Commercial Auto Insurance

Provides Coverage for Company Vehicles

Commercial auto insurance protects business and business owners when personal or company vehicles are used for commercial purposes. Do you need this coverage? What about an ENOL insurance policy, also referred to as an employer’s non-owner car insurance liability coverage? How can you buy commercial vehicle insurance? How do you get a commercial auto insurance quote?

Read this post to find out the answers to these and other questions about commercial car insurance.

Ready to compare commercial vehicle insurance rates? You can also use your ZIP code to get a free quote on commercial auto insurance.

What Is Commercial Auto Insurance?

Your company may be in need of commercial auto insurance whenever employees drive cars, trucks, or vans on the clock. Commercial auto insurance can benefit small business drivers, as well as companies that employ large fleets of vehicles (including fleet auto insurance for rental car businesses).

And it’s not just auto insurance for commercial drivers. In some cases, commercial auto insurance may be necessary for your personal vehicle.

When it comes to commercial driving, going without insurance is never worth the risk.

Commercial vehicle insurance will provide coverage for individual drivers in areas that a personal auto insurance policy does not cover. It’s critical to understand the distinctions between commercial car insurance vs. private insurance when driving for business purposes.

Commercial auto insurance may be referred to by a number of related names that fall into the same insurance category:

- Commercial vehicle insurance

- Commercial truck insurance

- Truck insurance

- Fleet insurance

When used for business driving outside of a daily commute (where personal car insurance applies), commercial insurance on a personal vehicle may cover:

-

Cars/SUVs

-

Pickup trucks

-

Vans

-

Snowplows

-

Commercial trucks

-

Box trucks

-

Dump trucks

-

Tow trucks

Commercial car insurance may appear similar to a personal car insurance policy at face value. However, commercial car insurance can prove beneficial by providing higher coverage and liability limits than a personal policy can offer, tailored to a specific business industry.

Is commercial auto insurance cheaper than personal coverage? Not in the short term, but in the long run it will be. Why? In layman’s terms, attempting to use a personal car insurance policy when driving on the job could leave you shortchanged in an accident.

A protective commercial auto insurance policy will offer extra coverage for employees that drive company vehicles. Seasonal insurance and optional coverage add-ons forhauling equipment or livestock in trailers may also be available.

Depending on the agent, commercial auto insurance is fully customizable. It can provide coverage for:

-

Bodily Injury

Bodily injury liability covers another party’s injuries or death in an at-fault accident.

-

Property Damage

Property damage liability covers another party’s property damage in an at-fault accident.

-

Collision

Collision car insurance covers damage to your vehicle in an accident, no matter who is at fault.

-

Comprehensive

Comprehensive car insurance covers damage to your vehicle outside of an accident, no matter who is at fault.

-

Medical Payments

Medical payment coverage covers you and your passengers’ medical expenses in an accident, no matter who is at fault.

-

Uninsured /Underinsured Motorist

Uninsured motorist coverage covers your bodily injury, damages, or death in an accident caused by an uninsured/ underinsured driver.

-

Hired Auto

Hired auto insurance covers borrowed or rental cars in an accident.

-

Non-Owner

Non-owner auto insurance covers employees that use personal vehicles for business purposes.

A basic commercial liability auto insurance policy will cover bodily injury and property damage in order to meet state minimum requirements. Other policy add-ons are available to extend commercial coverage.

For example, adding on collision and comprehensive insurance will offer full coverage auto insurance to provide complete protection in any type of accident, no matter who is at fault.

Who has the best commercial auto coverage?

Many of the major insurance companies offer commercial car insurance coverage. Your specific needs will determine the best company for you, but we’ve listed the top ten companies by market share and direct premiums written, per the National Association of Insurance Commissioners, in this table.

Top Commercial Auto Insurance Companies by Market Share and Direct Premiums Written

| Company | Direct Premiums Written | Market Share |

|---|---|---|

| Progressive | $4.4 Billion | 10.90% |

| Travelers | $2.6 Billion | 6.30% |

| Liberty Mutual | $1.8 Billion | 4.40% |

| Nationwide | $1.6 Billion | 4% |

| Berkshire Hathaway | $1.5 Billion | 3.70% |

| Old Republic | $1.4 BIllion | 3.60% |

| Zurich Insurance | $1.4 Billion | 3.40% |

| Auto-Owners | $994.9 Million | 2.50% |

| Tokio Marine Group | $761.7 Million | 1.90% |

| Chubb Ltd | $740.7 Million | 1.80% |

As you can see, you have options for purchasing your commercial car insurance policy. As we’ll discuss later, you should shop around and speak to licensed insurance agents about the best coverage for your situation.

What is non-owned coverage?

Most businesses can benefit from some type of non-ownership commercial coverage, often referred to as ENOL or Employers Non-Owned Car Liability Coverage. In a commercial non-owner policy, a business’s revenue will be protected against legal judgment when an employee drives a personal vehicle for business purposes.

ENOL coverage is recommended as an affordable commercial vehicle insurance add-on even if employees drive personal cars for work infrequently; going without protective commercial coverage is never worth the risk.

Who Can Benefit from Commercial Auto Insurance?

Personal car insurance policies are not intended for business use and vice versa.

As outlined above, commercial auto insurance can be advantageous if you or your employees drive any type of vehicle for work purposes. In many cases, certain vehicle types or commercial driving may be excluded from a personal policy.

If you happen to be a small business owner, your personal titled vehicle may not be covered when used for business purposes. Although you may already have a valid personal car insurance policy, a commercial auto policy will be needed to provide coverage when driving for work.

If you are having trouble finding the distinction between personal and business car use, it’s always better to be safe than sorry. When in doubt, contact your insurance agent for more information about where a personal auto insurance policy ends and a commercial policy begins.

You may need commercial auto insurance if you:

- Regularly use your personal vehicle for pickup or delivery, i.e. food delivery auto insurance, newspaper delivery, or work supply pickup.

- Allow employees to drive your personal vehicle for work regularly or occasionally.

- Use your vehicle for a service, i.e. taxi insurance or limousine insurance.

- Lease or own your vehicle through a business, partnership, or corporation.

- Own a vehicle registered through or titled to a business, partnership, or corporation.

- Lease or rent your vehicle to another party.

- Own a van, pickup, or utility vehicle that exceeds 10,000 pounds or with a rated load capacity of over 2000 pounds.

- Own a vehicle with specialty equipment, i.e. snowplowing tools, racing equipment, catering equipment, or restrooms.

- Own a vehicle with business-related installations, i.e. built-in ladder racks or toolboxes.

Work-related car accidents are not to be taken lightly

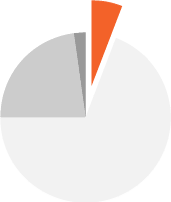

Consider the chart below, depicting vehicles involved in fatal crashes in California in 2018 as reported by the National Highway Traffic Safety Association (NHTSA):

-

34%

Passenger Cars

-

19%

Light Trucks

-

14%

Motorcycles

-

1%

Other/Unknown

-

1%

Large Trucks

-

0%

Buses

Although passenger cars made up the vast majority of crashes, light trucks and large trucks contributed to 19 and 1 percent of accidents, respectively, so business auto insurance in California is important, as it is across the country.

If your employees regularly drive commercial vehicles, you can’t afford not to have commercial auto insurance to protect both their safety and your financial responsibility in an accident.

Truck Drivers

-

Other Drivers

-

Passengers

-

Pedestrians

Commercial trucking remains a popular profession and the lifeblood of the US economy. Nonetheless, even a seemingly minor truck accident can incur costly vehicle damages and medical expenses, including but not limited to:

-

Medical bills

-

Property damage

-

Pain and suffering

-

Lost wages

-

Earning capacity impairment

-

Lifestyle changes

-

Life-care

-

Punitive damages

This simply reinforces the importance of commercial auto insurance for company vehicles and personal vehicles used in a professional context.

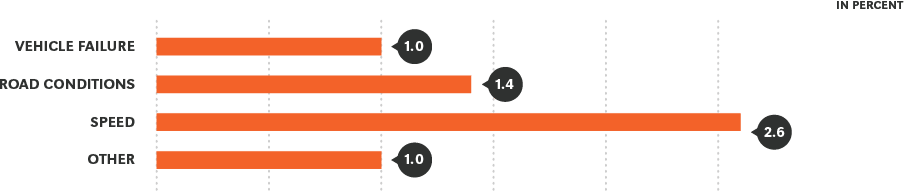

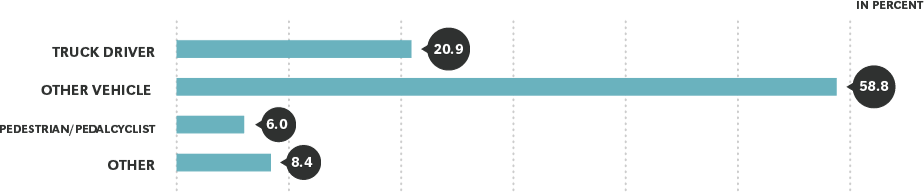

In the analysis of the Large Truck Crash Causation Study conducted by the Federal Motor Carrier Safety Administration, 58.8% of truck crashes were caused by the action of another vehicle, including loss of control

Other contributing factors to an unexpected crash involved the action of the truck driver, the action of a pedestrian or cyclist, speeding, road conditions, and vehicle failure. To provide peace of mind, it pays to expect the unexpected. Having a protective commercial auto policy leads to guarding you legally and financially if an employee gets into a car accident on-the-job.

Basic liability insuranceBasic liability insurance will protect the other parties and alleviate legal responsibility in an at-fault accident.

commercial auto insuranceFull coverage commercial auto insurance that includes comprehensive and collision coverage will provide compensation for your vehicle repair or replacement in an at-fault accident.

The Pros and Cons of Commercial Auto Insurance

If you fit the criteria for commercial auto insurance, it’s unwise to drive for business purposes without it. If your personal car insurance policy doesn’t cover you when driving commercially, you are technically driving without insurance. This is an irresponsible driving practice that could pose risk to you as an uninsured driver, as well as any other driver that you encounter on the road.

The advantages

-

Provides coverage in areas where personal car insurance lapses.

-

Meets state minimum commercial liability requirements to drive legally.

-

Provides protection for employees that drive on-the-job.

-

Extra liability insurance is available for an added cost.

-

Extra comprehensive/collision coverage is available for full protection at an added cost.

-

Meets insurance requirements for a fleet of company vehicles.

The disadvantages

-

May have policy limitations/ exclusions for high-risk businesses.

-

May come with a per accident dollar amount cap or limit.

-

May only provide partial coverage for losses in a catastrophic disaster or major lawsuit.

-

Claim payout may be slow if you are working with the wrong insurance company, but this applies to all insurance coverage types.

To protect yourself as a business owner, commercial auto insurance pros will most often outweigh the cons. Most importantly, commercial auto insurance is necessary to meet the minimum auto insurance required by state for employees that drive on-the-job.

If you decide to risk it and go without, one major accident that results in expensive damages or even a lawsuit could be enough to put you out of business. Commercial auto insurance can safeguard your business against a worst-case scenario on theroad, while keeping employed drivers protected.

How Much Will Commercial Auto Insurance Cost You?

How much is non-owner insurance? Is commercial car insurance expensive?

The amount that you pay in commercial car insurance will depend directly on the amount of liability coverage that you take out.

If you decide to stick with a bare-bones policy that meets state minimum liability requirements, you will be quoted cheaper rates compared to a full coverage policy with collision and comprehensive insurance lumped in.

Whatever you choose to purchase, it’s always a good idea to get multiple auto insurance quotes. In some cases, you may even be able to purchase an online insurance policy for commercial vehicles, based on comparing quotes.

Although it may seem like a better idea to buy the cheapest commercial auto insurance policy, you could end up paying more in the long run if it doesn’t offer adequate coverage in an accident.

This leads us to the question you may be itching to ask:

How much commercial liability coverage do I need to take out?

Unfortunately, there is no one-size-fits-all solution when it comes to how much auto insurance coverage you need. Your best bet is to meet one-on-one with your insurance agent to crunch numbers and determine exactly how much liability insurance is necessary to cover your bases in a major accident.

As a bottom line, the Insurance Information Institute recommends a minimum of $500,000 in commercial liability coverage per vehicle operated by your business.

The good news is that commercial auto insurance isn’t likely to increase exponentially as you raise your liability coverage amount. You may be quoted a slightly higher rate for a $1 million liability policy compared to a $500,000 policy – with twice the payout.

With that being said it is difficult, if not impossible to estimate an exact business auto insurance cost since business needs can vary greatly. The cost to insure an entire fleet of trucks (whether it be large or small business fleet insurance) will be dramatically different from the cost to insure a single company vehicle.

You can go into commercial auto insurance with both eyes open by taking into account factors that influence how much commercial car insurance costs, like:

- Type of vehicle

- Driving distance

- Driving record

- Driver’s gender

- Driver’s age

- Driving location

To dig a little deeper,if you are insuring an expensive car or SUV for an employee driver, commercial auto insurance will cost much more than coverage for an older company pickup truck. Commercial auto insurance for passenger vehicles will also typically cost less than coverage for commercial trucks.

This leads us to the truck class. What are the cheapest trucks to insure? A lighter weight truck will cost less to insure than a truck in a heavier class.

An insurance provider may use truck class categories to quote more accurate commercial rates:

-

Light Truck.Up to 10,000 pounds, i.e. pickup, flatbed, and refrigerated trucks.

-

medium Truck10,001-20,000 pounds, i.e. box and stake bed trucks.

-

heavy duty Truck20,001-45,000 pounds, i.e. farm, grain, and beverage semi trucks.

The exact purpose and use of a vehicle will also determine commercial insurance costs.A flatbed truck used for service and repairs will cost less to insure compared to a mid-weight retail delivery vehicle, like a dry cleaning truck, or commercial truck insurance for box trucks. A heavy-duty commercial truck that delivers beverages cross-country will cost the most to insure compared to vehicles in a lower class. You will also want to explore getting bobtail insurance for when the trailer is not attached.

Your deductible

If your business has enough money in the bank to spare, you can automatically lower your monthly insurance rates by opting to pay a higher auto insurance deductible amount.

As a word of caution, it’s important that your business is able to afford this deductible out-of-pocket in an at-fault accident. A higher deductible will lower your annual premium but is only recommended if you have the funds to pay the deductible amount upfront.

Speak to a licensed insurance agent or appropriate insurance broker (like a heavy vehicle insurance broker, in the case of insuring a heavy truck) to help you determine the best coverage amount and deductible for your policy as you’re shopping for cheap truck insurance.

Get started on shopping for cheap commercial insurance right now by using your ZIP code to get a free quote.