Broad Form Auto Insurance Coverage

Broad form insurance coverage, a form of liability car insurance, covers a single driver, which produces cheaper rates. This type of insurance does not extend to third parties. Broad form auto insurance is appealing to drivers because of its low price point. Additionally, it will cost less than many types of coverage.

What does broad form liability mean? Broad form insurance is a type of liability insurance policy that only covers one driver, resulting in cheaper rates. However, there are many auto insurance coverages to choose from, and it’s important to determine whether broad form auto insurance is the right type of coverage for you.

Below, we’ve provided plenty of information on broad form insurance (and explained the broad form insurance definition and how much broad form insurance is) to help you make the right decision. Before you buy broad form insurance, compare insurance rates right now by typing your ZIP code into our free helpful tool.

What is broad form liability insurance?

By definition, coverage is not extended to third parties, but this would not prevent a third party or passenger from presenting a claim against someone insured under a broad form auto insurance policy.

Read more: Buying Third-Party Auto Insurance: What You Need To Know

For example, a driver insured on a broad form insurance policy is operating a vehicle with a passenger. The driver is negligent and hits a tree, causing injuries to that passenger. The passenger would be able to file a bodily injury (BI) claim against the driver and also may be entitled to no-fault medical coverage (Personal Injury Protection/Med Pay), depending on the state.

For many drivers, broad form auto insurance is attractive because of its low price tag. Since only the driver is covered in a broad form policy, broad form insurance will cost less than most other types of standard coverage.

So if you’re asking, “What is broad form coverage?” the important thing to know is that it’s limited and straightforward. With a broad form policy, you won’t be allowed to add on the additional coverage.

Broad form insurance, or broad car insurance, is often controversial, as it provides a very narrow scope of protection on the road. In fact, broad form auto insurance is available in only a few states, including Washington, Idaho, and Oregon.

Broad form offers limited auto insurance coverage and is not recommended for high-risk drivers such as teen drivers. High-risk auto insurance is only available in some states.

What does broad form insurance cover?

Broad form will provide coverage for one driver, no matter how many cars are owned or driven. This means another driver that borrows your insured vehicle will not be covered, although you may still be legally responsible for vehicle damages or injuries.

Read more: How To Insure Two Cars for One Driver

Remember, broad form insurance provides only basic coverage.

You will not be covered when driving a non-traditional vehicle like an RV or motorcycle.

Only you, as the driver, are covered when driving any vehicle.

You will not be covered by insurance for any vehicle damage incurred to your vehicle in an at-fault accident. However, you can drive any vehicle (excluding company cars) since you are insured as a driver across-the-board.

Before you consider broad form auto insurance, it’s important to determine if it is legal in your state of residence. Since broad form is restricted to one driver, it may not offer enough coverage to meet state minimum insurance requirements.

Even if broad form insurance is allowed in your state, your insurance agent (ex. Geico broad form insurance) may not be open to the idea of you buying it. States that allow broad form insurance are currently reviewing policy terms and conditions to determine if broad form meets strict legal liability standards.

It’s important to understand that broad form coverage is considered secondary auto insurance when driving a vehicle you do not own.

For example, if you drive a friend or family member’s car and get into an accident, insurance claims will first be made through the primary policy on the vehicle before single driver broad form insurance kicks in.

Keep in mind that broad form may have a number of limitations, such as:

- Only providing coverage for one legal, licensed driver per house

- Not covering other drivers that use a vehicle

- Not providing adequate coverage for a costly or brand new vehicle

- Not providing adequate coverage for a high-risk driver

- Not providing driver coverage for company vehicles, vehicles that have a lienholder, or vehicles that are still being paid off. For example, most lenders will have to be listed as lienholders. If you have auto insurance on a new car through Progressive, lienholders will be added to the policy too.

In addition, broad form liability may have certain restrictions by state. In the state of Michigan, limitations in an accident may include:

Nature of Accident

- You are more than 50% at fault if you hit a tree, a person, another vehicle, etc.

- You are 50% or less at fault if you are rear-ended, side-swiped, etc.

No Collision Coverage

- Your insurance pays nothing. You are responsible for the cost of repairs to your car.

- Your insurance pays nothing. You are responsible for the cost of repairs to your car.

Limited Collision Coverage

- Your insurance pays nothing. You are responsible for the cost of repairs to your car.

- Your insurance pays. If you have chosen a deductible, your insurance pays the cost of repairs over and above the deductible. You must pay the deductible.

Standard Collision Coverage

- Your insurance pays, except the deductible that you have chosen. You must pay the deductible.

- Your insurance pays, except the deductible that you have chosen. You must pay the deductible.

Broad Form Collision Coverage

- Your insurance pays, except the deductible that you have chosen. You must pay the deductible.

- Your insurance pays. You do not have to pay the deductible.

Read on to see if you qualify for broad form insurance.

Who is a candidate for broad form insurance?

Broad form insurance isn’t for everyone. If you don’t put serious thought into this very limited car insurance policy, you could take a heavy financial hit in an at-fault accident.

You may consider this type of car insurance if you:

-

Are single. If you regularly drive alone without any family or friends in your car, it may not be necessary to pay for additional coverage for passengers in your vehicle. If no one else driveschea your car, even on occasion, additional insurance coverage for other drivers is redundant.

-

Don’t have any children/dependents. Single drivers without children or family members in the household may benefit from broad form car insurance.

-

Drive an older vehicle. Broad form insurance isn’t recommended if you drive an expensive or new vehicle. Many times, a lender will require that you carry full coverage auto insurance when paying off a loan or lease on a new car.

-

Don’t own a vehicle. If you fall into the category of a driver that doesn’t own a car and has non-owner car insurance, broad form insurance will offer on-the-road protection whenever you drive.

Once a vehicle has been paid off completely, you can consider dropping coverage to standard liability or even broad form insurance if you have enough money in the bank to pay for accident damages yourself.

Even without personal car ownership, broad form insurance will provide liability protection for you as a driver to meet legal driving requirements, which is why it’s sometimes referred to as “broad form liability insurance.”

Your broad form policy will only apply to you as the driver and will offer coverage in any eligible vehicle that you drive with permission. This will extend to borrowed cars, rental cars, and even test driving a new car before you buy.

Keep in mind that you may not need a broad form policy if you are renting a car. Many times your insurance company, such as Geico, covers rental cars.

Additionally, a broad form named insured endorsement gets added to your liability and can help simplify the administration process.

What are the pros of broad form insurance?

Before you take the plunge and cut back to broad form insurance, it helps to weigh the advantages versus the disadvantages of downgrading your policy.

Broad form auto insurance can provide certain benefits:

-

You can meet state minimum requirements. Depending on the state, broad form insurance may be used as bare-bones coverage for a single driver to meet minimum requirements to drive legally.

-

You can save money on insurance. When compared to limited liability auto insurance, broad form is cheaper in most cases.

-

It’s ideal for low-value vehicles. You can save money on your monthly rates if your car is paid off and has depreciated in value. As mentioned above, broad form insurance is not recommended for new cars under loan or lease.

-

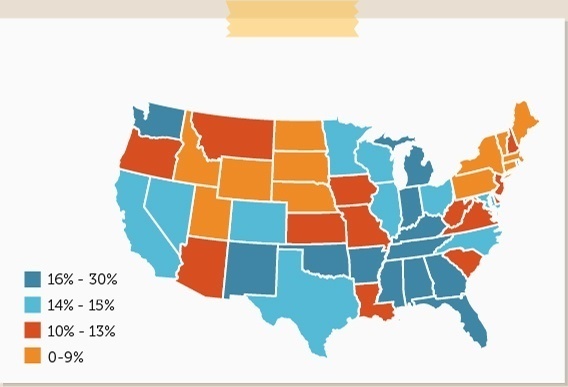

You can avoid unnecessary fines. If you have ever considered driving without insurance, think again. In a state like Washington, driving without insurance will earn you a hefty minimum fine of $450. Affordable broad form auto insurance can be an option for single drivers that seek minimum coverage. You don’t want to be one of 13% of uninsured drivers that the Insurance Information Institute says are out on the roads.

-

You can get coverage if you don’t own a car. If you’re a driver that doesn’t own a personal vehicle, broad form insurance will make the most sense when driving a borrowed car. In some states, you may receive a personal fine for driving uninsured, even in an insured vehicle.

Uninsured drivers by state

*Data from Insurance Research Council, 21 April 2011

If you meet the criteria for broad form insurance, it can be a smart choice to help you save money on your monthly auto insurance rates. Since broad form insurance restricts coverage to only a named driver or operator on a policy, it can offer inexpensive coverage for single drivers without dependents, drivers of low-value vehicles, or drivers that don’t own a car.

What are the cons of broad form insurance?

Of course, broad form insurance doesn’t come without its share of disadvantages. As we’ve already explained, broad form auto insurance isn’t an ideal policy for every driver, especially if you often drive with your family in the car or require more coverage for a brand new vehicle. Here are some disadvantages to consider before buying broad form car insurance:

-

Coverage is very limited. Broad form insurance for a single driver won’t provide extra coverage when driving a rental truck, RV, or motorcycle.

-

Only liability coverage is offered. What does liability coverage mean? In addition to a limited coverage scope for the vehicle that you drive, broad form car insurance will only offer liability coverage. This means that your car won’t be covered for any at-fault damages incurred.

-

Coverage doesn’t extend to regular vehicle use. If you’re a driver who regularly borrows a friend or family member’s car, broad form won’t cut it. Instead, the vehicle owner will need to add you on to their policy as a secondary driver.

-

Coverage doesn’t extend to company vehicles. If you have broad form insurance and are driving a car for business use, you will still require additional commercial auto insurance for adequate coverage.

-

Your state may not allow it. Broad form coverage is not available in all states. Check with your insurance agent for more information to meet state minimum requirements.

As you consider the broad form insurance cost, it’s important to understand that it isn’t a “fix-all” solution when looking for cheap broad form insurance.

In fact, choosing broad form insurance instead of more protective comprehensive coverage and collision coverage could cost you more in some circumstances, like getting into an accident when driving an expensive vehicle. Take the time to consult with your insurance agent one-on-one to determine the best coverage options for you, with broad form auto insurance rates or not. Additionally, check out the chart below for average insurance rates based on coverage type.

Average U.S. Auto Insurance Rates by Coverage Type

| Coverage Type | Average Annual Auto Insurance Rates | Average Monthly Auto Insurance Rates |

|---|---|---|

| Comprehensive | $148 | $12 |

| Collision | $326 | $27 |

| Liability | $555 | $46 |

| Full | $1,029 | $86 |

As you can see, rates differ greatly based on your amount of coverage.

If you’ve examined the pros and cons and have decided that broad form insurance makes the most sense for your situation, there are several steps that you can take to save on this extended coverage.

How to Save Money on Broad Form Insurance

Other static factors that may affect auto insurance rates include:

-

Geographic location

-

Car make and model

-

Credit score

-

Driving history

-

Marital status

Reviewed by:

Licensed Insurance Agent Brad Larsen