Best Usage-Based Auto Insurance (2025)

Pay-as-you-use insurance discounts are available from most top companies, but true pay-as-you-drive car insurance is still rare and is only offered by two usage-based insurance companies like Root and Metromile. Usage-based insurance programs, including pay-as-you-go auto insurance and pay-per-mile auto insurance can save you up to 50% on your rates.

Pay-per mile, Pay-as-you-go, and Pay-as-you-drive

A Concise Overview

- There are a number of types of usage-based insurance programs, including pay-per-mile, pay-as-you-go, and pay-as-you-drive

- Only two usage-based car insurance companies currently offer purely usage-based insurance policies: usage-based insurance startups Root and Metromile

- Most major insurance companies offer some form of usage-based insurance discount

Usage-based insurance programs (UBI), also commonly called pay-per-mile car insurance, pay-as-you-go insurance, pay-as-you-drive insurance, or pay-per-use insurance; are a growing form of insurance technology (both in the United States and globally) that allows drivers to receive rates based on their individual driving statistics.

In this guide, we’ll walk through key features of pay-as-you-go car insurance and other usage-based insurance types; ways it may save you money; common criticisms; penetration of pay-as-you-drive auto insurance in South Africa, Italy, and Singapore, compared to the United States; and more.

When you’re shopping for auto insurance, pay-as-you-go may be an option for you. Keep reading to find out what you need to know about pay-as-you-go insurance, including how to buy auto insurance with a usage-based discount.

Before we get started, use your ZIP code to get free quotes. While usage-based insurance rates on auto insurance are hard to offer due to the need for data, comparing standard rates with the potential discounts can help you see how affordable usage-based insurance can be.

What is usage-based insurance?

Firstly, UBI is an individualized insurance service, based on a telematic analysis of drivers. Each driver receives a personalized insurance rate based on their own driving, factoring in the type of road used (freeway or urban), braking, and cornering.

This pay-as-you-use auto insurance often enables drivers to save money both on base rates and through discounts.

There are a few main forms of UBI, each with a slightly different means of calculating your risk level, and therefore your rate.

The most common forms of UBI are pay-as-you-go auto insurance and pay-as-you-drive insurance; both work on broadly the same principle: that your driving is monitored to calculate your rate, and you are not given an ‘off the rack’ insurance quote. Ultimately, you are purchasing auto insurance based on driving habits, which can save you money, particularly if you are a safe driver. Auto insurance for safe drivers is cheaper than it is for high-risk drivers.

Keep reading to learn more specifics about the different kinds of UBI auto insurance.

Pay-per-mile, Pay-as-you-go insurance or Pay-as-you-drive (PAYD)

Pay-as-you-drive and Pay-as-you-go auto insurance both effectively work as a pay-per-mile auto insurance rate. Naturally, since the more you are on the road, the more likely you are to crash, insurers effectively charge you based on your road usage.

Insurance companies usually offer generous deals for those who drive fewer than 10,000 miles per year. It is estimated that for those driving fewer than 5,000 miles per year, insurance rates are around half the price under a pay-per-mile or by-the-mile auto insurance system, compared to using regular insurance.

If you don’t put many miles on your car, this option is perfect for you. More and more companies are offering a pay-as-you-go insurance plan that can help you save money. People driving few miles may also benefit from a low mileage auto insurance discount.

So how does pay-per-mile work? Pay-per-mile car insurance works as you might expect, by tracking the number of miles you drive each day, week, and month (in some cases they also track how you drive). Rates are generated based on this tracked mileage.

Most companies will charge a very low base rate for your policy and then have a per-mile fee. The per-mile fee is usually pennies. The amount changes based on the amount of insurance coverage you want for your vehicle and some other demographic questions.

As you can see, pay-per-mile, pay-as-you-drive, and pay-as-you-go auto insurance all mean basically the same coverage and provide a way to lower your car insurance rate. In the next two sections, we’ll look at the other two primary forms of UBI.

Read more: Is there an insurance mileage limit?

Pay-how-you-drive (PHYD)

Pay-how-you-drive is the more technologically-advanced form of insurance premium. This works by constantly monitoring your car, and providing metrics such as:

-

What time of day you drive

-

How hard you brake

-

How quickly you accelerate

-

Sharpness of turns

Each of these provides advanced data to the insurance company, who uses it to gauge the riskiness of your driving. Based on this, insurance companies can provide additional benefits to shape driving behavior, such as a reduction in rates if ‘gentle acceleration’ targets are met.

Manage-how-you-drive (MHYD)

Manage-how-you-drive insurance is still a relatively new form of UBI. It functions in a similar way to pay-how-you-drive insurance although it is a more dynamic auto insurance, offering near-instantaneous rate information.

In effect, manage-how-you-drive is pay-how-you-drive with quicker feedback.

Because of fluctuations in cost, insurance companies have been slower to offer it, although it is likely to become more popular in the future, particularly as telematics technology increases in effectiveness and market penetration.

Who offers usage-based insurance?

Most major insurance companies typically offer usage-based discounts, rather than entirely usage-based insurance rates. So where can you buy usage-based insurance? To-date, only two companies offer true usage-based insurance: Metromile auto insurance and Root auto insurance.

Both of these companies only sell usage-based policies. With Root, you’ll be required to install the company’s app on your phone in order to apply for coverage, file insurance claims, track your driving behavior, etc. The company currently offers coverage in 28 states.

In the case of Metromile, you can purchase auto insurance policies based on your mileage or your driving behavior, depending on your preference and how you choose to allow the company to track your driving. At this time, you’ll only be able to purchase Metromile in eight states, however.

Take a look at this table for a full list of Root and Metromile availability.

Metromile and Root Insurance Policy Availability by State

| State | Metromile Policies are Available for Purchase | Root Policies are Available for Purchase |

|---|---|---|

| Alabama | No | No |

| Alaska | No | No |

| Arizona | Yes | Yes |

| Arkansas | No | Yes |

| California | Yes | Yes |

| Colorado | No | Yes |

| Connecticut | No | Yes |

| Delaware | No | Yes |

| District of Columbia | No | No |

| Florida | No | No |

| Georgia | No | Yes |

| Hawaii | No | No |

| Idaho | No | No |

| Illinois | Yes | Yes |

| Indiana | No | Yes |

| Iowa | No | Yes |

| Kanses | No | No |

| Kentucky | No | Yes |

| Louisiana | No | Yes |

| Maine | No | No |

| Maryland | No | Yes |

| Massachusetts | No | No |

| Michigan | No | No |

| Minnesota | No | No |

| Mississipi | No | Yes |

| Missouri | No | Yes |

| Montana | No | Yes |

| Nebraska | No | Yes |

| Nevada | No | No |

| New Hampshire | No | No |

| New Jersey | Yes | No |

| New Mexico | No | Yes |

| New York | No | No |

| North Carolina | No | No |

| North Dakota | No | Yes |

| Ohio | No | Yes |

| Oklahoma | No | Yes |

| Oregon | Yes | Yes |

| Pennsylvania | Yes | Yes |

| Rhode Island | No | No |

| South Carolina | No | Yes |

| South Dakota | No | No |

| Tennessee | No | Yes |

| Texas | No | Yes |

| Utah | No | Yes |

| Vermont | No | No |

| Virginia | Yes | Yes |

| Washington | Yes | No |

| West Virginia | No | No |

| Wisconsin | No | No |

| Wyoming | No | No |

If you’re interested in either of these policy-types, you can find out more by speaking with an insurance or agent, or as we already noted, downloading the Root app.

Read More: Root Auto Insurance Review: Should you buy?

Which auto insurance companies offer usage-based auto insurance discounts?

Most of the major insurance companies do offer some form of usage-based insurance discount. To see a list of some of the companies that offer usage-based discounts, take a look at this table.

Usage-Based Discounts Offered by Company

| Discounts | Offers Driving Device/App (Telematics) Discount | Offers Low Mileage Discount |

|---|---|---|

| 21st Century | No | No |

| AAA | Yes | Yes |

| Allstate | Yes | Yes |

| American Family | Yes | Yes |

| Ameriprise | No | No |

| Amica | No | Yes |

| Country Financial | No | Yes |

| Esurance | Yes | Yes |

| Farmers | No | Yes |

| Geico | Yes | Yes |

| Liberty Mutual | Yes | Yes |

| MetLife | Yes | Yes |

| Nationwide | Yes | Yes |

| Progressive | Yes | Yes |

| Safe Auto | No | No |

| Safeco | Yes | Yes |

| State Farm | Yes | Yes |

| The General | No | Yes |

| The Hanover | No | Yes |

| The Hartford | Yes | Yes |

| Travelers | Yes | Yes |

| USAA | Yes | Yes |

Read more: SafeAuto Auto Insurance Review: Should you buy?

As you can see, these are primarily telematics-based (which we’ll discuss in further detail in the next section), but some are also simply based on your average annual mileage.

Usage-Based Technology and Auto Insurance

UBI technology works by transmitting information from your car to insurance companies. Because of the improvement in GPS technology in the last two decades, it is possible for a device within a car to measure extremely precise data, such as deceleration and lane-changing.

What usage-based technology is currently in use? The four current pieces of technology available are:

Black box

Black boxes are devices installed (usually professionally) in your car that can track a variety of metrics.

These automatically provide information to pay-as-you-go insurance companies about your driving.

Dongle

Dongles are small devices designed to connect with the USB port in your car. Unlike the black boxes, car insurance dongles can be easily removed by drivers.

Smartphone

Smartphones are still relatively underused when it comes to telematics. However, generally, the driver downloads an app, which monitors driving habits and relays this to the insurance company.

This technology is increasingly viable because of advances in GPS precision in the last decade.

Technology has come a long ways since cars were first manufactured using only simple machines in cars.

60% of the current market of UBI uses the ‘Black Box’ device to collect data. Insurance companies are more comfortable with the permanent black box devices because it is far harder for them to be tampered with.

However, as more cars are now coming equipped with onboard computer interfaces, such as Apple CarPlay, there is a growing movement to include UBI-capable technology in this software.

Regardless of the means of accessing the telematics, the impact of a pay-as-you-go insurance policy for a driver is contingent upon their driving ability, as well as the time and amount that they drive.

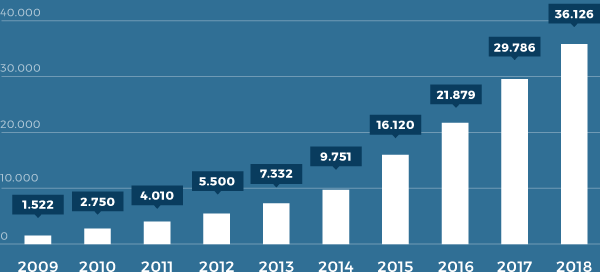

Because of technological advances making usage-based insurance ever more accessible, it is set to be an increasingly common way for drivers to get auto insurance. Let’s look at some usage-based insurance statistics.

In 2013, for example, 5.5 million drivers globally had a usage-based insurance policy.

In 2018, it was 107 million—an increase of nearly twenty times. In the United States, 13% of drivers had a UBI policy in 2013, and as of 2015 it was up to 20%.

Furthermore, the market as it stands is already extremely valuable. According to Allied Market Research, the global market for telematics was $50.4 billion in 2018 and is projected to be valued at $320.6 billion by 2026, which is a 536% increase over eight years.

In 2018, Progressive’s Snapshot program, which works as a usage-based insurance policy, was worth $5.5 billion in policy premiums.

How common is telematics technology? Take a look at this graphic to see the market penetration of telematics in the United States compared to other key countries pursuing this technology, according to the McKinsey Center for Future Mobility.

As the information shows, the United States has the highest levels of usage-based insurance market penetration for telematics (the technology that underpins UBI), with 20% of cars having telematics.

Telematics penetration rate worldwide in 2016, by key country:

- United states – 20%

- Italy – 17%

- South Africa – 12%

- Singapore – 9%

However, this level is still relatively low, particularly given the recent advances in GPS technology that makes UBI more viable.

Additionally, more cars are being manufactured with embedded telematics technology. Italy leads the European countries, although many market forecasters state that pay-per-mile insurance or pay-as-you-drive auto insurance in the UK and Germany are likely to increase and be major markets for UBI in the near future.

Usage-based insurance is likely to be a major player in the future, whether by replacing traditional insurance policies or working in some way alongside the existing setup. Interested in the technology that makes vehicle telematics work? Take a look at the video below.

Either way, usage-based car insurance is here to stay.

What are the benefits of pay-as-you-go insurance?

The potential benefits of pay-as-you-go insurance are great. Generally, they can be divided into three main categories: financial benefits, benefits to society, and safety/security benefits. Most of these benefits are still in the future and are dependent on a critical mass of people taking up pay-per-mile policies. Certainly, the impact of pay-as-you-go insurance will be far easier to measure once a majority of drivers move to the system.

Financial Benefits

The most obvious potential benefit for a pay-as-you-go system is that it can reduce your auto insurance rates.

If you are a safer driver than your demographic would suggest, you’re likely to see the benefits almost immediately. In particular, this could have an impact on those looking to buy cheap auto insurance for teens (16-20) who traditionally see the highest rates. Teen drivers traditionally pay up to 197 to 239% more for insurance than drivers at ages 25 and 35, respectively.

If you don’t drive much, you will also see benefits, particularly if your average is less than 10,000 miles in a year. You should see a sizable discount by using a mileage-based policy. And great auto insurance discounts are always worth seeking out. Plus that discount may not be your only benefit; committing to walking whenever possible, for instance, can help not only reduce your auto insurance rates, but also keep you healthier.

Finally, if your circumstances change midway through your policy (such as if you start working from home two days a week, or move nearer to your office) then you will see immediate rate reductions.

Benefits to Society

The most interesting benefits to a telematics-based system are those to wider society. In effect, the growing use of usage-based insurance will provide a financial incentive to safer driving.

Those who drive recklessly, known as high-risk drivers, by accelerating and braking dramatically, will see an increase in rates as they seek to buy high-risk auto insurance coverage, and so most rational drivers will attempt to drive in a manner that causes fewer accidents. There are still some cheap auto insurance companies that accept drivers with multiple accidents.

So insurance companies will benefit because of a reduction in accidents, as will individual drivers, and society as a whole.

When accidents do happen, the use of telematic data to determine who was at fault will ensure that poor drivers are punished, and not good drivers. Again, this will keep insurance costs down and will provide further incentives for good driving.

One benefit discussed within the wider insurance community is that pay-as-you-drive insurance may actually be an environmentally-sound approach too, as it disincentivizes driving.

Because drivers are, in effect, penalized for the miles they drive, over time non-essential trips may decrease. This may also push drivers toward public transport, thus keeping cars off the road, which in turn benefits the environment and limits congestion.

Safety/Security Benefits

Greater information and tracking technology in cars will also have safety and security benefits. For example, the presence of a black box or other tracking device in a vehicle will make it easier to recover vehicles and figure out what to do if your car is stolen (and presumably, therefore, decrease car theft). This will result in further reductions in insurance rates.

Tracking technology will also support emergency response’s ability to get to a vehicle in the case of an emergency. For parents, it may offer peace of mind to know they can monitor their teen drivers..

In fact, a recent study has shown that parents told about the possibility of knowing how their child drives resulted in their being 45% more likely to adopt pay-as-you-go auto insurance.

What are the disadvantages of usage-based insurance?

Despite the benefits of pay-as-you-go car insurance, there have been vocal critics of telematics who have claimed that the downsides of the technology outweigh the benefits.

The biggest objection is the amount of personal data that usage-based insurance requires a driver to send to their insurance company. Essentially, pay-as-you-go auto insurance allows an insurance company to monitor a customer at all times. Some people opt instead for auto insurance companies that don’t monitor your driving.

In the light of data breaches from companies such as Equifax and Facebook, consumers fear that the vulnerability of their data makes sharing location information a risky proposition.

Furthermore, with so much data being collected, the temptation for insurers to sell data means even if data is safe, it may be shared.

In response to these concerns, some states have enacted laws that specifically define who owns the data collected through telematic devices, how companies are permitted to use the data, when and how companies must disclose data collection and usage, etc. Studies have shown, however, that consumers are growing more comfortable with the concept of information sharing.

Towers Watson reports that a growing number of consumers now regard sharing personal driving information as comparable with online banking security, and more secure than social media information, as depicted in this graphic.

-

35%Driving Data

-

36%Online Banking Data

-

29%Internet Search Data

-

27%Social Media Information

The second objection to usage-based insurance has been the high installation cost, particularly of black box recorders.

However, the development of smartphone technology and the willingness of insurance companies to invest in their auto insurance mobile apps has led to greater use, particularly among young drivers.

- 34% of overall consumers said they would be interested in a smartphone-based pay-as-you-go insurance plan, and 80% of smartphone users said they would be happy to download an app to monitor their driving.

-

- The use of dynamic navigation apps such as Waze, which requires user information is likely to help make consumers more comfortable with sharing their information through an app.

Some companies like the Go auto insurance company (also referred to as gosafeinsurance.com) are taking advantage of this increased interest in app-based insurance and tracking by offering an entirely app-based experience for drivers (similar to Root Insurance), with regular in-app reminders and suggestions for how to save money and drive more safely.

Pay-as-you-go auto insurance is likely to be the most important change that happens in car insurance within the next decade. Certainly, insurance companies are investing in ever-better technology and marketing for their pay-per-mile policies.

Given that insurance companies benefit as much as the consumer, it’s easy to see why. Compared with traditional policies that rely on generalized information, pay-as-you-go insurance is far more targeted to individual drivers.

Usage-Based Insurance Programs

Pay-as-you-go auto insurance is likely to be the most important change that happens in car insurance within the next decade. Certainly, insurance companies are investing in ever-better technology and marketing for their pay-per-mile policies.

Given that insurance companies benefit as much as the consumer, it’s easy to see why. Compared with traditional policies that rely on generalized information, pay-as-you-go insurance is far more targeted to individual drivers.

From a purely economic perspective, providing incentives for drivers to be safe and courteous is likely to result in a change in driving habits.

Those who will benefit most from the introduction of usage-based insurance will be teen drivers (or those who pay for their insurance). If a teen driver can demonstrate that they are a safe driver, then their insurance premiums will drop substantially. They will effectively no longer be punished for the behavior of the rest of their cohort.

For the rest of the driving community, those who are safe drivers, or who drive infrequently, will see benefits; those who drive often during busy times, or at night, are less likely to benefit.

Regardless, usage-based insurance’s rise seems inevitable—at least until the introduction of self-driving cars changes the whole game again.

Take a moment before you go to enter your ZIP code and get a free auto insurance quote to see how pay-as-you-drive insurance or other usage-based programs might decrease your rates.

Buying Pay-Per-Mile Auto Insurance Coverage: What You Need To Know

Most pay-per-mile car insurance plans work by charging a small fee per mile in addition to a daily flat rate.

Pay-per-mile car insurance, also known as pay-as-you-go car insurance, is a cost-effective usage-based insurance (UBI) option for drivers who commute well under the average 13,000 miles per year.

Low mileage car insurance usually charges a set daily rate of a few dollars per day, then an additional few cents per mile driven, depending on the company.

Read on to learn more about car insurance by the mile. This guide covers how it works and where to purchase insurance by the mile.

Pay-Per-Mile Car Insurance Explained

A pay-per-mile plan is the best car insurance if you don’t drive much. It’s different from insurance companies offering low-mileage car insurance discounts, and it can save you hundreds of dollars a year.

For example, companies with UBI offer this coverage at a set rate instead of just giving a discount, so you only pay as much as you drive.

Generally, pay-per-use car insurance works by installing a tracking device in your vehicle to track how many miles are driven. Most pay-per-mile plans charge a few dollars a day as the set rate and then a few cents for each mile driven. What drivers pay each month for their auto insurance coverages is calculated based on daily rates and miles driven.

The base rate of pay-per-mile insurance is calculated the same as regular insurance. Insurance companies will examine your driving history, age, vehicle, and more to determine how much to charge. One of the most significant factors in your pay-per-mile rates is your annual mileage.

Drivers Who Should Buy Pay-Per-Mile Insurance

Paying for car insurance by mileage isn’t for everyone. However, pay-per-mile insurance may be for you if you fit into one of the following categories:

- Retired or work from home and aren’t logging daily miles on a commute

- Currently enrolled in college and rarely drive

- Regularly use public transportation, scooters, or bikes

- Own a second car you rarely use but want a separate policy for

Generally, those who drive less than 10,000 miles annually will benefit from pay-per-mile insurance. Insurance companies will set their own low-mileage requirements, but less than 10,000 miles is a good rule of thumb to start looking into pay-per-mile insurance quotes.

Car Insurance Companies That Sell Pay-Per-Mile Insurance

Some major car insurance companies offer pay-per-mile insurance in addition to regular auto insurance plans, and other companies solely sell pay-per-mile insurance. We’ve outlined the primary sellers of low-mileage car insurance and explain how these plans work below.

Allstate Milewise

Allstate Milewise uses a plug-in device to track the number of miles you drive per day. You can download the Allstate app to see your mileage and pay your bills.

Allstate will cap your daily mileage at 250 miles, so if you are leaving on a weekend trip, you don’t have to worry about being charged exorbitant amounts if you occasionally drive more than usual.

Coverage works the same way as a traditional auto insurance policy, but instead of paying a set monthly rate, you’ll pay a daily rate and a small fee per mile driven. Allstate does offer the option to choose an unlimited vehicle policy, and you are only charged a daily rate instead of the combined daily rate and per-mile fee.

Naturally, the cost of the unlimited policy will be more expensive. However, this option is suitable for those who drive a little more than a pay-per-mile policy average but still drive less than the average driver.

Esurance Pay Per Mile

Esurance auto insurance pay-per-mile program is only available in Oregon. Because Esurance is an Allstate company, Esurance customers who live in other states would be better off joining the Allstate Milewise program.

If you prefer not to switch to Allstate, existing customers can sign up with Esurance’s DriveSense program, which offers discounts based on driving habits. One of the habits tracked is trip duration, so drivers with fewer miles than average will be more likely to earn a discount.

Hugo Insurance

Hugo is a new low miles car insurance company that works differently from other pay-per-mile companies. Instead of paying daily and per-mile fees, customers just pay for the days they drive.

Hugo customers can turn their auto insurance on and off so they don’t pay for days they don’t drive.

While this may seem like a plus, it can leave drivers vulnerable if they forget to turn their insurance on before leaving for a trip. Hugo also only offers liability coverage on its basic plans. You would have to purchase its most expensive plan to get full coverage on the days you drive.

Metromile

Metromile is one of the more well-known pay-per-mile auto insurance companies. The company uses a plug-in device to determine your mileage and charges accordingly.

Metromile boasts that customers save an average of 47% by switching to its pay-per-mile program.

Like other pay-per-mile companies, Metromile charges a base monthly rate and then a per-mile rate, so your bill will vary monthly depending on how much you drive. Metromile also provides additional coverages besides liability insurance, such as collision, comprehensive, and roadside assistance.

Mile Auto

Mile Auto recommends its program for those who drive less than 10,000 miles annually because it can save drivers 30 to 40% on their car insurance.

It works differently from other pay-per-mile companies in that Mile Auto doesn’t require you to put a tracking device in your car. Instead, you must take a picture of your odometer each month and submit it to the company. Mile Auto then calculates your monthly per-mile rate in addition to your flat daily rate.

Mile Auto also provides full coverage policies in addition to basic liability insurance.

Noblr

Noblr auto insurance is another pay-per-mile insurance company that, like Hugo Insurance, is less well-known. It charges a daily and pay-per-mile fee, but it also uses your driving behavior, including what time you drive and hard braking, to calculate your rates.

Because Noblr tracks driving behaviors, not just mileage, it may not be the best choice for drivers with a poor driving record trying to save. It also operates solely on a smartphone rather than a plug-in device. So, you’ll have to remember to have your phone and app ready to go each time you drive.

The Final Word on Pay-Per-Mile Car Insurance

Pay-per-mile insurance is worth looking into for drivers who drive fewer than 10,000 miles per year. There are numerous pay-per-mile companies to choose from, with some standing out as better than others.

If you don’t want to sign up for a pay-per-mile program but still want to find savings, use our free quote comparison tool to find the best car insurance rates in your area.