Is Broken Glass Covered by Your Insurance Policy?

Cracking your windshield can seem like small potatoes compared to totaling your car in an accident, but it still may warrant an insurance claim.

A small nick or crack in your windshield is easy to ignore, especially if it doesn’t obstruct your vision while driving. But a larger break or a shattered windshield may need immediate attention before you can safely – and legally – get behind the wheel again.

The good news is that if you have a comprehensive auto insurance policy, broken glass should be covered by your insurance.

Most broken glass, whether it be a windshield or a window, will fall under the Comprehensive Physical Damage portion of your full coverage auto insurance. In many cases, your policy will require you to pay a deductible before broken glass repair or replacement is covered. A deductible is the amount of money that you will owe out-of-pocket before insurance funds the remainder of the repair.

You are responsible for determining your car insurance deductible. The average deductible can range from $250-$1000. If your deductible is $500, for example, you will have to pay $500 before any extra repair or replacement costs are covered by insurance.

Now to answer the burning question on your mind…

How much is windshield repair going to cost you?

If you decide to pay for windshield repair out-of-pocket, it could cost anywhere from $20-$325, depending on the extent of the damage. A small chip may only cost up to $60 to repair, while a complete windshield replacement could cost up to $325.

How Much Does Windshield Repair Cost?

Excellent question. The amount of the auto insurance deductible that you choose will inversely correlate with your insurance premium. Meaning, if you’re looking for a clever way to lower your car insurance rates, you can increase your deductible by a small amount, like $250, to lower your annual premium.

Of course, the catch is that you need to have enough money in the bank to pay for your deductible out-of-pocket. If you don’t have $500 to spare, then it wouldn’t be wise to raise your deductible from $250 to $500 – until you can afford to pay for it upfront.

But what if the cost of windshield replacement is less than your deductible?

Special windshield coverage may be written into a policy’s terms and conditions to offer a smaller deductible amount for replacement. The average broken glass policy deductible can range from $100-$300.

Additionally, if windshield damage is minor, like a chip or a small crack, repair may be available at no cost. That’s why it’s essential to understand your glass breakage policy terms and conditions in detail. If free minor glass repair is available, you should take advantage of it!

If you’re stuck between a rock and a hard place with a non-negotiable high deductible on glass coverage, you may be better off paying for it out-of-pocket without filing a claim. First and foremost, bypassing insurance to pay for windshield replacement yourself will keep an unnecessary claim off your record that could affect insurance rates. You may also be able to find cheaper glass repair yourself if you choose to hire a third-party auto glass repair company.

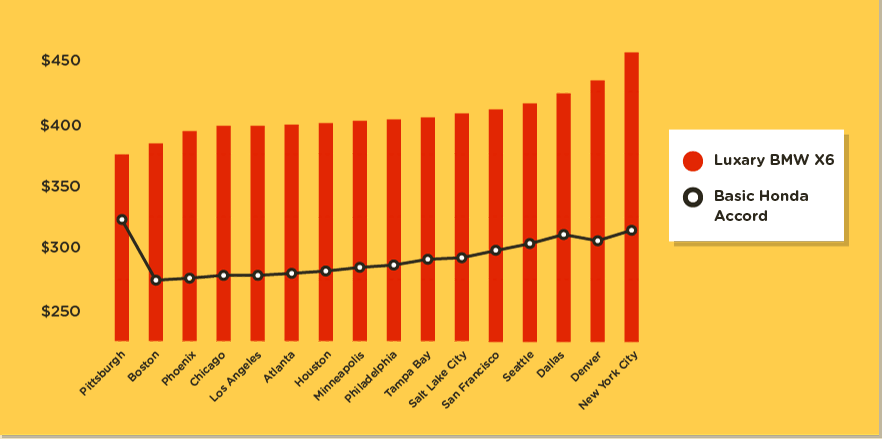

Here are several pricing samples from Glass.net to give you a better idea of average windshield replacement costs throughout the US:

Some auto insurance policies may even provide full glass coverage.

Full glass coverage differs from comprehensive insurance since there is no deductible. If a rock hits your windshield on the highway and shatters it completely, you won’t have to worry about paying a $500 deductible before insurance kicks in. Full glass coverage will pay for windshield and glass replacement upfront without any expense to you as the driver.

When to Consider Auto Glass Repair

You never know when you may need to file an auto glass claim for damages ranging from small to large:

-

Small rock or pebble cracks your windshield while driving.

-

Large object falls off a truck on the highway and shatters your windshield while driving.

-

Weather changes turn a minor windshield chip into a full lengthwise crack.

-

Fallen tree branch shatters your windshield while parked.

-

Theft of valuable items in your car results in broken window glass.

-

Vandalism results in a broken back windshield.

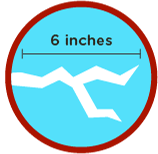

Most auto insurance providers recommend that a minor chip or crack measuring less than 6 inches be repaired. A larger crack beyond 6 inches or a fully shattered windshield may need to be replaced in its entirety.

Rolags.com, Repair of Laminated Automotive Glass Standard and representative of the National Windshield Repair Association (NWRA), offers the following guidelines for eligible windshield repair:

Damage Types and Repairable Dimensions

Repairable Damage

-

Bullseye

With a diameter no larger

than 1 inch (25mm) -

Combination Break

Diameter of body (excluding legs) not to

exceed 2 inches (50mm) -

Crack

No longer than 14 inches

(350mm) -

Half moon (partial

bullseye)

With a diameter no larger than

1 inch (25mm) -

star break

Diameter of the break

not to exceed 3 inches

(75mm) -

Surface pit

Damage with a diameter of not less than

1/8 inch (3mm)

Is It Dangerous to Drive with a Broken Windshield?

A chipped or cracked windshield may not seem like much, but it can compromise the structural integrity of your car.

If your windshield has a small nick in it from a pebble on the road, you – like many drivers – may decide to take the “no harm, no foul” approach. If the chip in your windshield doesn’t obstruct your driving, then there’s no need to repair it. Right?

Most drivers are surprised to find that there are a number of dangers associated with driving with a broken or even chipped windshield. Beyond aesthetic issues, a cracked windshield could earn you a ticket in many states.

Even one ticket can spell big problems down the road. For more information, see how long does a ticket stay on your record?

The reason that a damaged windshield is taken so seriously is that it compromises the safety of your vehicle. The purpose of a windshield is to uphold the structure of your car.

An in-tact windshield will buffer some of the impact of a front-end collision to protect all passengers in a crash. Once a windshield has even a small chip, it will shatter immediately in a front-end accident and greatly increase the risk of injury or death for all passengers in the car.

Besides working as a shield, a windshield will also provide vertical support to protect passengers in a rollover accident. If a windshield is already cracked, the roof of a car may be more likely to cave in to result in injury or fatality.

GlassAmerica.net confirms that this rollover risk becomes even more hazardous when occupants in a car aren’t wearing seat belts. A minor crack in a windshield could cause glass to shatter immediately upon impact. Passengers without seat belts could be fully ejected from the car.

But that’s not all

If you’re looking for one more reason to take windshield repair seriously, consider this:

Not all windshield replacements are installed properly the first time.

According to national statistics, close to 4 out of 5 auto glass replacements failed to pass proper safety and installation standards. A windshield that has been improperly installed can be just as dangerous to drivers and passengers in front-end and rollover accidents as a broken windshield.

Windshield repair is much safer than windshield replacement because your factory seal on your auto, truck, or recreational vehicle is kept intact and is air/watertight and never removed.

Mark Carpenter

Owner of Dings Plus Windshield Chip Repair

If you’re in the market for glass repair, try to request repair instead of full replacement to preserve the original factory seal.

there are several major benefits to windshield repair or replacement

-

Potential savingsRepairing a windshield is far cheaper than full replacement and is recommended whenever possible.

-

Safety on the road If you can repair instead of replace a windshield, you’ll preserve the factory seal for safer driving. It’s also advised to repair even a minor crack or chip in a windshield to protect a vehicle’s structural integrity in an accident.

-

Preserve manufacturing quality Keeping your windshield in the best condition will maintain the Original Equipment Manufactured parts of your vehicle. This is especially important to cut down on annual depreciation.

-

Cosmetic improvements At the very least, you may want to repair or replace your windshield to keep your car looking as good as new for as long as possible!

How to File a Broken Windshield / Glass Insurance Claim

Okay, so you have a broken windshield and need to file a claim. What do you do now? All insurance companies recommend filing an auto glass claim as soon as possible, no matter how minor it may be.

Call your insurance company or log in online to report broken glass.

Your insurance agent or representative will be able to provide more information about the extent of your glass coverage. They will also consult with you to arrange glass repair or replacement in a location convenient to you. Some insurers estimate glass repair in as little as 48 hours.

Pay the deductible, if applicable.

If you have full auto glass coverage, you’ll be eligible for repair or replacement with zero deductible. If you have comprehensive car insurance, you may pay a smaller deductible for glass repair or replacement; many insurers will offer free repair for minor glass damage.

Schedule glass repair.

You have the option to choose which company will repair or replace your windshield. Your insurer may recommend a specific auto glass replacement company within their network, or you may choose your own replacement company. Keep in mind that “going out of network” could incur a penalty by requiring you to pay your full deductible, in some cases.

Voila! There you have it

Filing a glass repair or replacement claim is often straightforward and simple, once you contact your insurance agent for more information. However, you can make the entire process easier on yourself by becoming well-acquainted with your glass coverage policy to determine how much of a deductible you will have to pay, if any, for windshield repair.

This will also help you to decide when and if it makes sense to pay for repair or replacement out-of-pocket without filing a claim. As outlined above, you may opt to pay for a $20 windshield repair yourself if your insurance deductible is $500.

If your insurance company provides free glass repair, by all means, take advantage.

Before you set off on your merry way to get your windshield fixed, take one final word of warning to watch out for windshield repair scams.

If you choose to file a glass claim through your insurer, scams will not be an issue as your insurance company will be responsible for your claim. However, if you go through a third-party provider, scams may be an unfortunate possibility.

A windshield scam is likely to occur if you are approached for repair in a public place, like a gas station parking lot. A scam artist may claim that your windshield repair will be fully covered by insurance, so why not take advantage of their services? In many cases, windshield scammers will try to replace perfectly intact windshields, raise prices for minor windshield chips, or charge your insurance for fraudulent glass claims. Check out Geico’s glass claims phone number here: 1 (800) 207-7847

If you have any reservations or questions about windshield repair, it’s best to go through your insurance provider.

Filing a glass claim will insure any work done on your windshield regarding repair and replacement. If damage isn’t repaired fully or up to standards, your insurance company will be responsible for expediting the claim.