AVERAGE car insurance rates by AGe

Car insurers will ask you for various information when calculating a policy quote: zip code, driving history, credit score, but also your age.

It may seem intrusive to first-time customers purchasing insurance, but it’s common practice in the industry. Insurers are obtaining this information in order to calculate the cost of risk of insuring you. Knowing how old you are allows them to use broad demographic statistics to get a sense of your likelihood of being involved in a collision that will require them to pay claims. All things being equal, age is a critical determinant of the cost of car insurance.

If you want to explore other factors, be sure to check out our insurance cost estimator. Getting an auto insurance quote online can be a great way to see if there are better rates available. It levels the playing field a little bit too. Since any auto insurance company is going to ask you questions, it stands to reason you should be able to do the same when searching for the best auto insurance policy.

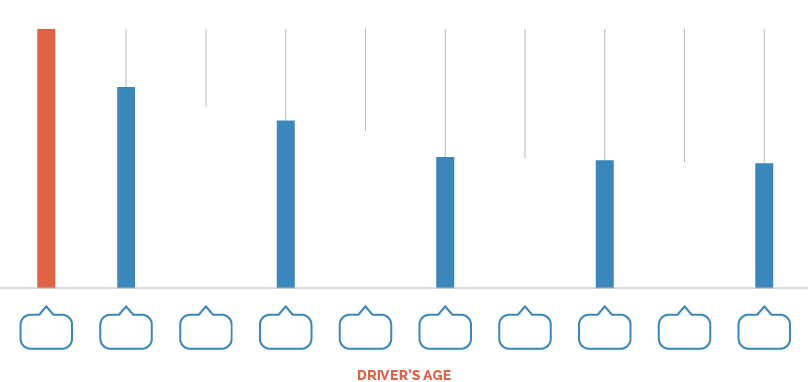

The overall trend for the average car insurance cost by age is an inverted bell curve. Teens and senior citizens are the most expensive to insure, and those in their thirties and forties are the cheapest.

Of course, any changes in driving history will affect premiums for any individual, but on average, being middle aged is the best time to buy car insurance. Because the costs of premiums vary throughout the years, so do the best tactics for saving at each age.

This guide will walk you through the costs for each age group, before showing you savvy ways to reduce your premiums.

WHAT ARE THE AVERAGE CAR INSURANCE RATES BY AGE AND GENDER?

A number of factors can affect car insurance rates, even things you never think about, like your credit score. Some auto insurance companies don’t check credit scores, though. A driver’s age already presents a drastic influence, but both genders do not get the same rates. This is why you will see differences in the average car insurance rates by age and gender.

Which gender pays more for car insurance? For example, car insurance for women is often cheaper than car insurance for men. Curious to see the average auto insurance rates for drivers like you? Keep reading to learn what auto insurance companies might charge you.

Why does age affect car insurance?

Age affects insurance because different age groups require insurance payouts at different levels. For example, in the United States, accidents are the leading cause of teenage death. By contrast, for drivers in their 70s, only 1% are killed in car accidents. Auto insurance for older adults can remain affordable if seniors maintain a clean driving record.

Car insurance premiums are based on a complex array of factors that ultimately boil down to one question: how likely is it that the insurance company will need to pay claims? The higher the likelihood, the higher the premium. So, for those who are considered high-risk drivers, auto insurance rates and necessary coverage amounts will differ.

Insurers analyze demographic data and compare that data to claims paid to those of similar demographic data,

and calculate risk based on this information. This is bad news for teenage drivers and great news for individuals in their 30s and 40s. However, what this also means is that if you can diminish your perceived risk, you can lower your premium, whatever your age.

{ 16-19 }

Which age group pays the most for car insurance?

Drivers aged between 16 and 19 have the highest insurance rates of all age groups.

Their insurance rates are high because this demographic group is the most likely to have an accident. Insurance is always a reflection of risk, and teen drivers represent a higher risk. Teen drivers take more risks, have less experience, and are more likely to break the law when driving. You can learn more about getting auto insurance for 18-year-olds here.

The statistics for teenage drivers support these conclusions. In 2013, there were 2,524 motor vehicle-related deaths involving teenagers, with an estimated 8 teenagers dying per day in car accidents.

10% of these accidents were the result of a distracted driver (and a third of teen drivers admit to having emailed or texted while driving).

Also, in 47% of fatal car crashes, the teen who died was not wearing their seatbelt.

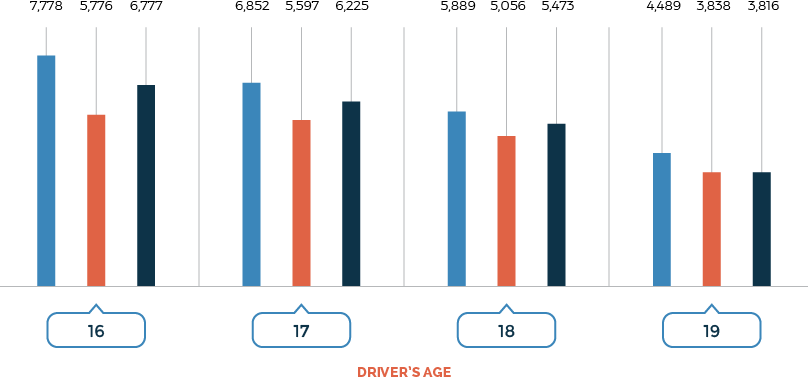

Teenage drivers also have the highest discrepancy in the gender gap when it comes to car insurance premiums. As the data below show, male teen drivers pay on average 20% more for car insurance.

- Male Driver Avg. Annual Premium ($)

- Female Driver Avg. Annual Premium ($)

- Average (all drivers) ($)

The table above demonstrates that the trend is for premiums to drop as drivers get older, reflecting the added experience that comes with age. Furthermore, car insurance is cheaper as you get older. The gender gap diminishes to the extent that when the driver is over 30, males tend to pay slightly less.

Teen drivers will always have high premiums, but there are teen-specific ways you can save money. Some insurance companies offer education discounts for students who have a GPA of above 3.0. If this is the case for you or your teen, send your high school transcript to your insurance company. Always remember that the best car insurance options for students often incorporate various incentives related to grades and achievement in school.

Another way to save, although not unique to teens, is to install a telematic device in your car. Most teenage drivers are penalized because they belong to a dangerous age group. If you are a safer driver than your peers, then installing a telematic device will show this to insurers. These devices monitor your driving, including your braking and accelerating. You end up paying by the mile. Learn more on our page about usage-based auto insurance.

The actual discount you may receive will vary, although can be between 10% and 40%. Teen drivers see far bigger discounts from telematics than other age groups.

{ 20-29 }

The day you turn 20, your insurance premium will drop by 20% on average. The added years of experience and (presumably) the number of hours spent driving make you more equipped to drive safely.

Drivers in their twenties report fewer accidents than those in their teens, and, as a result, their premiums continue the trend from the data above by declining year by year.

Average Annual Premium ($)

The average rate for a driver aged 29, therefore, is less than half of that for a driver aged 20, demonstrating how the best way to lower your insurance premium is to gain the experience that comes with age.

Of course, that is assuming that those additional years of accidents don’t lead to a poor driving history,

which will reverse the declining annual rates.

For those in their twenties, saving money on annual premiums can be tough because they’re already making savings compared with their teens. However, at this age, many drivers are leaving home and moving into a place of their own.

That means that, for the first time, drivers will be able to bundle their homeowners or renters insurance with their car insurance coverage, which saves around $100 per year on car insurance premiums.

Drivers at this age should also look to change their car insurance (or at least shop around) as the company that gave them the cheapest premium aged 20 may not be the cheapest when they are 25. Read more about the best auto insurance for young adults to find out where the most savings can be had.

If a driver in their 20s has paid off the cost of their vehicle, then there may be options to change an insurance policy to make it cheaper (or by raising the deductible).

{ 30-39 }

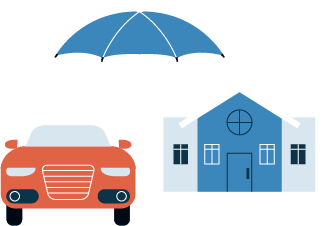

Your thirties are often seen as a continuation of your twenties, and car insurers certainly see there as being little difference between providing coverage to someone aged 29 and someone aged 39.

Across the decade, drivers get less than .5% of a discount per year. This is great news for those in their 30s, as it means that they are now in the cheapest period of their driving life.

However, when it comes to saving money on premiums, things start to get a little more tricky. As the data below show, the year-on-year figures change very little throughout the 30s.

Average Annual Premium ($)

The thirties is when most adults start to experience life as a ‘sensible adult’. Most people buy homes, have stable careers, and even start to have children. This means that there are a lot of factors that can influence your car insurance. Bundling multiple insurances together is, therefore, a good tactic.

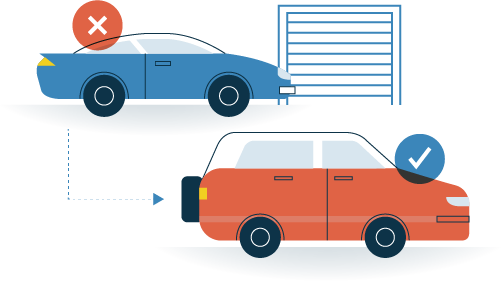

Your choice of vehicle will also play a major factor in shaping your insurance premiums.

A more ‘moderate’ and less speedy vehicle will keep things more affordable.

For those who are planning on having children, now is the time to ditch the sports car and upgrade to the family vehicle. Your children and your insurer will thank you for it.

An ongoing tip that will pay dividends in your thirties is to try and avoid making claims on your insurance as much as possible. Getting the cash in the short-term from a payout must be considered against the long-term rises to your insurance premiums. Avoiding insurance claims also means avoiding at-fault accidents, for which other people may be able to make claims against your policy.

Demonstrating a long history without needing a claim is a great way to let insurers know you’re a safe bet.

{ 40-59 }

Driving in your forties and fifties can see some serious changes to your insurance premiums. For drivers without children, the average premium for a married couple is $1,116 per annum, a further reduction on even the low rates from your thirties.

However, by this age, there is an important mitigating factor affecting your lowering premiums: the addition of young drivers to your account. This brings us almost full circle in terms of insurance premiums, as all of the same risks of teen drivers start to affect insurance premiums.

A study by TheZebra found that adding two teenage drivers to your car insurance will increase your rates by $3,600 per annum. Finding the best auto insurance for teen drivers is still possible.

There are steps you can take to prevent this from making insurance unaffordable.

One of the best is to add your youthful driver to your own insurance, rather than placing them on their own. This will balance out the teen driver’s risk against your own, safer, demographic group.

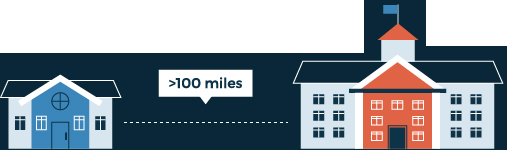

If your teen has gone off to college, then investigate the ‘distant student’ discount. The insurance company will assume that, with your young driver away at college, he or she will be less likely to use the car, and therefore present less of a risk.

This usually applies only to colleges that are more than 100 miles away from your home.

{ 60-69 }

As you enter your sixties, car insurance premiums can reduce further, particularly as your children move away, get their own cars, and car insurance policies.

This leaves you without the boosted premiums that you had in your forties and fifties. If your child has left home and does not use your car regularly, then you should let your insurance company know. If the vehicle belongs to your child, but they have left home then the insurance company will need to calculate them a new premium based on their new zip code.

However, if your children live with you, they will be able to stay on your insurance indefinitely – there’s no cut-off age like there is with healthcare.

For a driver aged 65, the average cost of insurance is $1,737, which is a slight rise in the forties and fifties, although lower than the cost for the average 75 and 85 year old ($2,037 and $2,416 respectively).

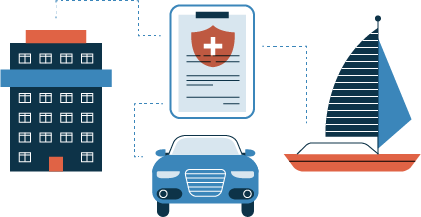

If you’re planning on retiring and buying a boat, or a condo somewhere, then bundling those insurance policies will save you money on coverage across the board. Having additional lines of insurance will function as an economy of scale, and will drive everything down in price.

Your age is something you can’t change (at least until your next birthday), so it’s best to focus on the things you can change in order to reduce your insurance premium. Things like driving safely, not using your insurance for minor repairs, and installing safety devices are all things that will reduce your car insurance premium, regardless of age.

Knowing how and why your insurance premiums are affected by your age will help you to know the best ways to save. Knowing how your premium is calculated based on your demographic can help you see how to either identify with or distance yourself from that group.

Telematics, for example, may be hugely cost-saving if you’re a teen driver, but not so much if you are in your 40s.

Knowing the market, and how insurers see you, puts a lot of power in your hands as a consumer. With this information, you can change how much of a risk you are for an insurer, and ultimately that means more money in your pocket. That’s useful at any age.

Remember that when you’re searching for auto policies, you can determine what coverage level you need ahead of time, so that you get a better quote from any auto insurance provider you’re looking into. Plus, don’t forget insurance rates by car and age can vary. Even if you own the same car as someone else, if you’re in different age brackets, you’ll pay different prices.