101

A car insurance deductible is the amount of money you tell your insurance company you will cover in the event of a claim.

For example, if you have a deductible of $250 and you have $300 in damage to your car you will pay $250 and the insurance company will pay the remaining $50.

If you have a $250 deductible and you have $2000 in damages, you will still pay the $250, and the insurance company will pay $1750.

If you total your car, your insurance company will write you a check for the car’s value, minus the deductible. Using a totaled car value calculator will help determine the value of the vehicle.

It may be tempting, therefore, to lower your car insurance deductible when you’re getting a new insurance policy.

However, because it means that the insurance company is more likely to have to pay out, they will raise your premiums.

- By contrast, selecting a high deductible will lower your annual premium – often drastically.This can be tempting, particularly if you’re looking to get the cheapest car insurance policy.

-

- However, if you have a $1,000 deductible, and only $750 available in savings, you will not be able to afford any repairs to your car, and you’ll be unable to get your insurance to cover the remainder.

Picking the right deductible is a fine balance.

Too high and you can leave yourself seriously out of pocket (which is the exact opposite reason for buying insurance); too low and your premiums will be too high. Most deductibles are between $50 and $2000, although some insurance companies offer $0 deductibles. The most common amounts are $250 and $500.

Importantly, unlike health insurance, you can’t meet your annual deductible.

This means that you can be liable to pay your deductible many times over each year.

When do I have to pay a deductible?

You have to pay a deductible whenever you file a claim with your insurance company.

If you have an accident and your car requires maintenance, the amount your insurance company will payout will be based on the following formula:

- total cost of repairs

- deductible

- insurance company payout

For example, if your deductible is $500 and the cost of repairs to your car is $2,000:

- $2000(total cost)

- $500(deductible)

- $1500(insurance payout)

If you were in a crash that wasn’t your fault, then your insurance company will be able to recover the costs from the party that was at fault. This may take some time, and you may be out of pocket in the meantime.

If you and another driver are at fault during a collision, then you may have to pay part of your deductible, and the other part will be covered by the other driver.

If you choose not to get your car repaired, then you will not need to pay the deductible, and some car insurance policies may actually write you a check for the amount the repairs would have cost (less deductible).

What deductible should I choose?

The deductible you choose will have a major bearing on your insurance premiums, so you should think carefully about which deductible is right for you.

In effect, you’re making a decision based on the risk of having an accident, and weighting short-term savings versus potentially large expenses. The Department of Motor Vehicles recommends that you calculate your deductible based on the following information:

What is your emergency fund like?

The deductible for your car insurance is not like an out of pocket for health insurance, in that you do not meet your maximum level for the year and then are done. You could conceivably have to pay your deductible many times over each year.

Therefore, you should always plan for the worst, and choose a deductible amount you could afford to pay twice in a year without it causing too much of a strain on your finances.

If your emergency savings are less than 3 months’ expenditure, then choose a lower deductible and pay the higher premiums.

What is the value of your car?

If your car is older and unlikely to have a high resale value, then you should think about whether a high deductible is worth it. If your car only has a resale value of $1,500, then it isn’t worth spending $1,000 to get it repaired. In this instance, a lower deductible may be better value.

At the other end of the spectrum, if your car has a high value, then picking a higher deductible will mean you only call on the insurance in the most extreme cases.

What is your driving record?

Although your insurance company will factor this in when they calculate your premium, you should pre-empt them by taking it into consideration when selecting your deductible.

If you have a solid driving history with no accidents, insurance points or moving violations, then choosing a high deductible will mean your premiums are as low as possible. Having a clean driving record is a great way to lower your auto insurance rates.

What is your risk?

Insurance quotes are effectively a measure of risks – the more likely the insurance company thinks you are to require payment, the higher your monthly premiums will be. Think about this in advance to decide what you will need insurance for.

If you are planning on driving regularly during rush hour, or at night (when most accidents happen), or will be leaving your vehicle parked in a high crime area, then you are increasing your chances of needing insurance money.

In this instance, you can either select a higher deductible to lower your monthly premiums or select a lower deductible in order to avoid large out of pocket expenses.

How does a deductible affect my premium?

Deductibles and premiums are inversely related: as one increases, the other decreases.

This means that there is a ‘sweet spot’ for all drivers where the cheapest combination happens. Naturally, this varies from driver to driver, and from insurance company to insurance company, but it shows that doing research into your options and adding up the numbers is extremely important.

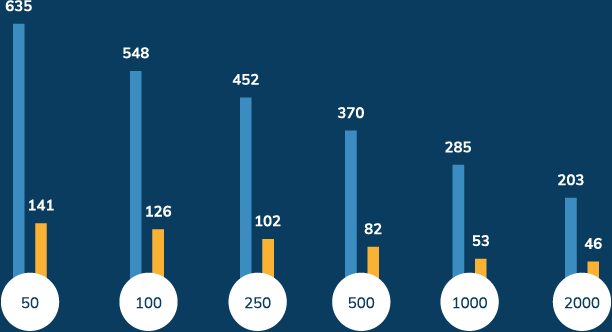

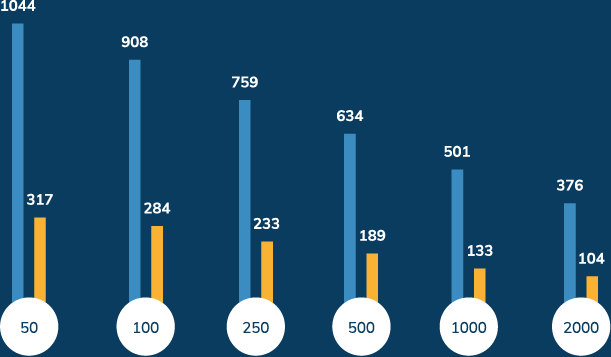

ValuePenguin undertook a major study, using a hypothetical 34-year-old married man, and calculated the different permutations of premium and deductible for collision auto insurance and comprehensive auto insurance. The sample information was for a driver who had a spotless driving record and was driving a 2010 Toyota Camry. Each of these factors will change the numbers slightly, although illustrates the general trends (as seen in the graph below).

Collision vs. comprehensive coverage annual premiums by deductible of a 2010 toyota camry

- collision premium

- comprehansive premium

Premium ($)

Deductible ($)

In this instance, a driver with a deductible of $50 per year would have a premium of $776 ($635 collision and $141 comprehensive). Increasing his deductible to $500 would save him $324, or over 40% for his annual premium. Of course, if he were to have an accident that required him to cover all of his deductible, the numbers would be different.

Using the ValuePenguin numbers to do additional calculations, and imagining the situation for a single event in the year that required the driver to pay his deductible in full once (i.e. if he had a major car accident and was liable for the cost), it is possible to see that a cheaper premium and a higher deductible can quickly become the more expensive option.

| Deductible ($) | Total Cost of Premium (collision and comprehensive in $) | Total Cost if Deductible is met once ($) |

|---|---|---|

| 50 | 776 | 826 |

| 100 | 674 | 774 |

| 250 | 554 | 804 |

| 500 | 452 | 952 |

| 1000 | 338 | 1338 |

| 2000 | 249 | 2249 |

The key caveat is that it is possible to have multiple major incidents in a year that require out of pocket expenses, although that only exacerbates the differences. However, given that this is a driver with no prior history of accidents, his likelihood of having more than one crash for which he is responsible (i.e. he is at fault) is extremely unlikely.

This shows that the cheapest option would be the $100 deductible, which leaves his maximum exposure at $774.

ValuePenguin also ran the same numbers, based on the same driver, but with a more expensive car, a 2010 Mercedes-Benz E350.

As the graph below shows, the impact of the deductible on the annual premiums is much greater. At a $50 deductible, the premium is $1,361 (collision and comprehensive). At $500, the premium is $823. A $2,000 deductible will save $882, or 64% compared with a $50 deductible.

collision vs. comprehensive annual premiums by deductible of a 2010 mercedes-benz e350

- collision premium

- comprehansive premium

Premium ($)

Deductible ($)

However, it is not until we complete the table that we see the true value of increasing the deductible. Because the E350 is a more expensive car, it is more expensive to fix in case of an accident, meaning it is more likely that the driver will meet his out of pocket limit. Therefore, assuming a single incident in the year for which he is liable, we see the following numbers.

| Deductible ($) | Total Cost of Premium (collision and comprehensive in $) | Total Cost if Deductible is met once ($) |

|---|---|---|

| 50 | 1361 | 1411 |

| 100 | 1192 | 1292 |

| 250 | 992 | 1242 |

| 500 | 823 | 1323 |

| 1000 | 634 | 1634 |

| 2000 | 480 | 2480 |

What this data shows is that each driver should get multiple auto insurance quotes at every deductible level in order to better compare and contrast. This will give you a sense of the picture involved. Then you can do some further math to get an optimal number for your own circumstances. What this demonstrates is that the optimal deductible level is $250, leaving him with a maximum exposure of $1,242.

Although these calculations are based upon the idea that a driver will have a crash over the course of the year, ultimately insurance is a measure of risk and intended only for the purposes of mitigating against risk.

If the driver does not crash, or otherwise require insurance payments, then a higher deductible is always a better option.

Calculating your own risk

Although you will need to do some actuarial math in order to get a true sense of your risk, you can use past performance to indicate future likelihood. For example, if you have not used your insurance for the past three years, assume that you will not for the next three years.

If you had to have insurance cover your costs last year, assume that you will this year. That will give you a rule of thumb to work off. People who have gotten into accidents might need to consider high risk auto insurance.

Using the Camry driver in the information above, if he had been accident-free for three years, he could do the following math, based on the fact that he will need to meet his deductible in four years:

| Deductible ($) | Annual Premium ($) | Four-year premium ($) | Four-year premium plus deductible ($) |

|---|---|---|---|

| 50 | 776 | 3104 | 3154 |

| 100 | 674 | 2696 | 2796 |

| 250 | 554 | 2216 | 2466 |

| 500 | 452 | 1808 | 2308 |

| 1000 | 338 | 1352 | 2352 |

| 2000 | 249 | 996 | 2996 |

According to these numbers, therefore, the driver’s cheapest option is the $500 deductible, which comes out at $2308 for four years’ coverage and one event that requires him to meet his deductible.

When you are calculating your own insurance premiums and deductibles, make your own table. Use the following template to get a rough idea of the costs involved:

-

Deductible ($)–

-

Annual Premium ($)–

-

N year premium ($)ANNUAL PREMIUM × N

-

N year premium plus deductible ($)N YEAR PREMIUM + DEDUCTIBLE

(N is the number of years since you last required insurance to make a payout. Use this as the basis for future incidents)

This will allow you to work out what the cheapest option is for you based on your own personal circumstances, driving history, and make and model of car.

Choosing the right deductible for you is a very precise, very individualized process. Go through the information above and factor in your personal circumstances and the quotes from the insurance companies. In general, however, you should plan for the worst and hope for the best.

Choose an insurance policy and a deductible that covers you in the worst case scenario- you shouldn’t pick a deductible that will leave you unable to cover your expenses. Even though it’s tempting to imagine you’ll never crash, the whole point of getting insurance is for that very eventuality.

Run the numbers based on a best case, worst case, and medium case scenario and you’ll soon see what the best option is.