Auto-Owners Auto Insurance Review: Should you buy in 2025?

Auto-Owners Insurance Company offers standard car insurance coverage options and several add-ons to individuals in 26 states. Here's everything you need to know about Auto-Owners auto insurance.

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jun 13, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 13, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Auto-Owners Insurance Group

Average Monthly Rate For Good Drivers

$109A.M. Best Rating:

A++Complaint Level:

LowPros

- Positive customer reviews

- Multiple insurance products

- Excellent financial strength

- Local insurance agents

- The option to customize a car insurance policy

- Low complaint index with NAIC

Cons

- Limited availability

- Poor claims process

- Limited online presence

- Limited digital tools

- Auto-Owners offers car insurance in 26 states in the U.S.

- Rates with Auto-Owners are often competitive and lower than the national average

- Auto-Owners has an A++ (Superior) financial strength rating with A.M. Best

Auto-Owners has a lot to offer. The company has good customer reviews, excellent prices for coverage, and financial strength and future outlook that could make policyholders feel safe and secure.

Auto-Owners may not be best for you if you want a company with more online presence. And before you make any final decisions on coverage, you should compare quotes from multiple providers to see which offers the coverage you want at the best price.

Auto-Owners Insurance Group Insurance Coverage Options

Auto-Owners offers the following types of car insurance coverage to its policyholders:

- Liability

- Comprehensive

- Collision

- Uninsured/underinsured motorist coverage

- Medical payments

- Personal injury protection

- Purchase price guarantee

- Rental car

- GAP coverage

- Diminished value

In addition to the coverages listed above, Auto-Owners offers the following add-ons for more protection:

- Road trouble service. This coverage acts as a roadside assistance plan, covering fuel delivery, battery jump starts, lockout services, and more.

- Additional expense coverage. This coverage provides rental car reimbursement and trip interruption services.

- At-fault accident forgiveness. This coverage stops your rates from increasing if you’re at-fault in an accident.

- Diminished value coverage. This coverage pays for any loss in value if your vehicle is in an accident.

- GAP coverage. This pays the difference between your car’s value and what you owe in your loan or lease.

- Personal automobile plus package. This coverage includes 10 additional coverages like cellphone replacement and identity theft protection.

- Glass and windshield repair. This coverage pays for repairs to your car’s glass or windshield.

If you know you’re looking for additional coverage to help ensure you and your vehicle are protected, Auto-Owners’ add-ons could be a good option.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does Auto-Owners offer specialty insurance coverage?

Auto-Owners offers the following specialty auto insurance options:

- Classic cars. If you have a classic car, you’ll need something other than standard auto insurance. Classic car coverage is often cheaper than a typical policy and offers protection for vintage vehicles.

- Modified cars. Vehicles that are converted or altered can be difficult to insure. Modified car coverage may cost more but meets each individual’s needs.

Auto-Owners may be a great company to consider if you have a classic or modified car because of the options for specialty coverage.

What other types of insurance does Auto-Owners offer?

In addition to auto insurance, Auto-Owners offers:

- Homeowners

- Renters

- Condo

- Mobile home

- Business

- Farmers

- Floods

- Motorcycle

- Valuables

- Umbrella policy

- Life insurance

- Long-term disability

- Pet insurance

If you purchase auto insurance along with one or more other types of insurance from Auto-Owners, you may be eligible for a multi-policy discount with the company.

Auto-Owners Homeowners Insurance

With a homeowners insurance policy, Auto-Owners covers:

- The dwelling

- Detached structures

- Personal liability

- Injuries

- Personal possessions

- Expenses if policyholder stays elsewhere due to a covered loss

Customers can purchase add-ons such as equipment breakdown insurance or identity theft expense coverage for additional security.

Auto-Owners Life Insurance

Auto-Owners offers term life, whole life, and universal life insurance policies. Depending on the type of life insurance you need, you may be able to find a policy that meets your needs with Auto-Owners. And you could save money on coverage with discounts for multiple policies.

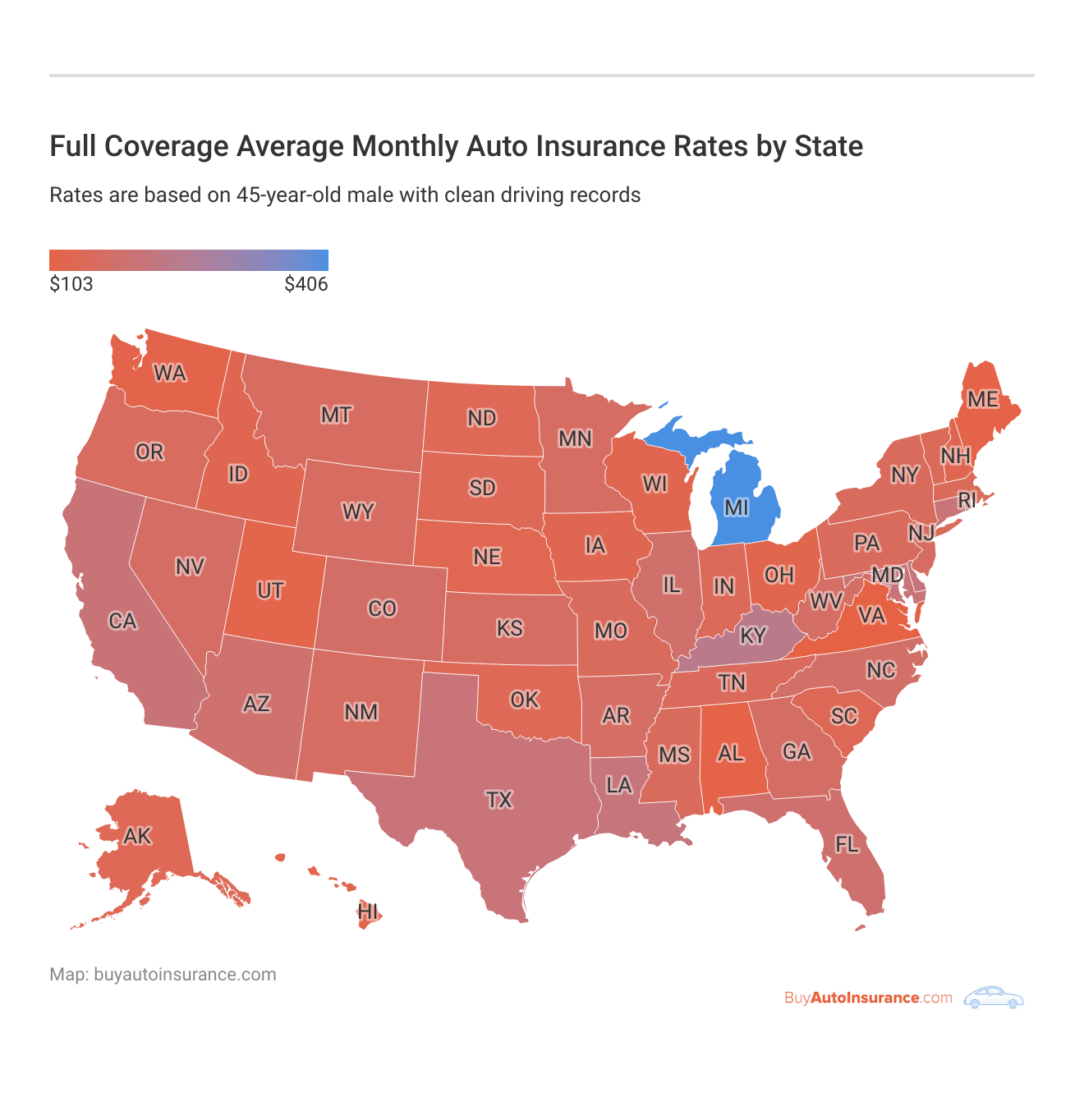

Auto-Owners Insurance Group Insurance Rates Breakdown

The average cost for a full coverage policy with Auto-Owners is around $1,305 annually. Therefore, Auto-Owners has relatively low premiums compared to the national average. Here’s how that compares with each state’s average annual full coverage auto insurance rates.

Similarly, while the national average for a liability-only policy costs around $545, a minimum coverage policy with Auto-Owners is $325 annually.

Regarding age groups, a policy with Auto-Owners is significantly cheaper once an individual turns 25.

Coverage with Auto-Owners is much less expensive for people with a clean driving record. But rates are most expensive if you add a teen driver to your policy.

If you have a clean driving record, you may want to consider Auto-Owners coverage to see how much you could save. Here are some examples of how your driving history can affect your auto insurance rates.

First, let’s look at how a DUI can increase your auto insurance rates.

If you are pulled over for speeding, or other traffic violations, and given a ticket, you may see your auto insurance rates increase.

Another factor that can cause your car insurance rates to go up is if you are involved in an accident and found to be at fault.

As you can see, keeping your driving record clean can help keep your auto insurance rates low.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto-Owners Insurance Group Discounts Available

Policyholders may qualify for a discount with Auto-Owners. Some of the company’s most common discounts include:

- Green discount. Receive a discount if you receive paperless billing.

- Multi-policy discount. Save money if you have more than one insurance policy with Auto-Owners.

- Multi-car discount. Get additional savings if you insure more than one vehicle.

- Paid-in-full discount. Spend less if you pay for your six or 12-month policy in full.

- Student discounts. Save money with discounts like good student, away at school, and teen driver monitoring.

Specific discounts can help people save up to 25% on their car insurance, so speak with a representative to see if you qualify for savings.

Does Auto-Owners have a mobile app?

Auto-Owners offers its policyholders a mobile app that allows them to pay their bills, submit roadside assistance requests, view their ID cards, and view their policy information. The app has 3.1 out of 5 stars on the App Store and 3.8 stars on Google Play.

Though the mobile app allows policyholders to check the status of their claims, the app does not allow people to file claims. Instead, policyholders have to speak with an Auto-Owners representative.

How Auto-Owners Insurance Group Ranks Among Providers

Compared to other companies, Auto-Owners tends to cost a bit more than State Farm in most situations, but coverage is often cheaper than it is with companies like Progressive and Allstate.

Auto-Owners is cheaper on average than Progressive and Allstate for people with clean driving records and those with accidents on their records.

As with any insurance company, you’ll never know how much you will pay for car insurance until you get a quote. So if you’re considering purchasing a car insurance policy with Auto-Owners, you should call or visit the company website to see how much you would spend on coverage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Frequently Asked Questions

Does Auto-Owners offer accident forgiveness?

The company offers at-fault accident forgiveness as an add-on for individuals to purchase.

Who owns Auto-Owners?

Auto-Owners was founded in 1916 and owns nine subsidiaries that comprise the Auto-Owners Insurance Group.

Is Auto-Owners insurance satisfactory?

Auto-Owners offers good insurance products at competitive rates. As a result, the company has fewer than average customer complaints and excellent ratings.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Does Auto-Owners offer accident forgiveness?

The company offers at-fault accident forgiveness as an add-on for individuals to purchase.

Who owns Auto-Owners?

Auto-Owners was founded in 1916 and owns nine subsidiaries that comprise the Auto-Owners Insurance Group.

Is Auto-Owners insurance satisfactory?

Auto-Owners offers good insurance products at competitive rates. As a result, the company has fewer than average customer complaints and excellent ratings.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

helthscreen

Poor service

Vic_the_man

Good Enough

ellenamcd2

Well done Auto Owners Insurance

josechepe2001

Great policies and great road assistance

jessman1128

We love Auto Owners Insurance!

64061

Try auto owners.

VSchmitt

Good company from longtime customer

pallam

Great policy for all our family needs

Tricia987654

Easy to love

db404

Agent mistakenly did not put comp on my oldest vehicle.