Are You a

High Risk Driver?

The odds are that if you are a high risk driver, you’re going to know it. “High risk” is a term often used by insurance providers to describe a driver in a higher risk category than the average safe driver on the road.

If you’ve been ticketed for risky driving behaviors, you’re likely to fall into a high risk driving category.

Some of the most common high risk driving behaviors include:

-

Major Traffic Violation

Just one major traffic violation could qualify you as a high risk driver compared to a driver with a clean record; violations may include speeding tickets, tickets for reckless driving, or at-fault car accidents.

-

Multiple Traffic Violations

After you accrue 6 points on your driver’s license from multiple traffic violations, you may have issues qualifying for affordable car insurance. Multiple traffic violations may result from several consecutive speeding tickets or a combination of high risk traffic citations.

-

DUI

A DUI conviction is one of the fastest ways to qualify as a high risk driver. A DUI may automatically result in a suspended license and will dramatically increase insurance rates once you are permitted to drive.

-

No Insurance

It’s against the law to drive without insurance in almost all states. If you have a valid driver’s license and have lapsed in insurance for at least six months, you will be considered high risk.

For the vast majority of drivers, you may have had a speeding “whoops” moment more than once in your lifetime. But if you’ve made the mistake of racking up several minor or one major speeding ticket, you could find yourself in high risk driving territory before you know it.

Maximum Speed Limit

by state as of 2012

- 55D.C

- 60Hawaii

- 65Alaska Connecticut Delaware Illinois Maryland Massachusetts New HampshireNew Jersey New York Oregon Pennsylvania Rhode Island Vermont Wisconsin

- 70Alabama Arkansas California Florida Georgia Indiana Iowa Kentucky Michigan Minnesota Mississippi Missouri North Carolina Ohio South Carolina Tennessee Washington West Virginia

- 75Arizona Colorado Idaho Kansas Louisiana Maine Montana Nebraska Nevada New Mexico North Dakota Oklahoma South Dakota Wyoming

- 80Utah

- 85Texas

-

4,067,396

miles of road in the U.S.

-

35 states

with 70 mph+ speed limits

-

texas

State with the highest rural interstate speed limit @ 85mph

-

Hawaii

State with the lowest rural interstate speed limit @ 60mph

Source:blog.esurance.com

Out of the 196 million licensed drivers in the US, one in six drivers will get a speeding ticket within a year.

The average speeding ticket cost? A cool $150. This adds up to over $6 billion in speeding ticket fines in the US since roughly 100,000 people receive speeding tickets each day. Men are also more likely to get speeding tickets than women.

The average speeding ticket cost? A cool $150. This adds up to over $6 billion in speeding ticket fines in the US since roughly 100,000 people receive speeding tickets each day. Men are also more likely to get speeding tickets than women.

Again, exact point values will vary by state, but the “point” is clear:

- Any type of driving infraction, large or small, can affect your risk category as a driver.

- A minor speeding ticket may not make an initial difference, but subsequent tickets or a major traffic violation will increase risk levels significantly.

Regarding major traffic violations, DUI’s most often come to mind.

So, how far do insurance companies look back? Yes, a DUI is a major offense that can mar your driving record for years to come. The truth is that the average drunk driver will drive under the influence roughly 87 times before their first arrest. Consequently, one person is injured in an alcohol-related crash every minute.

Drunk driving offenses place a heavy financial burden on society, estimated at $500 per adult in the US per year. Even after receiving a citation for this serious offense, 50%-75% of convicted drunk drivers continue to drive on suspended licenses – leaving themselves open to even greater traffic violations for driving illegally.

-

average drunk driver dUI roughly 87 times before their first arrest

-

one person is injured in an alcohol-related crash every minute.

-

Drunk driving offenses estimated at $500 per adult in the US per year

-

50%-75% of convicted drunk drivers continue to drive on suspended licenses

If you have been charged with a DUI, you will need high risk car insurance in order to resume your driving privileges. While a single DUI violation doesn’t mean that you’ll never be able to drive legally again, it does make it difficult to find affordable high risk insurance after a license has been suspended or revoked. A DUI citation will require an SR22 policy as proof of financial responsibility before the DMV can reinstate a restricted driver’s license.

In addition to “bad” behaviors,

there are a number of characteristics that could warrant a high risk driving label, like:

Teen Driver

Bad Credit

Renting

Occupation

Sports Car

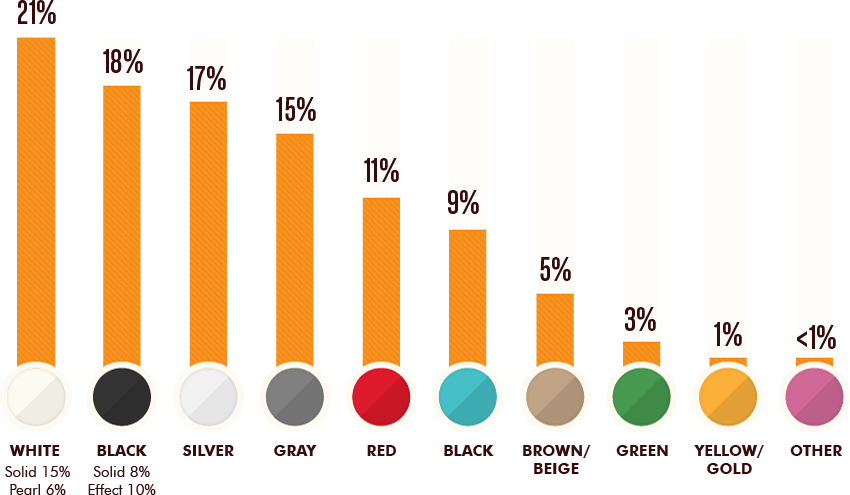

Source:2010 DuPont Automotive System Global Color Popularity Report

While many of the above characteristics are beyond your control to classify you in a high risk driving category, the good news is that car color may not have anything to do with it.

Many drivers mistakenly believe that red cars cost more to insure. Industry experts reveal that though red cars may come with a higher price tag on the lot, it’s a long-lived myth that driving a red car will inflate insurance rates.

3 Driver Risk Categories

Now that you know what can qualify you as a high risk driver, it helps to understand basic risk categories that an insurance company may use to set car insurance rates. The Insurance Information Institute separates drivers into three different categories based on the behaviors and characteristics listed above:

-

PreferredA driver has a clean driving record and is eligible for the best insurance rates.

-

StandardA driver is considered average with a fair driving record.

-

Nonstandard/High RiskA driver may have multiple traffic citations or fall into a risk category, like a teen driver.

Some insurance agents also consider complete ineligibility to be a fourth risk category.

There are drivers with serious offenses on their record that may be refused auto insurance by multiple providers. An ineligible high risk driver can still qualify for car insurance through the DMV assigned risk pool in their state; a driver may have to provide proof of rejection from several high risk car insurance companies.

If high risk insurance has your head spinning, take heart. In most cases, a high risk label isn’t the kiss of death when it comes to inexpensive car insurance. Your risk category will directly influence your insurance rates, but it is possible to keep premiums affordable – as we will discuss in the next section.

Here are a few important facts to remember about high risk

insurance if you are considered a high risk driver:

-

You are still eligible for auto insurance.

Some auto insurance companies prefer squeaky clean drivers, while others specialize in high risk drivers.

-

Not all high risk insurance providers are created equal.

It helps to compare insurance companies to make sure you’re paying the most affordable high risk rates.

-

High risk insurance may require an SR22.

Keep in mind that an SR22 isn’t insurance; an SR22 insurance form is provided by an insurance company as legal verification that a driver can meet minimum requirements for financial responsibility in order to drive.

-

A high risk driving category isn’t permanent

It may be discouraging to be branded high risk, but you can clear your driving record over time. You may also be able to take continued driver’s education courses to improve your standing.

If you need an SR22 for a major traffic citation, you may have to find a specialty high risk insurance

agent to supply it.

5 Ways to Save on High Risk Auto Insurance

By now, it’s crystal clear that a high risk label will affect your car insurance rates.

According to DMV.org, your driving record carries the most weight in triggering your insurance rates to increase. In fact, DMV.org calls your driving record your “driving DNA.” This simply means that your driving record will be used by an insurance agent to determine exactly how much you will pay in car insurance based on a low or high risk category, as discussed in the previous section.

So how much is high risk auto insurance, and is there any way to keep it affordable? Fortunately, you’ve come to the right place.

Consider these top 5 tips to scout out reasonable high risk insurance that won’t break the bank:

Be honest about your driving history

If you were cited with a DUI a few years back, it’s important to be upfront about the charge with a new insurance company providing a car insurance quote. Many insurance providers are willing to be lenient with you if you disclose past violations on your driving record. If an insurance agent finds out that you lied months down the road, you may be booted and left without coverage.

Compare different car insurance agencies

This has been said once, but it’s worth saying again. If you’re not happy with the high risk rates quoted by your regular insurance provider, there’s no harm in shopping around. Comparing high risk car insurance quotes from a minimum of three providers will give you a better idea of the fair market rate for car insurance for high risk drivers based on your specific risk factors.

Improve your driving record

If you’re facing sky-high insurance rates after one or more DUI convictions, it’s time to sit down for a one-on-one meeting with your insurance agent. Your insurance agent may be able to provide you with helpful advice as to how to clean up your record with defensive driving courses and/or safe driver discounts for good behavior. Learn how to get insurance after a DUI.

Consult with a lawyer

If you were ticketed unfairly, it may be worthwhile to hire a lawyer with experience in traffic law. Removing an unjust conviction from your record could save you hundreds of dollars annually by lowering your insurance risk category.

Be patient

We know, we know, this is the last thing you want to hear as a high risk driver. However, points will drop automatically from your license after a certain time frame, which will vary by state. Once these points drop, you can begin to price insurance and get multiple insurance quotes from different providers to find even cheaper monthly rates.

Once a High Risk Driver, Always a High Risk Driver?

There is light at the end of the tunnel if you are a high risk driver.

Even though it may seem like you will be permanently branded with a scarlet letter, a high risk label won’t last forever. Of course, this is contingent upon you turning over a new leaf to dramatically improve your driving record. Once this happens, you will be rewarded with cheaper insurance for your efforts. The amount of time you are categorized as a high risk driver will depend on what earned you this label in the first place. For example,

-

Multiple tickets

It may take up to three years to drop high points off your driver’s license from multiple tickets.

-

DUI

A major infraction like a DUI can impact insurance rates for up to five years, depending on the provider.

-

No insurance

If you were caught driving without insurance, you may be considered high risk for a minimum of six months.

When in doubt,

don’t take the risk of engaging in unsafe driving behaviors that could cost you in the future!

If you’re already considered a high risk driver, there are steps you can take to move beyond this high risk

category to lower your insurance rates.

-

Familiarize yourself with the exact dates of your traffic violations.

-

Once the points from a violation are dropped from your record, you can request a new quote from your agent or another provider to lock in lower rates.

-

The same holds true for a major violation like a DUI, although points may not drop to reflect lower rates for up to five years.

For high risk drivers, time is on your side.

Working to improve your driving habits can reward you with

better rates in the future once violations drop from your record.