Auto Insurance Calculator

How to Calculate

Your Auto Insurance Rates

- – One of the best ways to save on your auto insurance is to compare rates from multiple insurance companies

- – Using a car insurance calculator makes it easy to make an apples-to-apples comparison of coverage and rates from multiple insurance providers

- – Every insurance company calculates rates differently, but most use the same factors to assess your risk

- – Factors that can affect your rates include your age, driving history, marital status, where you live, whether or not you’re a parent, and more

Are You Paying Too Much for Auto Insurance?

It’s safe to say that you’re probably paying too much for car insurance. You may have signed up for your spouse’s coverage, or you’re staying on your parent’s car insurance plan without really thinking about it. Or, you may have gone with a locally advertised insurance company or the first search results that popped up on Google.

This is the way most people choose car insurance. It’s straightforward, effortless, and makes sense. But putting in a little extra effort could pay big in the long run.

How much does auto insurance cost, and how much should you be paying? By putting in a little extra effort, you could save big in the long run. What’s the first step? Using a car insurance quote calculator is one way to save.

Read our guide for more on what an auto insurance calculator is, how it works, factors car insurance companies consider when calculating your rates, and more.

Comparing auto insurance coverages and weighing risk factors could shave hundreds of dollars off your annual rate. Ready to find affordable auto insurance or seek help buying no down payment auto insurance with an auto insurance calculator? Enter your ZIP code in our free tool to compare auto insurance calculator quotes.

How much should you pay for auto insurance?

This is an excellent question with no easy answer. Countless factors determine how much you will pay for car insurance, but one thing is for sure—if you haven’t researched your risk factors, you’re probably paying too much.

So how much should your car insurance cost? To break it down, we can start with car insurance averages.

The average cost of car insurance varies by state. Some states have notoriously higher car insurance premiums than others. Michigan is the state that takes the cake for the nation’s most expensive average car insurance costs.

The top three most expensive states for auto insurance are:

-

Michigan

-

Louisiana

-

Florida

What about the cheapest? If you live in Maine or New Hampshire, then you’re in luck. Maine has the most affordable auto insurance rates in all 50 states, and New Hampshire has the second-lowest rates.

Throughout the U.S., car insurance rates fluctuate based on several variables, including traffic, urban versus rural regions, state insurance stipulations, percentage of uninsured drivers, number of car insurance providers, and rate of auto theft.

If you’d like to put a dollar amount to this damage:

Average annual car insurance premiums in Michigan hit a whopping $2,878

Louisiana follows in the number two slot at $2,389/year.

Florida drivers can expect to pay $2,239 on average.

At the bottom of the list:

Maine and New Hampshire’s car insurance rates are at $912 & $985 per year, respectively.

What does risk have to do with auto insurance?

There’s only one way for an auto insurance provider to quote car insurance rates: based on risk.

This risk is essentially an educated guess. There’s no way for an insurance provider to predict your skill and safety level as a driver.

Risk will be statistically assessed based on a collection of factors, including but not limited to age, sex, marital status, driving history, and type of vehicle.

Just as important to remember is the fact that not all insurers calculate risk with the same formula. Risk is a guess. It’s anyone’s game.

Comparison shopping insurance providers is the only way to take your risk assessment into your own hands to find the cheapest market rates. You can fill out our auto insurance calculator (even without personal information) to help you prepare for what you might pay for car insurance.

Michigan’s sky-high car insurance rates may be the result of the generous personal injury protection benefits required in the state.

You see, Michigan is a no-fault auto insurance state. This means that every single driver on the road must purchase personal injury protection (PIP) within their auto insurance policy in order to drive legally.

Louisiana doesn’t have the same no-fault laws as Michigan, but it has its share of problems: specifically, a high rate of uninsured drivers (an estimated 13%) and a high rate of lawsuits related to car insurance and vehicle accidents. That said, it’s still possible to buy cheap Louisiana auto insurance.

Florida car insurance prices are driven up by several factors, including the high number of uninsured drivers (the state is ranked number one for uninsured drivers at 26.7%) and traffic.

What are some important factors to remember when it comes to your auto insurance rates?

-

Drivers are required to have valid insurance in almost all 50 states.

-

The average driver will claim an accident on their record every 17.9 years.

- Car insurance rates normally drop at the age of 25.

-

Fender benders are the most common car insurance claim, followed by theft.

-

13 percent

of drivers may be uninsured at any point in time, according to the Insurance Information Institute.

You can be the most careful driver in the world, but that does not make you immune to car accidents on the road. Things like weather and unpredictable drivers mean you are always vulnerable.

The Ohio Department of Insurance, home to the third-cheapest car insurance rates in the nation, explains,

“Insurance is a product that relies on the spreading of risk among diverse individuals or groups to operate. All insurance companies use data and statistics to predict levels of risk for various individuals or groups. This risk calculation information is also used to develop rating plans. Generally, higher risk factors will result in higher premium rates, and lower risk factors will drive premiums lower.”

What about uninsured drivers?

Every time you get behind the wheel, you never know what is going to happen.

That’s precisely why car insurance rates are calculated based on a game of risk. Once you understand your specific car insurance risk factors, your rate quote will no longer be a mystery.

In New Hampshire, drivers must provide proof of sufficient funds to pay for any injury or damage in an at-fault accident.

How do you calculate your auto insurance rates?

Now to the nitty-gritty. What factors can affect your auto insurance quote? You can use these guidelines to better understand how to calculate car insurance cost and how to get the best deal:

Is age a factor?

Age is just a number, except when it comes to your car insurance rates.

Average car insurance rates depend upon age. You may have noticed that car insurance rates start dropping at the age of 25 and begin to go back up when you pass 70.

“Age affects your car insurance rates the most when you are under 25 or over 70.”

Sadly, this is not age discrimination. It’s all part of the car insurance biz. Car insurance providers base their rates on solid statistics, like texting and driving, that indicate younger and senior drivers are more likely to get in accidents.

New drivers and teen drivers have been proven more dangerous on the road; the accident-related death rate per mile in the 16-to-19-year-old age bracket is three times higher than a 20-year-old driver.

Our car insurance quote estimator will take into account your age when determining your quotes. Take a look at this table for some average rates based on age.

| Insurance Company | Average Annual Rates for a Single 17-year old female | Average Annual Rates for a Single 17-year old male | Average Annual Rates for a Single 25-year old female | Average Annual Rates for a Single 25-year old male | Average Annual Rates for a Married 35-year old female | Average Annual Rates for a Married 35-year old male | Average Annual Rates for a Married 60-year old female | Average Annual Rates for a Married 60-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $9,282.19 | $10,642.53 | $3,424.87 | $3,570.93 | $3,156.09 | $3,123.01 | $2,913.37 | $2,990.64 |

| American Family | $5,996.50 | $8,130.50 | $2,288.65 | $2,694.72 | $2,202.70 | $2,224.31 | $1,992.92 | $2,014.38 |

| Farmers | $8,521.97 | $9,144.04 | $2,946.80 | $3,041.44 | $2,556.98 | $2,557.75 | $2,336.80 | $2,448.39 |

| Geico | $5,653.55 | $6,278.96 | $2,378.89 | $2,262.87 | $2,302.89 | $2,312.38 | $2,247.06 | $2,283.45 |

| Liberty Mutual | $11,621.01 | $13,718.69 | $3,959.67 | $4,503.13 | $3,802.77 | $3,856.84 | $3,445.00 | $3,680.53 |

| Nationwide | $5,756.37 | $7,175.31 | $2,686.48 | $2,889.04 | $2,360.49 | $2,387.43 | $2,130.26 | $2,214.62 |

| Progressive | $8,689.95 | $9,625.49 | $2,697.73 | $2,758.66 | $2,296.90 | $2,175.27 | $1,991.49 | $2,048.63 |

| State Farm | $5,953.88 | $7,324.34 | $2,335.96 | $2,554.56 | $2,081.72 | $2,081.72 | $1,873.89 | $1,873.89 |

| Travelers | $9,307.32 | $12,850.91 | $2,325.25 | $2,491.21 | $2,178.66 | $2,199.51 | $2,051.98 | $2,074.41 |

| USAA | $4,807.54 | $5,385.61 | $1,988.52 | $2,126.14 | $1,551.43 | $1,540.32 | $1,449.85 | $1,448.98 |

| Overall Average | $7,559.03 | $9,027.64 | $2,703.28 | $2,889.27 | $2,449.06 | $2,445.85 | $2,243.26 | $2,307.79 |

Car insurance rates are likely to decrease with age until you hit the cut-off age of 70.

Is your car make/model a factor?

Why do some cars cost more to insure than others?

This one is simple: Expensive cars cost more to replace in an accident.

If you’ve recently upgraded to a new vehicle, you can expect a car insurance hike to follow. If you want to save money on car insurance online, consider trading in your brand-new car for an older (and less sporty) model.

Even if you do not own a car, you should still get insurance coverage to protect yourself when you drive other vehicles.

Is having a college student a factor?

Adding a teen to an auto policy can hurt your wallet.

Fortunately, by the time they make it to college, you may be home-free.

Personal finance strategist Shannah L. Compton estimates that “You can save as much as 10-20% off your rates if your kid decides to go to a college that is 100 miles or more away from your home.”

Is credit score a factor?

Why on earth would your credit score matter to your car insurance provider?

In a nutshell, your credit history reflects your ability to pay on time. Insurance providers can use credit score data to determine rates in all states, except California, Hawaii, and Massachusetts.

Your credit score is likely to reflect your car insurance rate when moving up or down. Excellent credit can lower your premium by more than 30%. However, there are low-income car insurance options.

Is coverage type a factor?

Liability car insurance is the least expensive coverage option required in most states.

Liability coverage will cost less than full coverage auto insurance and may be a better choice for older vehicles with a lower value. However, your lender may require you to carry full coverage insurance to protect your car’s value if you are still paying off a loan.

Full coverage, or comprehensive car coverage, may include a number of policy customizations that depend on the provider, such as collision, medical payment, custom parts and equipment, rental reimbursement, roadside assistance, and loan payoff coverage.

There are many other types of coverage to consider, such as collision car insurance, medical payments, and personal injury protection.

https://www.youtube.com/watch?v=04SZGS6DdVM

While some of your insurance coverage will be required by your state or financial lender, you may choose to go above and beyond. Our monthly car insurance cost calculator can help determine quotes for multiple types of insurance coverage.

Is your driving record a factor?

One car insurance risk factor within your control is your driving history.

We all make mistakes, but it is to your advantage to keep your driving record as clean as possible.

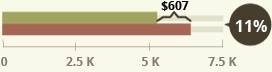

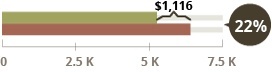

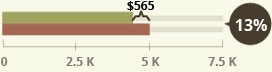

A reckless driving ticket can increase car insurance rates by up to 22%; a first-time DUI offense may result in a rate hike of 19%; a seemingly minor infraction like a speeding ticket one-to-14 miles over the speed limit could increase rates by up to 11%.

Is how far you drive a factor?

When in doubt, carpool on your commute.

Not only does carpooling benefit the environment and reduce wear and tear on vehicles, but taking public or alternate transportation instead of driving to work could lower your auto insurance rates.

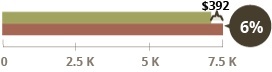

A one-way commute of three or fewer miles falls into the leisure driving category and will not affect rates. A one-way commute of four-to-nine miles could increase auto insurance rates by several dollars, while a significantly longer one-way commute of 20 miles or more could add $10 per month to your policy.

Is your gender a factor?

Women are statistically seen as safer drivers.

Men may pay an estimated $15,000 more in total lifetime car insurance than women when similar age and income levels are factored in. The playing field is leveled when you consider that women are likely to pay more than men for health insurance on average, but it’s possible to buy cheap auto insurance for women.

However, states like California and Hawaii have made this practice illegal.

Is being a parent a factor?

Babies are expensive, but they may prove beneficial to your car insurance rates.

Parents are expected to be safer drivers and may trade in a sporty car for a minivan. This new practical driving attitude—and a car with a better safety rating—could reward you with lower auto insurance rates.

Is your insurance provider a factor?

Every auto insurance provider is different.

Each insurer will calculate car insurance rates based on preferred data and company claim history using its own specified criteria. Again, car insurance rate calculations will vary by provider based on multiple risk factors, making it imperative to compare quotes before signing on the dotted line.

Our car insurance estimator will give you quotes from multiple car insurance providers in your area.

Is a lapse in coverage a factor?

Here’s another reason why it never pays for uninsured motorists:

Even a small lapse in coverage can affect your car insurance rates.

It may seem like a good idea to save money in the short term by neglecting to renew your policy, but keep in mind—your next insurance provider will look at your coverage history when calculating your premium.

You could be labeled a high-risk driver for letting coverage lapse, indicating that you drove uninsured.

Even if you hold coverage continuously but you only purchase the bare minimum coverage, you could still be looked at as less financially responsible than individuals who purchase more insurance than is required by their state or lender.

A high-risk driver label means high-dollar coverage when you buy high-risk auto insurance coverage.

Is your location a factor?

You’ve already learned that car insurance rates can vary drastically by state.

Yet even if you reside in an inexpensive car insurance state, your regional location could affect your rates.

Regional risk factors are based on the risk of an auto accident. If you live in an urban area with high-volume traffic and a high crime rate, you can expect to pay more than drivers in rural areas.

Your ZIP code makes a big difference. The actual state you live in is a significant factor as well.

New Jersey, California, Florida, and Texas are all in the more expensive tier of states. While New York, Illinois, Ohio, and Arizona are in the bottom half of all states.

You should also keep in mind that, if you’re moving, your insurance requirements and cost of insurance may change depending on where you move. It may be helpful to calculate car insurance rates before you move to be better prepared.

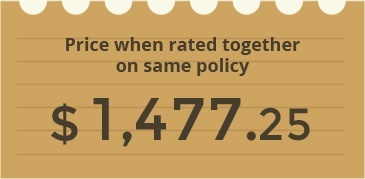

Is your marital status a factor?

Married couples are expected to combine car insurance policies, which automatically yield discounts and cheaper rates. If you decide to buy a house and bundle your homeowners and auto insurance, look forward to an even better deal. (For more information, read our “Buy Cheap Auto Insurance for Married Couples“)

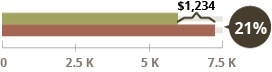

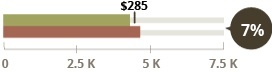

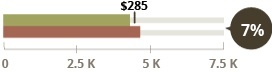

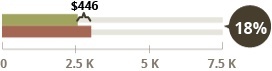

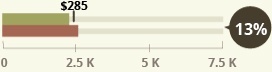

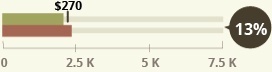

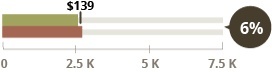

Six-Month Policy Prices for a Married Couple

-

Husband alone

-

Wife alone

Quotes are based on 25/50/25 liability protection with comp and collision coverage with $500 deductibles. Both drivers were rated for their own 2010 Toyota Corolla LEs. Rates are based on the 90039 ZIP code of Los Angeles.

Is the number of drivers on your policy a factor?

Adding new teen drivers to a policy can increase rates, but there’s a catch.

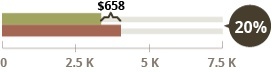

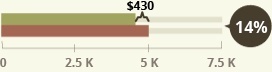

Teen drivers bundled onto a parent’s car insurance policy may be eligible for good student discounts. Some insurers provide up to a 20% discount for a student driver with a B grade average or on the Dean’s list. Take a look at the rates below to see how much a good student discount could save your teen in Los Angeles, Buffalo, or Houston.

For new drivers, a clean driving record is more important than ever as traffic tickets can cancel out a good student discount.

As stated above, bundling experienced drivers in the same household on a policy, such as after marriage, can lead to a rate decrease. It is also possible to insure one driver for two cars.

Read more: How To Insure Two Cars for One Driver

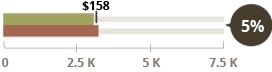

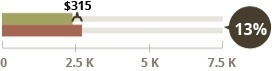

-

Good

Student Cost -

Average

Insurance Cost -

Difference

-

% Excess Cost

| Age |

|

|

|

|---|---|---|---|

| 16 |

|

|

|

| 18 |

|

|

|

| 20 |

|

|

|

| 22 |

|

|

|

| 24 |

|

|

|

Is your occupation a factor?

Did you know that some careers have a statistically higher car accident risk?

If you’re a doctor, lawyer, business executive, architect, salesperson, or real estate agent, you may pay the price in higher car insurance rates. These career fields are statistically linked to lack of sleep, high-stress levels, and working overtime, which can cause car accidents.

You may enter your ZIP code below to approximate your car insurance with our calculator for free.

Five Ways to Reduce Your Auto Insurance

Rates Today

How can you save on auto insurance? Keep reading for five ways to save on your coverage.

Compare, compare, compare. This cannot be overstated. Every insurance provider uses its own formula to calculate car insurance rates. You never know how much you could save—or spend—until you compare providers and crunch numbers. Use an auto insurance calculator to quickly estimate auto insurance rates from multiple providers before buying.

Drop extra coverage. How much coverage do you need? If your car has decreased in value, paying extra for collision coverage may no longer be necessary. At the very least, consider cutting policy perks you don’t need, like roadside assistance.

Perfect the art of negotiation. When comparing insurers, it never hurts to leverage one quote against another.

Ask specific and pointed questions to whittle down rates for drivers: How much can I save by bundling auto and homeowners insurance? How much can I save by paying my annual rate upfront? Can you beat this insurer’s rate quote?

Ask for discounts. The squeaky wheel gets the grease, as the saying goes. Ask regularly about auto insurance discounts, which may apply to in-vehicle anti-theft devices, good students, seniors, low-mileage drivers, and more.

Raise your deductible. Your deductible is the amount you are responsible for paying when you file a claim. If you can set aside a chunk of change and increase your deductible, do so. Agreeing to pay $1,000 instead of $250 out-of-pocket will lower your annual premium significantly.

Auto Insurance Calculator: The Bottom Line

Many different factors affect how to calculate the insurance cost for a car. And each car insurance provider may have a different way of going about determining your policy costs.

It’s always a good idea to shop around and compare quotes before committing to one auto insurance company. Use your ZIP code in our free insurance comparison tool to get and compare auto insurance calculator rates from car insurance companies in your area.