you can buy no-fault auto insurance coverage, you would contact your own insurance company to pay for medical expenses. However, in states without no-fault insurance, you would file a claim with the at-fault driver’s insurance company, which will pay your medical expenses up to the driver’s insurance limit. Any excess will need to be paid out of your pocket or covered by your uninsured/underinsured or medical payments insurance coverage.

If the at-fault driver’s insurance coverage doesn’t cover the cost of property damage, you will either need to pay the rest out of pocket or have it covered by your own uninsured/underinsured driver’s or collision insurance coverage. There is when buying uninsured motorist coverage is helpful.

How do you get third-party car insurance online? It’s best to comparison shop, and when you shop for policies online, third-party insurance is often the cheapest (and certainly the simplest) option you will be quoted by your insurance company. Adding on other more all-encompassing forms of insurance will cause your premiums to go up, but will cover you in more situations.

When you’re looking at how to check third party car insurance costs, take a moment to use your ZIP code and get third-party automobile insurance quotes that you can use to buy third party car insurance online or through an insurance agent, as well as other forms of coverage, should you decide third-party coverage is not sufficient.