Full Coverage Auto Insurance

What is considered full coverage auto insurance? How can I compare full coverage auto insurance? How much does full coverage auto insurance cost? We’re here to answer all your questions.

If you have ever purchased a new vehicle, you have likely heard the phrase “full coverage.” When buying a new car, a dealership will often ask for a copy of your insurance declaration page or proof of coverage. Specifically, the dealer is ensuring your policy offers liability coverage as well as collision and comprehensive coverage – full coverage. So, what is full coverage insurance? There can be a lot of confusion regarding full coverage car insurance’s meaning.

What, exactly does full coverage mean? First, let’s discuss what full coverage is not. Despite the name, which makes a person think that the policy offers complete and total insurance coverage, there are some limitations and exclusions to this coverage. It is important to understand what, exactly, your auto insurance coverages offer for you and your automobile in the event of an accident.

The best way to buy full coverage car insurance from a top insurance company is to shop around. Enter your ZIP to compare cheap full coverage car insurance quotes online.

What Full Coverage Does Not Cover

Medical payments

Depending on your state’s minimum coverage requirements, not every policy will automatically provide coverage for you or your vehicle occupants in the event of an accident. Medical payments may be referred to as first-party medical, personal injury protection, or in some states no-fault coverage.

This coverage is often a separate coverage, and full coverage does not, necessarily, mean medical coverage for you or your vehicle occupants in the event of an accident. Check your state minimum requirements for this coverage.

Rental

Rental insurance coverage is not automatically applied to your policy when you request full coverage. This coverage type provides insurance coverage for a rented replacement automobile in the event your vehicle is not drivable or unavailable due to damage repairs after an accident. It is often an inexpensive additional coverage charge. Many people do not know how comforting it is to have rental coverage until it is needed.

Another option is non-owner car insurance if you regularly rent a car.

Consider the situation of a hit and run. If your automobile is struck and the at-fault vehicle leaves the scene without leaving any information, there is no other auto insurance company to provide coverage for damages to a rental vehicle. In these situations, having your own coverage offers peace of mind. This additional coverage is worth consideration.

Towing

Keep in mind, that if your vehicle is damaged in an accident and you call a tow truck, the tow is covered under collision coverage in most situations. Towing, as a separate coverage, may not be a necessary option for everyone, so consider your needs when looking for affordable towing coverage.

Underinsured motorists

Not to be confused with uninsured motorists coverage, which is compulsory, or required, coverage; underinsured motorist coverage is used when an at-fault motorist has liability car insurance coverage, but the coverage is not sufficient to cover all the damages you or your household member sustains in an accident.

This coverage varies slightly from state to state, so please verify your state’s specific language regarding underinsured motorist coverage.

Now that we have addressed the common misconceptions, what does full coverage mean, and how does it apply to you? Is there such a thing as full coverage auto insurance?

What qualifies as full coverage auto insurance?

Full coverage is personal auto insurance coverage that includes all state-specific compulsory coverages, plus collision and comprehensive coverage for your automobile.

In layman’s terms, it’s what your insurance company is required to provide, plus insurance coverage for damage to your vehicle in the event your vehicle is involved in an accident. The additional coverages of both collision and comprehensive are the coverage types most often associated with full coverage.

https://youtu.be/PiYyLELU5l4

There are many factors that go into determining if you need full coverage car insurance. Talk with an agent about your specific needs.

Let’s Start With Collision and Comprehensive

Collision insurance coverage is the insurance coverage for damage to your vehicle in the event it is involved in a collision or accident. This coverage is accessible even if you are at fault for the accident.

It is also available in the event of the hit and run situation discussed earlier. This coverage often has a deductible clause, which requires you to pay the initial damages up to an agreed-upon dollar amount.

The most common deductible is $500. This means you agree to pay the first $500, and the insurance company pays the remaining damages up to the value of the vehicle.

This coverage applies to minor repairs and also damages so significant that the vehicle is declared a total loss. A vehicle is a total loss when it costs more to repair the vehicle than it costs to sell the vehicle for salvage.

This coverage also comes in handy in situations where the at-fault driver’s insurance company investigates the accident due to liability or other insurance policy concerns. In these situations, you can use your own collision coverage even if you are not at fault. Your insurance company will seek reimbursement through a process called subrogation.

There are some exclusions to this coverage, so please check with your carrier or agent for any restrictions. Generally, though, collision coverage will cover damages to your car if you or an authorized driver is involved in a collision.

What is comprehensive coverage?

Sometimes your car is damaged, even when it has not been involved in a collision. Vandalism, acts of nature, and even thefts can be covered under this coverage type. Like collision coverage, comprehensive insurance also usually has a deductible. Just like collision, under this coverage, you agree to pay the agreed-upon deductible value.

If your damages are more than your deductible, your insurance will pay all the damages in excess of the deductible, up to the vehicle’s value. Comprehensive coverage also is the coverage type for glass damage coverage. The most common glass claims are windshield replacements.

An example of when comprehensive coverage is important is when your vehicle is damaged by falling debris or a collision with an animal. Much of North America is populated with deer and other mid to large-sized animals. These animals often wander into roadways, especially at night, and colliding with one can cause significant damage to a vehicle.

This damage claim would fall under the comprehensive coverage type. If you hit a deer and your vehicle is damaged, your insurance company will not pay to repair your vehicle if you do not carry this coverage type.

Those are the optional coverages associated with full coverage.

Full coverage is not just comprehensive and collision coverages. Full coverage not only applies to the coverages in the event your vehicle is damaged, but also covers the legal requirements for liability car insurance coverage and uninsured motorist coverage.

Liability and Uninsured Motorist

Liability coverage is insurance protection for accidents wherein you might inadvertently cause damage to another vehicle, or accidentally injure another person. Liability and uninsured coverages are also referred to as compulsory coverages, which means that they are required.

Liability coverage encompasses both physical or property damage, and injuries caused by a motor vehicle accident. This means if you cause damage to another person’s vehicle or other property in an accident, your insurance company will provide payments to cover that damage up to the limits you choose.

It will also provide payments for pain and suffering claims made by a person who is injured by you in an accident. The limit of how much your insurance company will pay is up to you, but most states have a state-mandated minimal limit. You do have the option to choose higher limits than the state minimum limits.

Basically, if you are at fault for an accident, your insurance company will pay for things like damaged cars or injury claims for anyone involved in the accident who was not at fault for the accident.

Full coverage also includes uninsured motorist coverage. Like the liability car insurance coverage, uninsured motorist coverage usually has a state minimum limit, but you do have the option to select higher limits if you like. Uninsured motorist coverage will apply to you, your household member, or guest occupants of your car. You can only use uninsured motorist coverage if the person at fault for the accident has no insurance or was not identified.

Uninsured motorist coverage provides coverage for injury claims for pain and suffering to qualified individuals who were not at fault for an accident.

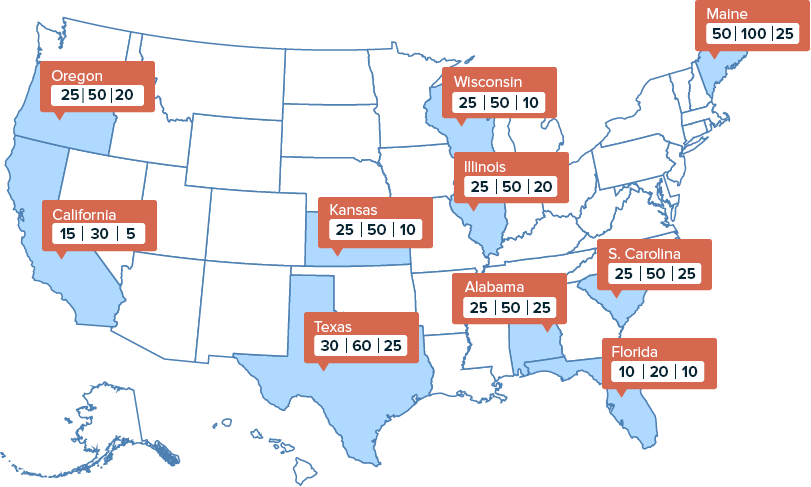

Minimum Insurance Examples by State

State minimum insurance requirements are listed in a series of three numbers that include bodily injury liability limits and property damage liability limits. The first number out of the three refers to the bodily injury liability per person (in thousands of dollars) and the second number is the bodily injury liability per accident (in thousands of dollars). The third number limits the total property damage coverage per accident.

Let’s take full coverage auto insurance in California for example, which has minimum auto insurance requirements of 15/30/5. In this case, each person injured in an accident could receive maximum damages of up to $15,000 at a maximum of $30,000 total per accident. The total property damage coverage limit is $5,000.

On the other side of the coin, a state like Maine has stricter minimum insurance standards with higher payouts. Every person injured in an accident could receive maximum damages up to $50,000 at $100,000 total per accident. Total property damage coverage is limited to $25,000. (For more information, read our “Buy Cheap Maine Auto Insurance“)

Who needs full coverage?

Do I really need full coverage auto insurance?

The need for full coverage depends on the car. Anyone leasing or financing a vehicle will be required by the bank or lienholder holder to carry full coverage.

While you make payments to the bank or lienholder, that institution has a vested interest in the safety and surety of the vehicle.

They technically still own the vehicle or at least co-own the vehicle. Until your loan is paid off or the leased vehicle is returned, you are required to carry full coverage, consisting of collision, comprehensive, uninsured motorist, and liability coverage.

Read more: Buy Cheap Auto Insurance for Leased Vehicles

Consider the hit and run scenario previously discussed. Payments you may be making on your vehicle are for the initial purchase of the vehicle.

If your vehicle is struck by a car in a hit and run situation, and your vehicle is deemed a total loss, then the insurance company will issue you a check for your vehicle’s value under the collision coverage. From this settlement value, the insurer will also help you resolve the lien by issuing part of the settlement to the bank providing finance for your vehicle.

Now consider this same scenario without collision coverage. Without collision coverage, if your vehicle is deemed a total loss and there is no other identified person to go after for coverage, you will receive no settlement check for your vehicle. In such a situation you would be left with a salvage vehicle and continued loan payments toward a vehicle that is no longer drivable. (For more information, read our “Buying Salvage-Title Auto Insurance: What You Need To Know“)

If your vehicle is paid off, and it is not your sole source of transportation, then you can consider whether or not you need full coverage. Reducing coverages that are not necessary can reduce your insurance premium. A good way to tell whether or not full coverage is cost-effective is to first determine your vehicle’s value.

Kelley Blue Book has an online calculation tool that can be very helpful in estimating your vehicle’s value. If your annual insurance premium for collision and comprehensive coverage exceeds the value of your vehicle, then it may not be cost-effective for you to carry full coverage.

For instance, if the cost to include collision and comprehensive coverage on your policy is $600 per year, but your vehicle is only worth $500, then collision and comprehensive coverages may not be the most financially sound choice. You may be better suited to put that money into a savings account as a rainy-day fund in the event that the vehicle is damaged and repairs or salvage are needed.

If you only have liability insurance, you may be saving money on your monthly auto insurance premium. However, liability insurance will only cover the damage you cause in an accident.

Full coverage insurance, on the other hand, will also cover damages to your own vehicle due to an accident through collision coverage and can cover several other risks, like fire, theft, or vandalism, through comprehensive coverage.

Full coverage is not required by state law, but many lenders make this coverage mandatory if you still owe payments on a vehicle.

Can you drop a full coverage auto insurance policy?

Full coverage does offer comfort and security to know that you and your vehicle are covered in most accident situations. It is more costly than basic liability coverage, so financial implications are important discussions to have with your agent.

It is possible to drop your full coverage auto insurance policy if you’d like, but might not be a good idea if you are financing or leasing your vehicle. It is also best to keep your full coverage policy if you have a high-cost vehicle.

Some Car Insurance Stats

THE 7 MOST COMMON CAR INSURANCE CLAIMS FILED ARE:

-

Fender Benders

-

Theft

-

Whiplash

-

Vandalism

-

Windshield Damage

-

Back Injuries

-

Animal Collision

If you have been involved in an accident related to one or many of the circumstances listed above, you likely relied on your car insurance policy to take care of the damage for you. In these cases, it literally pays to have full coverage insurance.

About 1 in 8 motorists in the United States is uninsured.

Even though almost every state requires auto insurance coverage (there are exceptions in New Hampshire and Virginia), some people do drive without coverage. This is of course risky as the average claim for an uninsured motorist is $20,000, which does not even include the damage to the vehicle itself.

According to the Insurance Information Institute, about 13 percent of all drivers are uninsured. If you are in an accident without insurance, you can be held personally liable for all damages.

Read more:

| Most expensive

|

Cheapest

|

|---|---|

| Michigan | Iowa |

| Louisiana | Virginia |

| Florida | Idaho |

| Rhode Island | Ohio |

| Connecticut | Vermont |

The top five most expensive states for car insurance are Michigan, Louisiana, Florida, Rhode Island, and Connecticut.

The five Cheapest States for car Auto Insurance are Iowa, Virginia, Idaho, Ohio, and Vermont.

Read more:

Generally, the younger you are, the more you may pay for car insurance.

This is due to the fact that younger drivers are less experienced and considered riskier to insure. Average car insurance rates by age can differ quite a bit, but tend to go down as you get older.

How much auto insurance do you really need?

If you’re in the market for a full coverage car insurance policy, there are varying levels of protection available to you. Based on the foundations of full coverage, as well as the long list of “extras” that may or may not be included, you can tailor your car insurance policy to best meet your needs.

HERE IS A PROGRESSION OF HOW ONE CAN APPROACH FULL COVERAGE INSURANCE:

-

Basic Full Coverage

At the very minimum, you can sign up for cheap full coverage insurance with liability, uninsured motorist coverage, collision, and comprehensive coverage. This insurance will meet state requirements and protect your vehicle from damage, regardless of who is at fault or if the at-fault driver has auto insurance coverage or not.

-

Intermediate Full Coverage

Taking it one step further, you can upgrade a basic full coverage car insurance policy with medical payment coverage. Medical payment coverage will reimburse for medical treatment and medical expenses up to a certain amount, no matter who is at fault in an accident.

-

Ultimate Full Coverage

If you’re looking for complete protection in a full coverage package, you can add on all of the extras listed above. This may include towing, car rental reimbursement, and GAP insurance. Upgrading your policy in this manner will provide peace of mind if any type of damage affects you or your car in an accident or related catastrophic event.

CONSIDER THESE HELPFUL TIPS FOR CHOOSING THE RIGHT FULL COVERAGE POLICY FOR YOU:

If you aren’t financially able enough to afford the cost of injury and damages in an accident, increase your coverage amount above basic liability insurance.

Additional Personal Injury Protection (PIP) coverage may be redundant if you or your family have a solid health insurance policy. Discuss your PIP or MedPay insurance coverage options with your agent. It’s important to structure this part of your policy properly to ensure coverage.

If annual comprehensive and collision rates exceed the value of your vehicle, this extra coverage may be unnecessary. When your car reaches around eight to ten years of age, calculate how your annual rate compares to the value of your car.

If you are financially ready to pay for the replacement of an older vehicle, paying a monthly full coverage premium may no longer make sense. As your car gets older and depreciates in value, you can start to drop some of the “extras” in your policy or raise your deductible, as finances allow, to lower your monthly premium even further.

Uninsured motorist coverage is always recommended and often required, so that you don’t have to pay for a no-fault accident. Extra towing coverage isn’t needed when you have full coverage auto insurance from Progressive, AAA, or a similar service subscription. (For more information, read our “Buying Michigan No-Fault Auto Insurance: What You Need To Know“)

Rental car insurance reimbursement is often a personal preference and matter of convenience; cut it out if you can’t afford it.

What is the cost of full coverage auto insurance?

As with basic auto insurance policies, full coverage auto insurance policies can differ based on a number of factors, including where you live, your credit history, your driving record, and many more. While full coverage policies can be expensive, most companies offer several auto insurance discounts.

How to Save Money on Full Coverage Auto Insurance

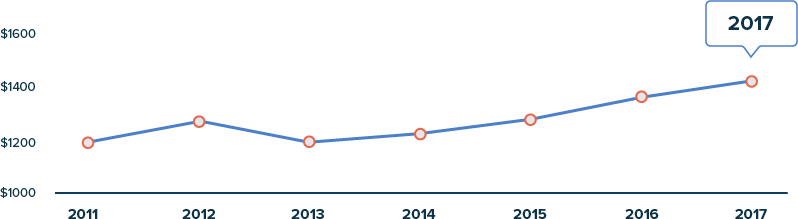

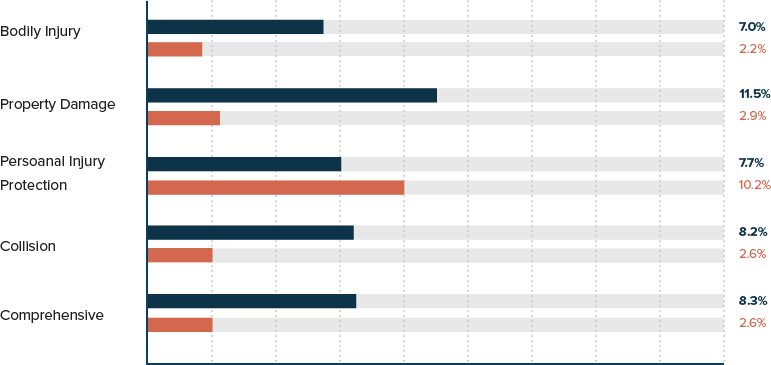

As this chart indicates, the cost of car insurance in the U.S. is continuing to increase. One of the reasons for this hike in pricing is due to the increase in claims in recent years as well as the rising cost of car repairs and replacement parts. Since cars these days are equipped with more advanced safety features such as sensors and cameras, replacement parts are more costly and thus why costs are going up for consumers.

ANNUAL AUTO INSURANCE PREMIUMS IN THE U.S.

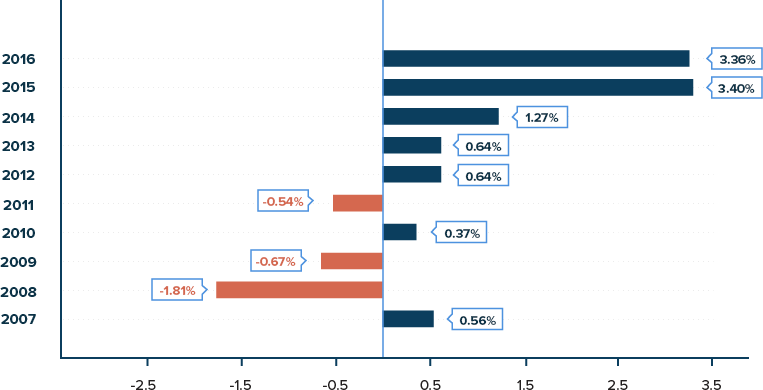

Another reason that premiums are going up is that the severity and frequency of auto accidents are increasing. This chart shows the percentage increase from 2014-2016.

AUTO ACCIDENTS GROWING IN SIZE AND FREQUENCY

Percentage Change 2014-2016

-

Severity

-

Frequency

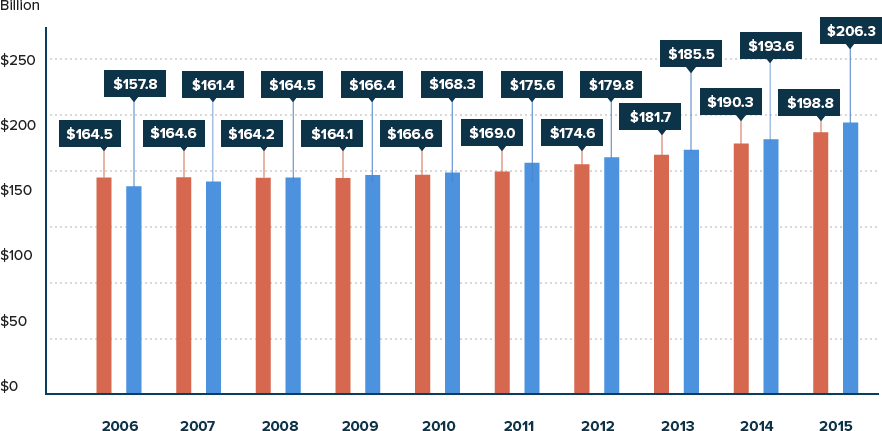

This next graph shows that every year since 2007, the losses and expenses for auto insurance companies have surpassed premiums.

PRIVATE PASSENGER AUTO INSURANCE: PREMIUMS VS. LOSSES AND EXPENSES

-

Written premiums

-

Losses and expenses

From 2014 to 2016, auto insurance coverage saw a striking increase in accident loss costs.

INCREASE IN AUTO INSURANCE LOSS COSTS

2014:Q1 – 2016:Q1

-

9.6%Bodily Injury

-

14.7%Property Damage

-

18.4%Personal Injury

Protection -

11.1%Collision

-

11.0%Comprehensive

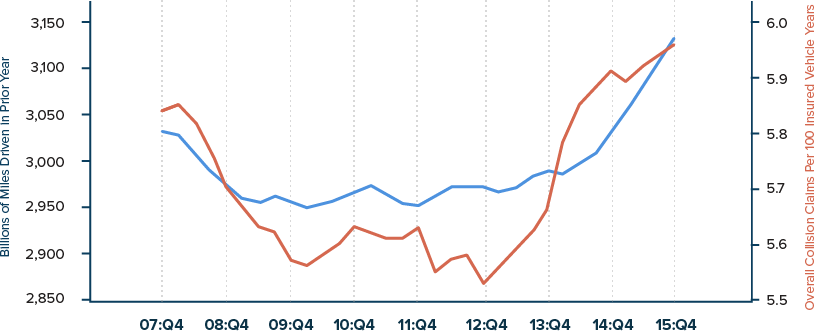

Additionally, people have been driving more over the past several years, which directly correlates to more collisions and claims.

AMERICANS ARE DRIVING MORE

Percentage change in miles driven

INCREASED DRIVING MEANS INCREASED COLLISIONS

2007 – 2015

- Miles Driven

- Collision Claim Frequency

HERE ARE SOME TIPS TO GET THE CHEAPEST FULL COVERAGE CAR INSURANCE AVAILABLE:

Compare insurance companies

One of the best ways to save money on full coverage insurance is by simply comparing rates. Most providers today offer free car insurance quotes online; compare a minimum of three companies before making a final decision.

Combine your insurance policies

Your insurance provider may offer you a discounted rate if you lump policies together, including auto, homeowner’s, and/or life insurance.

Improve your driving record

Good drivers are rewarded with better insurance rates. One of the most effective ways to keep full coverage insurance affordable is by eliminating speeding tickets and traffic violations, including DUIs.

Raise your deductible

If you can afford to raise your deductible by several hundred dollars, you could drop your full coverage insurance rates.

Crunch numbers before you buy a new car

The type of vehicle you purchase can raise or lower insurance rates. For example, if you purchase a minivan, that communicates to insurance companies that you have children and will be driving more cautiously and your insurance rates will be lower. If you purchase a sports car, your insurance rates will be higher.

Staying up-to-date on the value of your vehicle can help you make the most educated decision about full coverage insurance. If you have a new car or are still paying on it, full coverage is likely to be required. As the value of your vehicle drops, additional coverage may not be necessary. Check in with your insurance agent annually to determine the most affordable and most protective policy for you.

How did we do? Hopefully, we have helped you find full coverage cheap car insurance. If you have any questions or comments, please leave them below.

Compare affordable full coverage car insurance rates now. Enter your ZIP for free full coverage auto insurance quotes.

Reviewed by:

Licensed Insurance AgentCynthia Lanctot