Buy Cheap Philadelphia, PA Auto Insurance in 2026

The cheapest Philadelphia auto insurance policies are sold by USAA with an average monthly cost of $246. GEICO and State Farm also offer cheap auto insurance premiums in Philadelphia, PA to non-military drivers. All Philadelphia drivers must carry a minimum of 5/15/30 in liability insurance, but it's a good idea to carry additional coverage.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Aug 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| PHILADELPHIA, PA SUMMARY | Details |

|---|---|

| Required minimum auto insurance limits | 5/15/30 |

| Average Cost of Insurance in Philadelphia | $9,302.74 |

| Cheapest Car Insurance Company | USAA |

| Road Conditions | Poor: 43% Mediocre: 28% Fair: 11% Good: 17% |

Given how amazing the city of Philadelphia is, you should have equally amazing car insurance to match The Birthplace of America. What is the best auto insurance in Philadelphia though? Well, keep reading, and you’ll know.

We get that finding car insurance is a tough and confusing process, which is why we’re going to make it as easy as possible for you to find the best car insurance in Philadelphia that is also best for your needs. Plus if you’re interested in how Philly compares to the state as a whole, check out our Pennsylvania Auto Insurance Guide.

Keep reading to learn and make finding car insurance easier for you.

To find great Philadelphia auto insurance rates for you, just enter your ZIP code in our free tool.

The Cost of Car Insurance in Philadelphia

We get that cost is one of the biggest factors for you when you’re deciding which car insurance you want. That’s why we’re going to show you some factors that directly affect your car insurance, so you can learn how to lower your auto insurance rates. Here’s how certain aspects of your life affect your insurance rates.

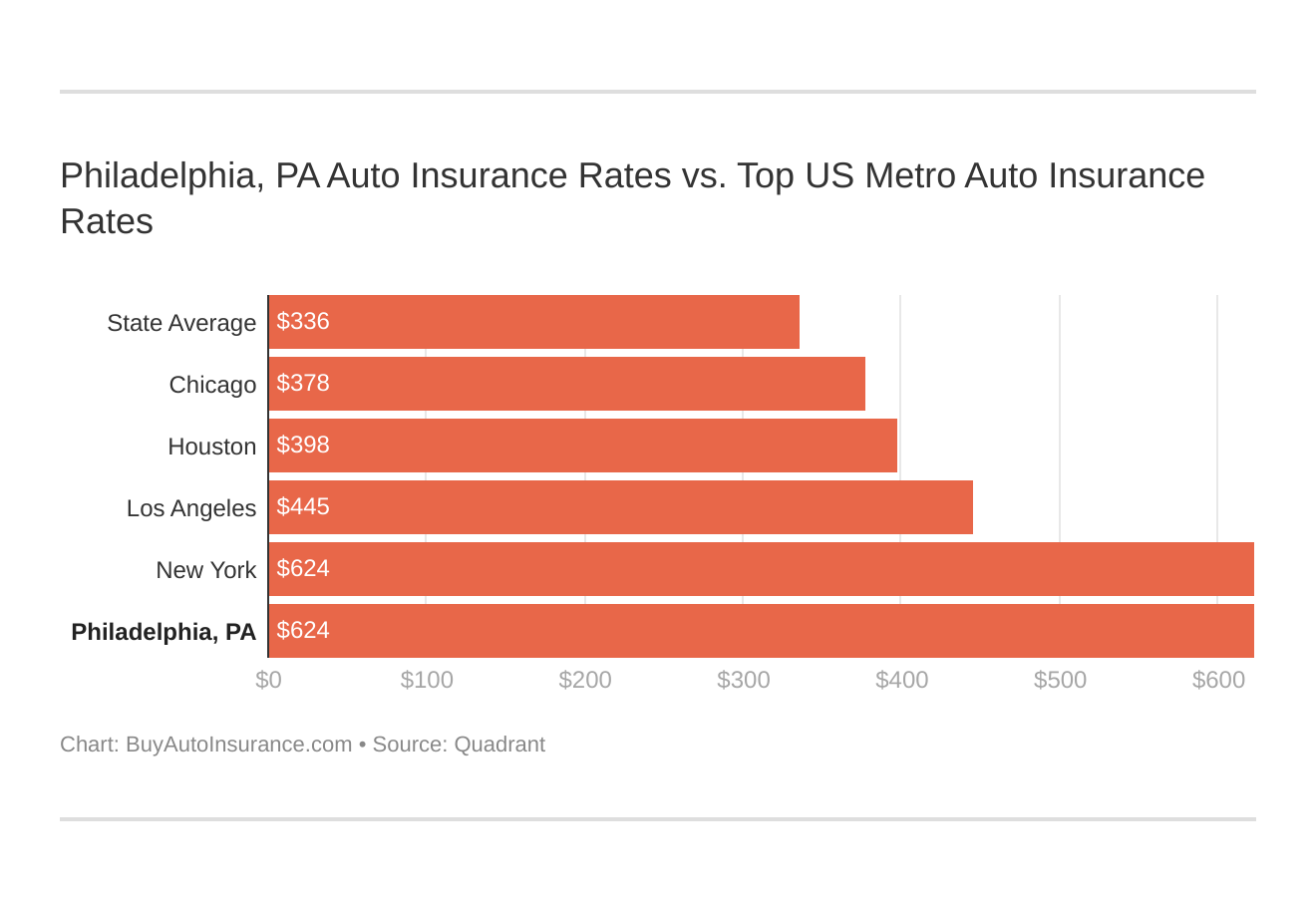

Which city you live in will have a major effect on car insurance. That’s why it’s essential to compare Philadelphia, Pennsylvania against other top US metro areas’ auto insurance rates.

In this section, we’ll talk about how gender and age affect your insurance rates, how where you live affects your insurance, how your commute affects your insurance, what the cheapest car insurance companies in Philadelphia are, and much more.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does gender and age affect my auto insurance in Philadelphia?

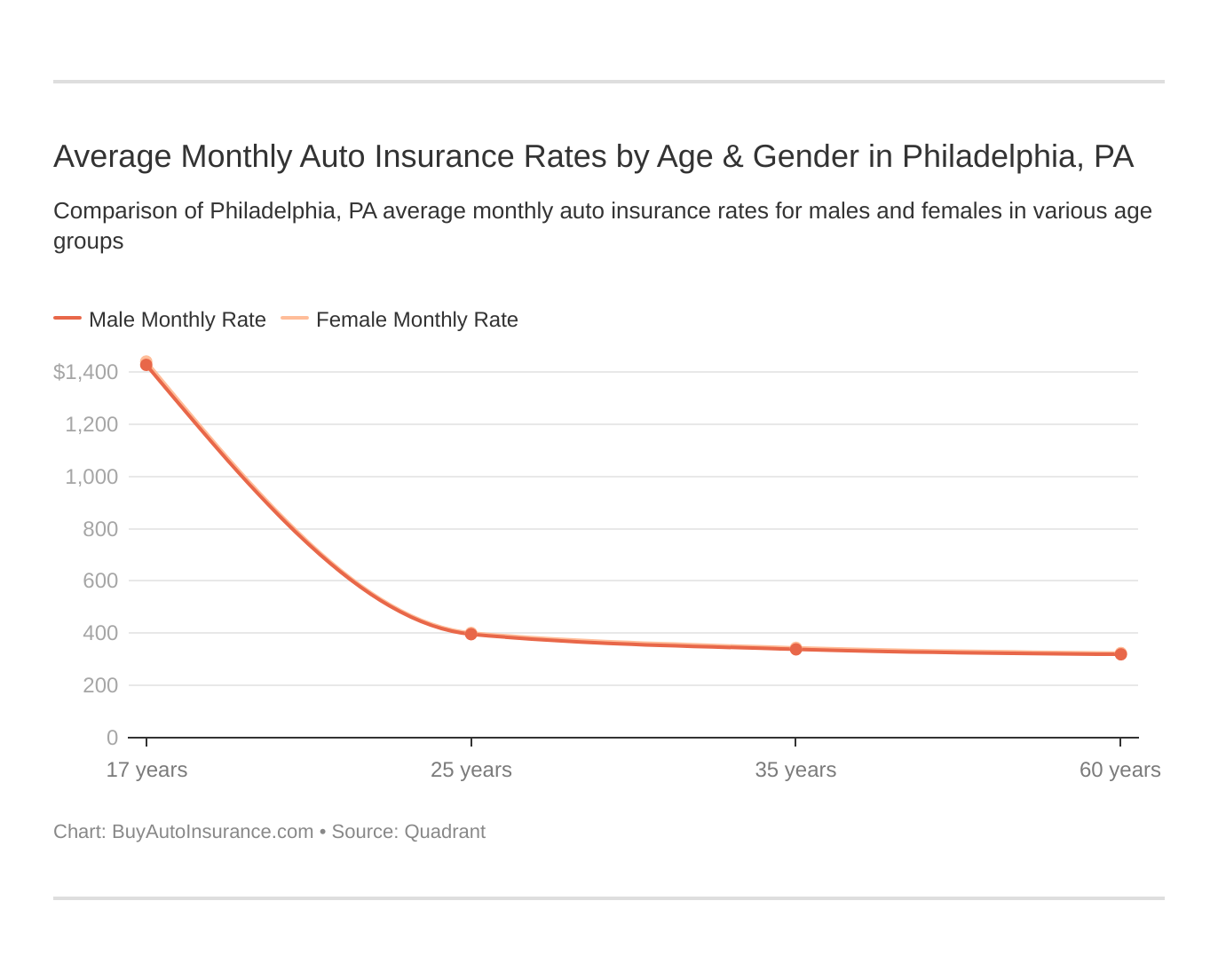

Age, as we’ve mentioned, is certainly a deciding factor for insurance companies when they determine how much your rates cost. According to DataUSA, the median age in Philadelphia is 34.5 years old. It’s crucial to know what the median age is for Philadelphia (and facts about ages in general) because it’s illegal to base rates on gender in Philadelphia.

These states no longer use gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, and North Carolina, Pennsylvania. But age is still a big factor because young drivers are considered high-risk drivers in Pennsylvania. PA does not use gender, so check out the average monthly auto insurance rates by age in Philadelphia, PA.

Thus, it’s more important than ever to know about how age affects rates because it’s the sole determining factor in this category. This table shows the average cost for each major age for Philadelphia car insurance.

| AGE | 17 | 25 | 35 | 60 |

|---|---|---|---|---|

| Philadelphia | $17,201.53 | $4,779.13 | $4,092.17 | $3,856.53 |

As you can see, the most expensive age is 17-year-olds, with an average car insurance rate of $17,201.53. This makes sense, as these drivers have recently acquired their licenses and have less experience than other drivers. This rate drops significantly when a driver turns 25, as the average rate for that age is $4,779.13. Here’s how to buy cheap auto insurance for teens.

At 35, it drops a bit more to $4,092.17, and then it becomes the cheapest at 60, with an average rate of $3,856.53. Find out how to buy cheap auto insurance for seniors.

As we’ve previously mentioned, it’s illegal to base rates on gender in Pennsylvania (it’s also illegal in CA, HI, MA, MT, PA, NC, and parts of MI, too); however, it is still absolutely legal to base rates on your marital status. Here is a table that informs you of the different rates by marriage.

| DEMOGRAPHIC | RATE (CHEAPEST) |

|---|---|

| Married 60-year-old | $3,856.53 |

| Married 35-year-old | $4,092.18 |

| Single 25-year-old | $4,779.14 |

| Average | $7,482.34 |

| Single 17-year-old | $17,201.54 |

As you can see, it’s considerably easier to buy cheap auto insurance for married couples. For example, there is nearly a $13,000 difference between a single 17-year-old and a married 35-year-old. This is likely because insurance companies typically see people who are married as more risk-averse, meaning you’re less likely to cause a car accident and will be cheaper to insure.

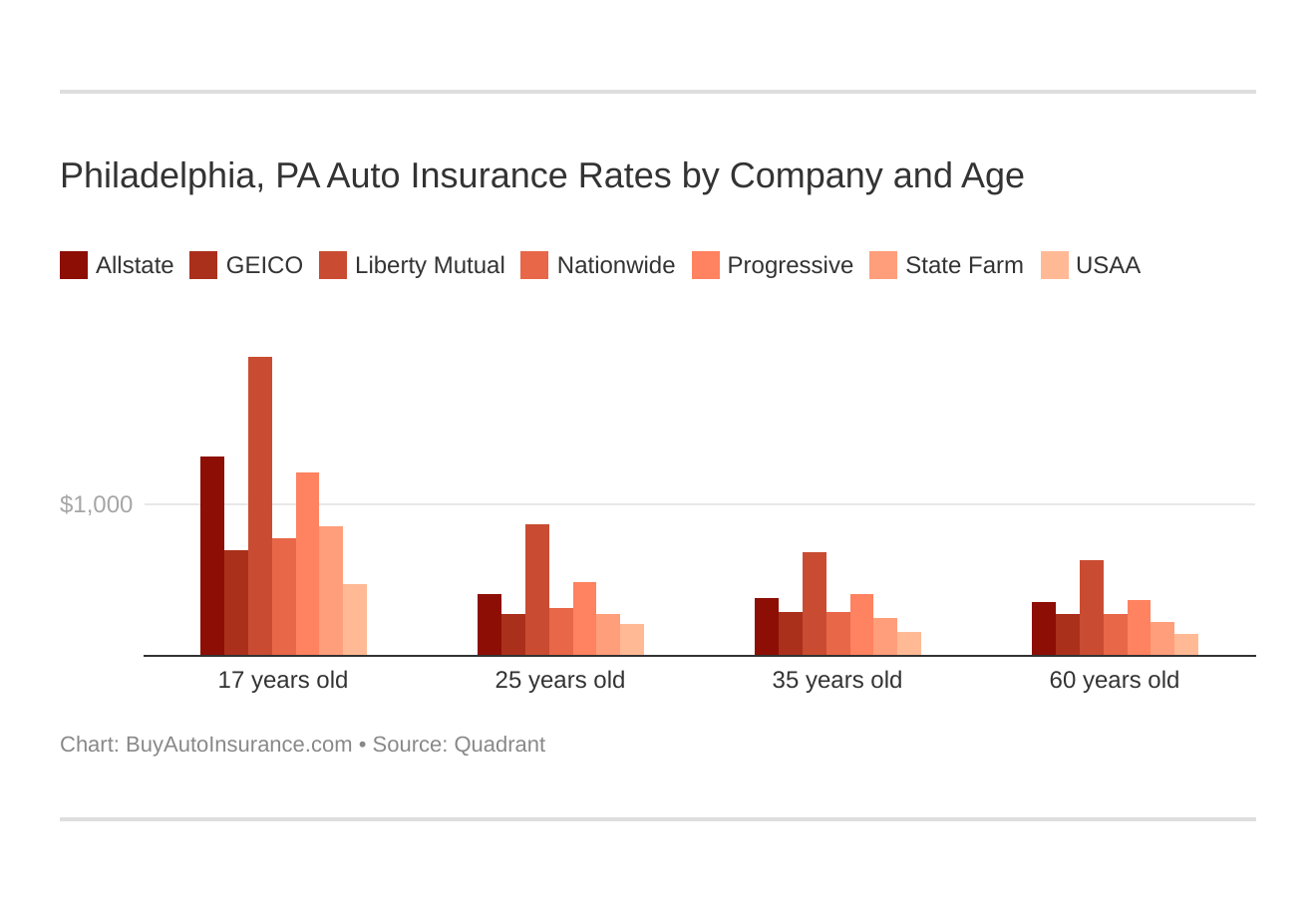

Pennsylvania auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

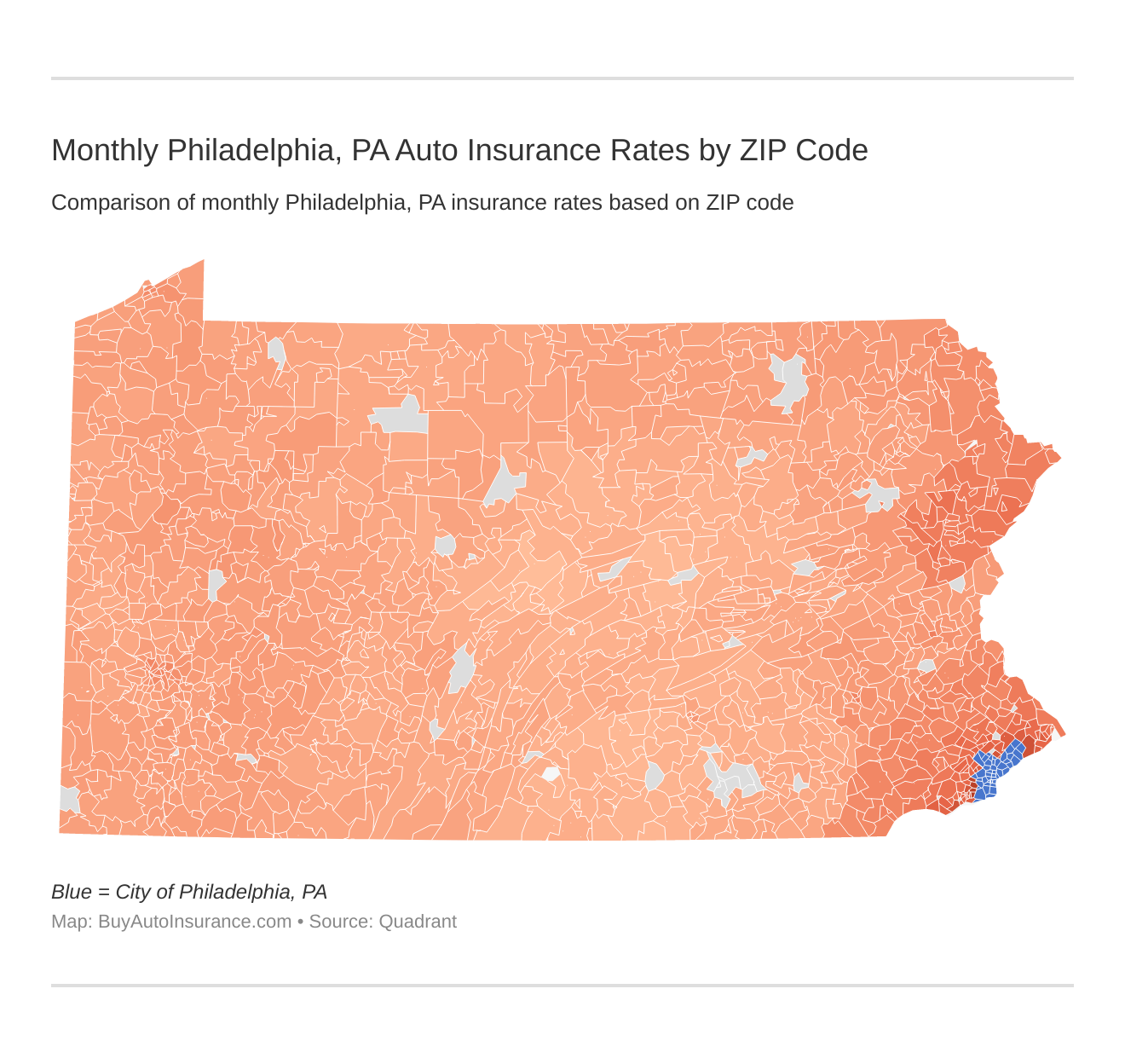

What are the cheapest ZIP codes for Philadelphia auto insurance?

Another major factor when determining insurance costs in Philadelphia is what ZIP code you live in. This may be a little surprising, but it does make some sense. Certain ZIP codes have higher rates of accidents and more vehicle theft, so if you live there, an insurance company will likely charge you more because it’s more of a risk to insure you.

Find more info about the monthly Philadelphia, PA car insurance rates by ZIP Code below:

With this information in mind, let’s take a look at the cost of living in each ZIP code in Philadelphia, shall we?

| ZIP | COST |

|---|---|

| 19102 | $8,771.34 |

| 19103 | $9,148.09 |

| 19104 | $9,581.50 |

| 19106 | $9,023.19 |

| 19107 | $9,241.41 |

| 19109 | $9,392.81 |

| 19110 | $9,248.59 |

| 19111 | $8,957.91 |

| 19112 | $10,086.22 |

| 19113 | $7,230.41 |

| 19114 | $8,418.71 |

| 19115 | $8,865.96 |

| 19116 | $8,681.96 |

| 19118 | $8,015.18 |

| 19119 | $8,717.53 |

| 19120 | $9,780.21 |

| 19121 | $10,283.48 |

| 19122 | $10,186.97 |

| 19123 | $9,298.94 |

| 19124 | $9,672.32 |

| 19125 | $9,719.20 |

| 19126 | $9,681.59 |

| 19127 | $8,067.84 |

| 19128 | $7,971.25 |

| 19129 | $8,567.87 |

| 19130 | $9,125.87 |

| 19131 | $9,539.80 |

| 19132 | $10,446.90 |

| 19133 | $10,480.35 |

| 19134 | $9,650.55 |

| 19135 | $9,194.67 |

| 19136 | $8,797.21 |

| 19137 | $8,731.85 |

| 19138 | $9,631.63 |

| 19139 | $10,358.57 |

| 19140 | $10,370.26 |

| 19141 | $9,793.33 |

| 19142 | $10,372.77 |

| 19143 | $10,219.59 |

| 19144 | $9,362.74 |

| 19145 | $9,771.21 |

| 19146 | $9,337.55 |

| 19147 | $9,428.07 |

| 19148 | $9,508.89 |

| 19149 | $9,043.03 |

| 19150 | $9,169.50 |

| 19151 | $9,178.22 |

| 19152 | $8,761.68 |

| 19153 | $9,685.55 |

| 19154 | $8,305.29 |

| 19190 | $9,564.29 |

According to this table, the most expensive ZIP code in Philadelphia for car insurance is 19133, with an average rate of $10,480.35. The cheapest ZIP code in Philadelphia for car insurance is 19113, with an average rate of $7,230.41. Use the search bar to find out what the average cost of car insurance in your ZIP code is.

What’s the best auto insurance company in Philadelphia?

There’s a lot that goes into deciding what the best car insurance company for you is. You need to consider the costs, the amount they charge for aspects of your life and driving, and other factors that make your insurance company right for you. We’ll examine these various factors below to help you choose your ideal car insurance.

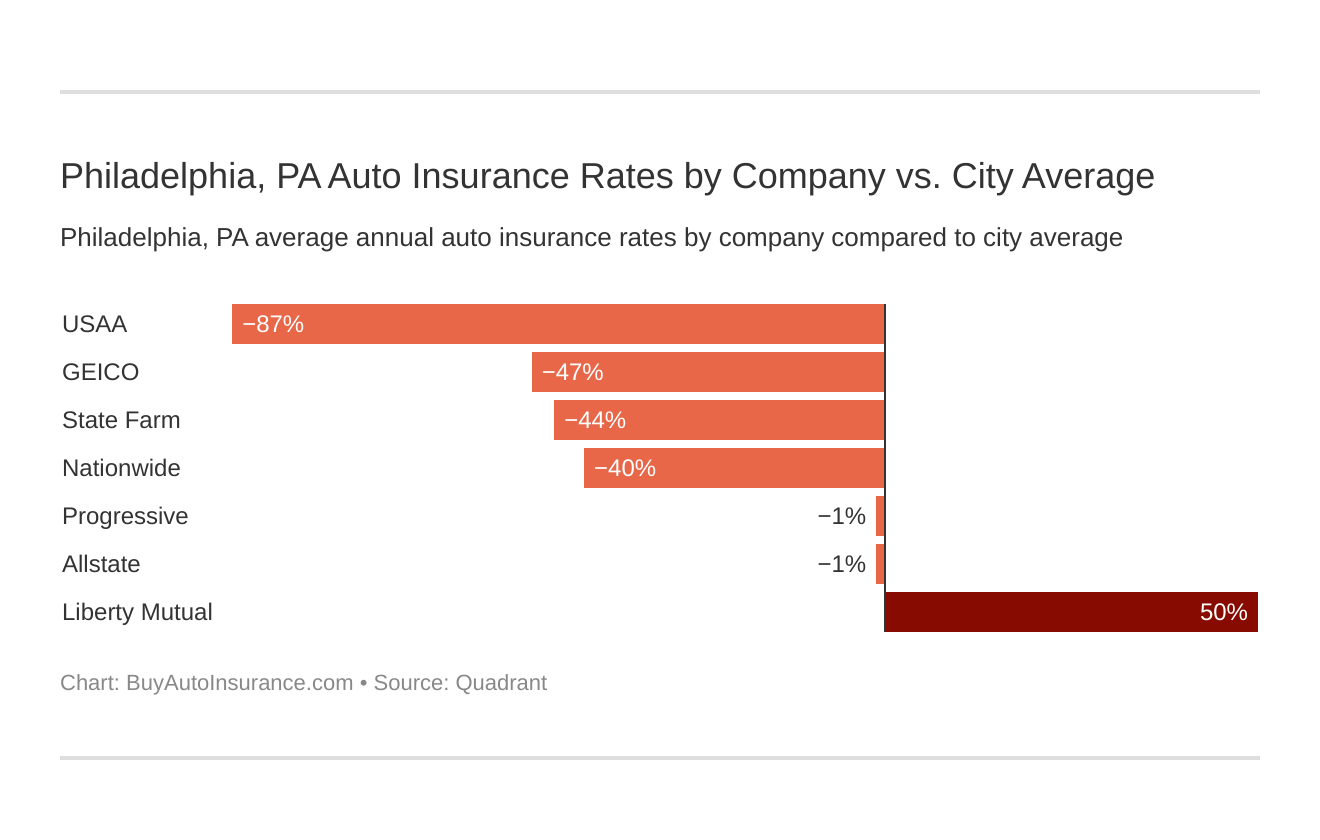

The cheapest auto insurance company in Philadelphia can be discovered below. You then might be asking, “How do those rates compare against the average auto insurance company rates in Philadelphia?” We cover that as well.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Auto Insurance Rates by Company

Despite all the other factors that can make certain car insurance companies great, you have to be able to afford your car insurance. Auto insurance coverage types impact your costs. Here is the cheapest car insurance in Philadelphia by the company.

| Group | Married 35-year-old female | Married 35-year-old male | Married 60-year-old female | Married 60-year-old male | Single 17-year-old female | Single 17-year-old male | Single 25-year-old female | Single 25-year-old male | Average |

|---|---|---|---|---|---|---|---|---|---|

| Allstate | $4,534.62 | $4,534.62 | $4,251.22 | $4,251.22 | $15,830.38 | $15,830.38 | $4,920.02 | $4,920.02 | $7,384.06 |

| Geico | $3,659.99 | $3,154.47 | $3,597.48 | $3,100.88 | $8,992.37 | $7,789.85 | $3,584.35 | $3,089.58 | $4,621.12 |

| Liberty Mutual | $8,295.78 | $8,295.78 | $7,619.34 | $7,619.34 | $23,772.74 | $23,772.74 | $10,467.69 | $10,467.69 | $12,538.89 |

| Nationwide | $3,487.69 | $3,487.69 | $3,321.34 | $3,321.34 | $9,294.93 | $9,294.93 | $3,880.78 | $3,880.78 | $4,996.19 |

| Progressive | $4,869.14 | $4,869.14 | $4,389.55 | $4,389.55 | $14,597.00 | $14,597.00 | $5,880.20 | $5,880.20 | $7,433.97 |

| State Farm | $2,999.54 | $2,999.54 | $2,671.30 | $2,671.30 | $10,223.02 | $10,223.02 | $3,322.46 | $3,322.46 | $4,804.08 |

| Travelers | $3,270.16 | $3,270.16 | $3,553.91 | $3,553.91 | $49,765.94 | $49,765.94 | $3,915.43 | $3,915.43 | $15,126.36 |

| USAA | $1,873.20 | $1,873.20 | $1,696.36 | $1,696.36 | $5,737.15 | $5,737.15 | $2,509.52 | $2,509.52 | $2,954.06 |

According to this data, the cheapest car insurance company that you can have is USAA, as their average rate for all insurance coverage is $2,954.06. Read our USAA auto insurance review for more information. The most expensive of these companies is Travelers, with an average cost of $15,126.36 for all insurances. This is a pretty large price disparity (almost $12,000), but remember: cheaper isn’t always better.

While price is certainly a major factor, it’s important to take a look at all the other aspects of car insurance that are important, too.

We’ll show you these factors below so you can have an idea of all the different parts of insurance you need to consider before making a purchase.

Best Auto Insurance for Commute Rates

Commutes are part of what car insurance companies consider when deciding your rates. Before showing you the exact numbers for the different commute types that car insurance companies charge for, let’s take a look at how much the average Pennsylvanian drives per year.

According to highways.dot.gov, the average Pennsylvanian drives 11,203 miles per year, which is less than the United States’ average of 14,132 miles. This information is important because insurance companies compare how much you drive to these averages, and that affects your car insurance rates.

Now, let’s see how car insurance companies charge by the different commute distances. We’ve compiled this data and put it together in the table below.

| Group | 10 mile commute. 6000 annual mileage. | 25 mile commute. 12000 annual mileage | Average |

|---|---|---|---|

| Allstate | $7,221.19 | $7,546.93 | $7,384.06 |

| Geico | $4,547.62 | $4,694.62 | $4,621.12 |

| Liberty Mutual | $12,223.66 | $12,854.12 | $12,538.89 |

| Nationwide | $4,996.18 | $4,996.18 | $4,996.18 |

| Progressive | $7,433.97 | $7,433.97 | $7,433.97 |

| State Farm | $4,648.40 | $4,959.76 | $4,804.08 |

| Travelers | $15,126.36 | $15,126.36 | $15,126.36 |

| USAA | $2,867.82 | $3,040.30 | $2,954.06 |

Car insurance companies typically separate commutes into two different categories: a 10-mile commute and 6,000 annual mileage, and a 25-mile commute with a 12,000 annual mileage. According to this data, the 25-mile commute and 12,000 annual mileage is sometimes more expensive than the other commute type.

However, there are some companies that charge the same for both commutes.

These companies are Nationwide ($4,996.18), Progressive ($7,433.97), and Travelers ($15,126.36). The most expensive company for a 10-mile and 6,000 annual commute is Travelers, with an average of $15,126.36 for this type of commute. The most expensive company for the 25-mile commute and 12,000 annual mileage is also Travelers, with the same rate of $15,126.36.

The least expensive company for a 10-mile and 6,000 annual commute is USAA, with an average rate of $2,867.82. The cheapest company for the 25-mile commute and 12,000 annual mileage is also USAA, and their average for this commute is $3,040.30.

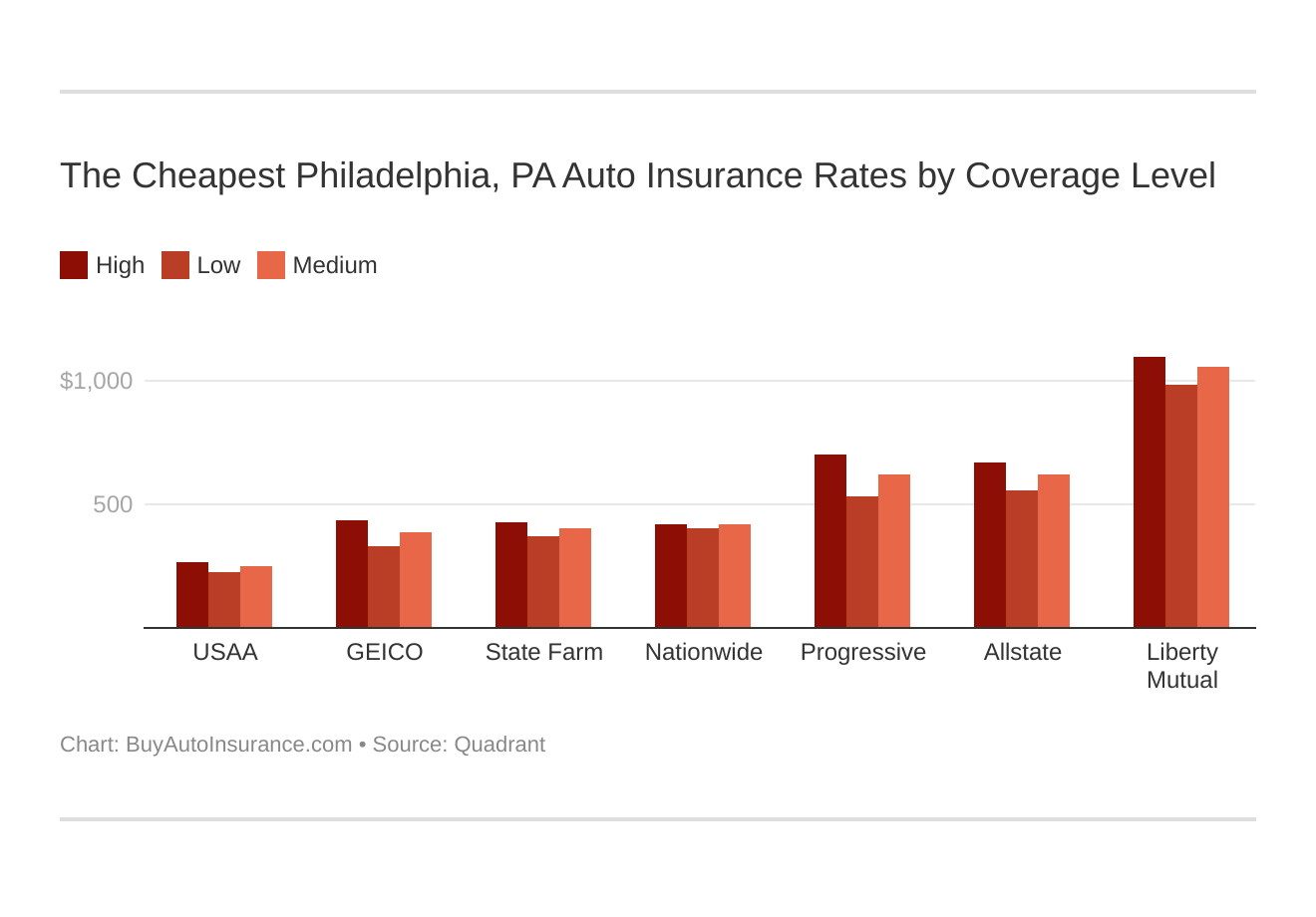

Best Auto Insurance Rates by Coverage Level

Another crucial element that car insurance companies use to decide how much you pay for car insurance is how much coverage you have. There are three levels for this: high, low, and medium. For more information, read our discussion of best full coverage auto insurance.

Your coverage level will play a significant role in your auto insurance in Philadelphia. Find the cheap car insurance in Philadelphia, PA by coverage level below:

Here is a table that shows you the cost of each level of car insurance coverage for those of you who live in the City of Brotherly Love.

| Group | High | Medium | Low | Average |

|---|---|---|---|---|

| Allstate | $8,020.68 | $7,468.23 | $6,663.27 | $7,384.06 |

| Geico | $5,246.88 | $4,670.50 | $3,945.98 | $4,621.12 |

| Liberty Mutual | $13,175.96 | $12,648.26 | $11,792.43 | $12,538.88 |

| Nationwide | $5,051.93 | $5,060.43 | $4,876.19 | $4,996.18 |

| Progressive | $8,447.87 | $7,453.60 | $6,400.45 | $7,433.97 |

| State Farm | $5,114.04 | $4,881.11 | $4,417.09 | $4,804.08 |

| Travelers | $15,502.99 | $15,177.09 | $14,699.01 | $15,126.36 |

| USAA | $3,187.90 | $2,987.59 | $2,686.69 | $2,954.06 |

According to this table, the most expensive coverage level is high coverage, and the most expensive company for this type of coverage is Travelers ($15,502.99). Medium coverage is the middle cost, and the most expensive company for this coverage type is also Travelers ($15,177.09).

Unsurprisingly, the cheapest coverage is low coverage, and the most expensive company for this coverage is, once again, Travelers ($14,699.01).

As for the cheapest companies for coverage levels, USAA has the cheapest rates for all three coverage types, with $3,187.90 for high coverage, $2,987.59 for medium coverage, and $2,686.69 for the low coverage.

While, on average, the high coverage is the most expensive coverage, for Nationwide, it’s cheaper to get high coverage ($5,051.93) than medium coverage ($5,060.43), so you might as well get the high coverage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

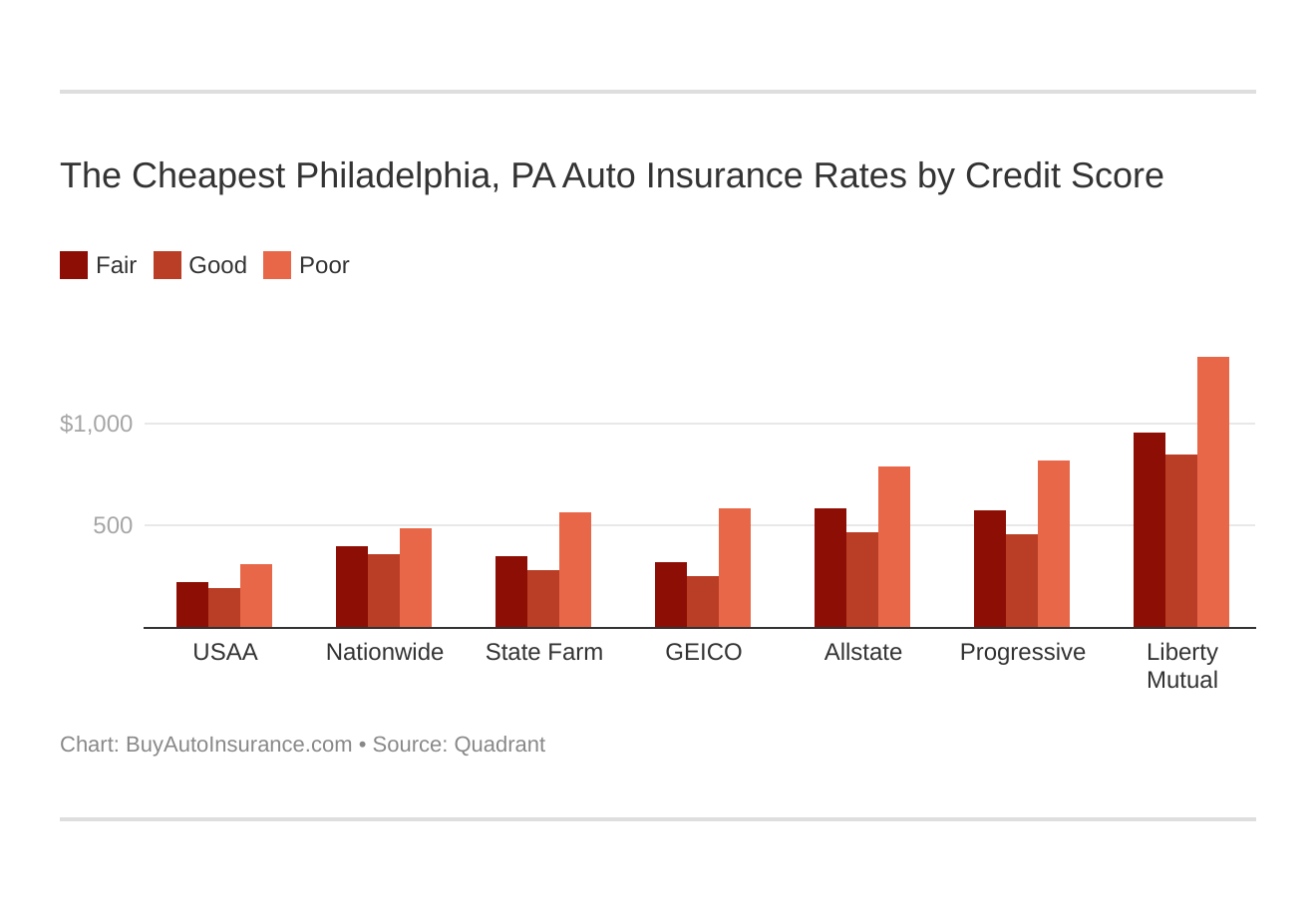

Best Auto Insurance Rates by Credit History

Another big factor that car insurance companies use to determine your insurance rate is credit history. Insurance companies judge credit based on three categories: fair, good, and poor. You might be interested in learning more about no credit check auto insurance.

Your credit score will play a major role in your rates for car insurance in Philadelphia unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest car insurance in Philadelphia rates by credit score below.

Let’s see what the cost of each score is for the different major insurance companies in Philly.

| Group | Good | Fair | Poor | Average |

|---|---|---|---|---|

| Allstate | $5,638.55 | $7,048.60 | $9,465.03 | $7,384.06 |

| Geico | $2,986.78 | $3,893.08 | $6,983.51 | $4,621.12 |

| Liberty Mutual | $10,176.47 | $11,494.99 | $15,945.20 | $12,538.89 |

| Nationwide | $4,279.62 | $4,814.49 | $5,894.45 | $4,996.19 |

| Progressive | $5,513.16 | $6,909.76 | $9,879.00 | $7,433.97 |

| State Farm | $3,356.18 | $4,239.43 | $6,816.64 | $4,804.08 |

| Travelers | $13,999.55 | $14,869.14 | $16,510.40 | $15,126.36 |

| USAA | $2,393.33 | $2,724.60 | $3,744.26 | $2,954.06 |

Based on this information, we can see that the most expensive credit history is poor credit. The company that charges you the most for this type of credit is Travelers, and they charge an average of $16,510.40 for this credit type. The company that is best for poor credit is USAA, with an average rate of $3,744.26 for poor credit.

Good credit is rewarded with lower prices, and the cheapest company for good credit is USAA, with $2,393.33 as an average cost. The most expensive company is Travelers with $13,999.55 as their average cost.

And, as you could probably have guessed, the credit type with the middle cost is fair credit. The cheapest company for fair credit is USAA, with $2,724.60 as an average cost for this type of insurance, and the most expensive company for this credit history is Travelers, with an average cost of $14,869.14.

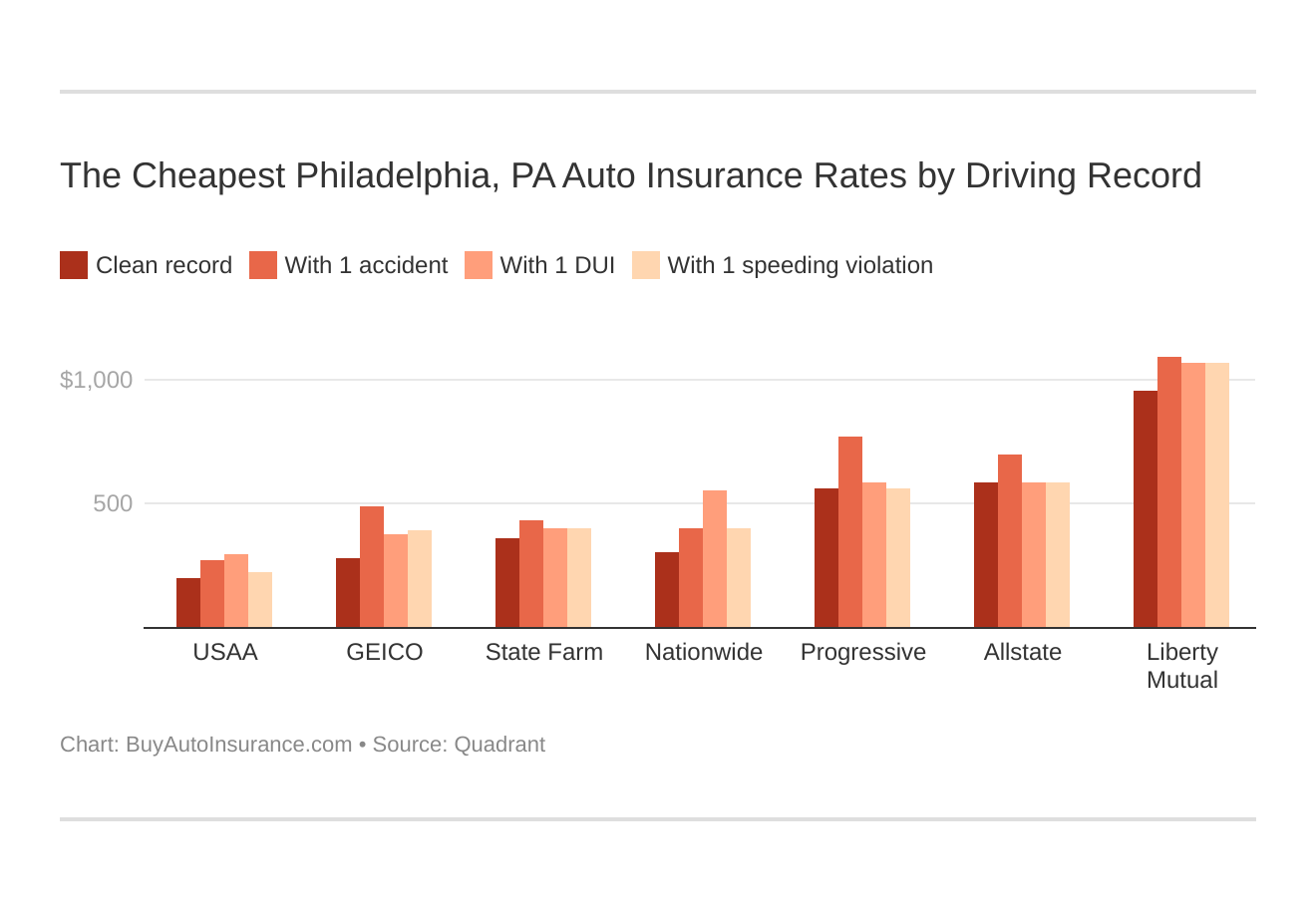

Best Auto Insurance Rates by Driving Record

The last factor that insurance companies consider from your life is your driving record. This begs the question, how far back do auto insurance companies look when reviewing your record? Each insurance company charges differently based on the infractions, or lack thereof, on your driving record.

Your driving record will affect your Philadelphia auto insurance rates. For example, a Philadelphia, Pennsylvania DUI may increase your auto insurance rates by 40 to 50 percent. Find the cheapest car insurance in Philadelphia by driving record.

There are typically five types of records that car insurance companies use to determine what their rates are: a clean driving record, a record with an accident, a record with a DUI, and a record with a speeding violation. If you need to know how to get auto insurance after a DUI, this article will help.

If you would like to see what each major insurance company in Philly charges for the different record types, check out the table below.

| Group | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation | Average |

|---|---|---|---|---|---|

| Allstate | $7,045.78 | $8,398.88 | $7,045.78 | $7,045.78 | $7,496.81 |

| Geico | $3,356.70 | $5,913.58 | $4,546.42 | $4,667.79 | $4,605.57 |

| Liberty Mutual | $11,444.01 | $13,109.97 | $12,800.78 | $12,800.78 | $12,451.59 |

| Nationwide | $3,654.90 | $4,841.23 | $6,666.09 | $4,822.52 | $5,054.07 |

| Progressive | $6,727.17 | $9,240.42 | $6,989.74 | $6,778.57 | $7,652.44 |

| State Farm | $4,373.72 | $5,234.44 | $4,804.08 | $4,804.08 | $4,804.08 |

| Travelers | $10,688.46 | $15,238.90 | $19,339.18 | $15,238.90 | $15,088.85 |

| USAA | $2,362.27 | $3,288.44 | $3,518.96 | $2,646.58 | $3,056.56 |

According to these numbers, you can see that on average, the most expensive driving records are those that have an accident or a DUI, which makes sense because it makes you seem like you’re a bigger risk to insure. Travelers are the most expensive company for both these types of records, as they charge $15,238.90 for an accident and $19,339.18 for a DUI.

The cheapest type of record that you can have is a clean record, and this makes sense, too. The company that is the cheapest if you have a clean record is USAA because they charge an average of $2,362.27 for clean records.

What is the minimum coverage for auto insurance in Philadelphia?

The minimum requirements for coverage in Philadelphia are the following:

- $5,000 for property damage liability coverage for a single accident

- $15,000 for bodily injury per person involved in a crash caused by you

- $30,000 for total bodily injury per accident

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

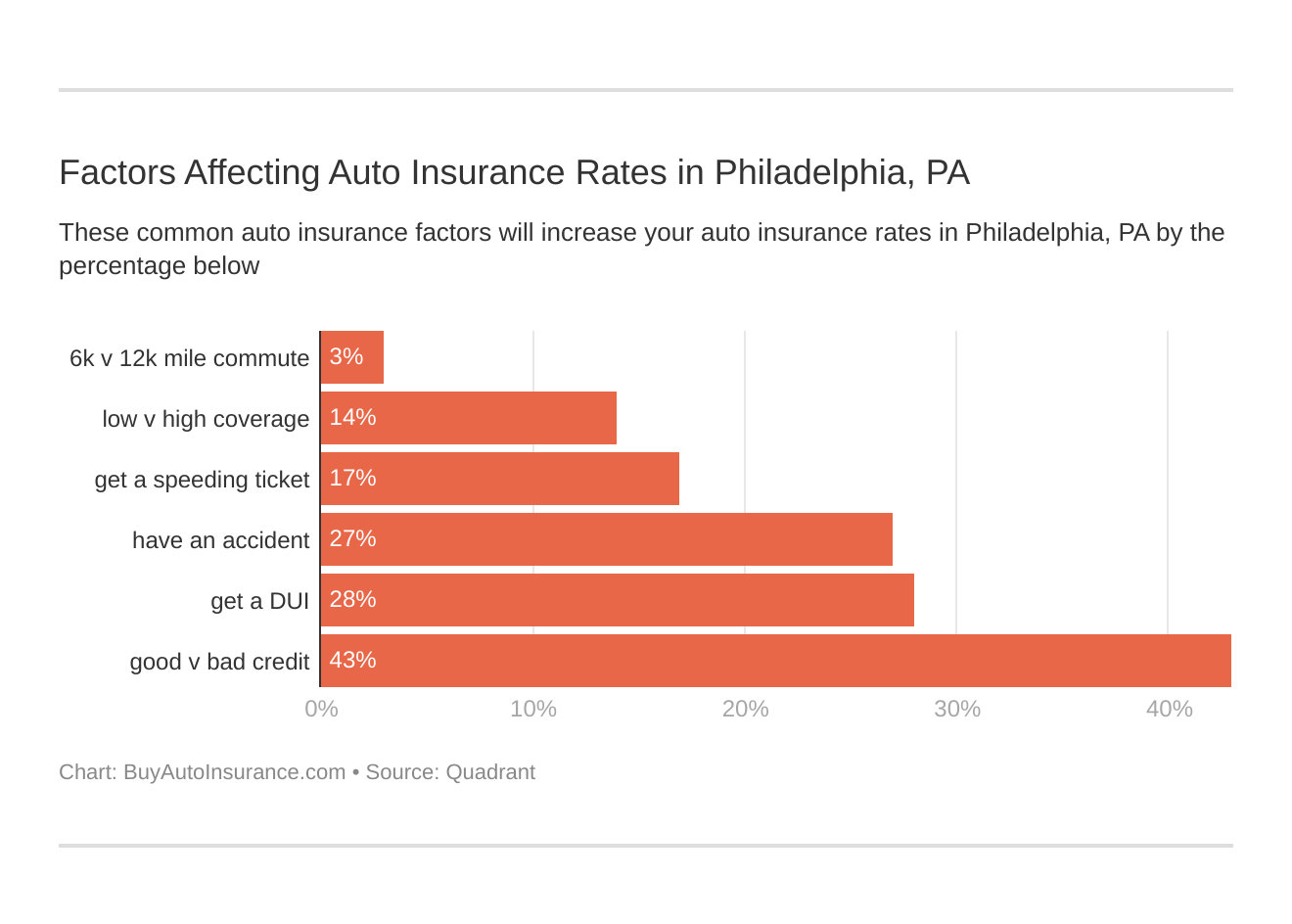

What factors affect rates for auto insurance in Philadelphia?

While there are some factors that you have control over that influence the cost of your car insurance, there are some factors that affect your car insurance that having nothing to do with you and everything to do with where you live. Keep reading to see what these factors are and how they affect the insurance rates of Philadelphians.

Factors affecting auto insurance rates in Philadelphia, PA may include your commute, coverage level, speeding tickets and other moving violations, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Philadelphia, Pennsylvania auto insurance.

Philadelphia growth and population

Growth and prosperity rates of cities are major factors when car insurance companies decide what you pay. Based on some numbers from Metro Monitor, Philadelphia ranks 38th for growth and 44th for prosperity out of the top 100 largest metro areas in the United States. Here are the numbers that constitute Philadelphia’s growth and prosperity rankings:

Growth (38th):

- Jobs: +1.4 percent (51st)

- Gross metropolitan product (GMP): +2.4 percent (44th)

- Jobs at young firms: +7.1 percent (18th)

You may be unsure of what a gross metropolitan product is, so we’ll explain it to you. A Gross Metropolitan Product is a measurement of the total output of goods and services within a given metro area. Now, let’s take a look at the prosperity numbers.

Prosperity (44th):

- Productivity: +1 percent (47th of 100)

- Standard of living: +2.1 percent (24th of 100)

- Average annual wage: +0.6 percent (70th of 100)

You may be confused as to why these numbers matter when companies decide what your car insurance rates are. Well, these numbers can show how competitive the market of the city in which you’re shopping for car insurance is, and this has an impact on the prices of your car insurance.

Median Household Income in Philadelphia

Another aspect of your city that affects the cost of car insurance is its median household income. According to DataUSA, the median household income for Philadelphia is $46,116. This median household income shows a 16 percent growth from 2017’s median of $39,759. However, it’s still a bit lower than the United States’ average of $61,937.

Philadelphia’s average premium for car insurance is $9,302. That means that Philadelphians spend around 20 percent of their income on car insurance. That number is pretty high. If you want to see the percentage of your income that you spend on car insurance, you can use our free calculator below.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Homeownership in Philadelphia

DataUSAalso states that the homeownership percentage for Philadelphia is 52.7 percent. This number has grown from 2017’s percentage, which was 49 percent. However, this is still lower than the national average of 63.9 percent.

It’s important to know that owning a home affects your car insurance rates. This is because homeownership rates can evidence the state of a city’s economy, and car insurance companies can also see owning a home as a form of financial responsibility.

And while homeownership can’t have a direct impact on your car insurance rates. An insurance company might give you discounts if you own a house through an auto insurance bundling discount.

It’s also worth mentioning that the median property value in Philadelphia is $167,700, which is higher than it was in 2017 ($166,200), but lower than the national median property value of $255,000.

Education in Philadelphia

Education in your city is another factor that car insurance companies consider when determining what your cost of insurance is. For more info, find out how to buy cheap auto insurance for students. Your level of education is a factor. This is controversial, but it is in practice because certain studies show that different education levels and occupations have a correlation with higher risk levels and lower risk levels when driving.

Thus, if a study shows your education level has a certain level of risk, your insurance company will charge you accordingly. Higher levels of education generally show a lower risk, so they pay less; lower levels of education show the opposite.

Philadelphia has 115 colleges and universities, and this high number of schools affects your insurance rates, as well. DataUSA shows that the three largest universities in Philadelphia, which are measured by the number of degrees awarded, are Temple University (9,383 degrees awarded), University of Pennsylvania (9,234 degrees awarded), and Drexel University (7,679 degrees awarded).

However, just because you don’t have a four-year degree doesn’t mean you can’t contribute to The City of Brotherly Love. Philadelphia has an awesome food scene, and according to Academic Courses, two of the most popular associate degrees in Philadelphia are culinary arts degrees from Delaware Community College and The Restaurant School at Walnut Hill College.

You can also make significant contributions to Philadelphia’s tech world by getting a degree from Delaware Community College in Game Development or Web Development.

Wage by Race and Ethnicity for Common Jobs in Philadelphia

As unfortunate as it is, different races and ethnicities earn differently for different jobs. And, because this has an effect on car insurance rates, we’ll share this information with you.

The highest-earning race in Philadelphia is Asian, who earn $67,044 a year. The next highest-earning race in Philadelphia is white ($54,569 a year), and the third highest-earning race is Native Hawaiian and Other Pacific Islanders ($45,677).

It’s also important to know how much each race earns by common jobs for people in Philadelphia. Here is a table that displays this data.

| Race | Other Managers | Nurses | Teachers | Drivers/Truck Drivers/Sales | Secretaries and Administrative Assistants, Except Legal, Medical, and Executive |

|---|---|---|---|---|---|

| Asian | $132,621 | $69,001 | $64,641 | $28,715 | $32,034 |

| White | $96,371 | $62,949 | $55,353 | $44,872 | $36,124 |

| Black | $76,302 | $71,830 | $50,932 | $37,632 | $35,390 |

| Other | 74,462 | N/A | $34,157 | $53,153 | N/A |

| Two or More Races | $53,578 | $59,134 | $61,959 | $47,548 | $49,076 |

Based on these numbers, you can see that Asians earn the most as managers, and they earn an average of $132,621 in this position. The lowest-earning demographic in a job are Asians as truck drivers, as they earn an average of $28,715 in this career. There are N/As by Other Races as Nurses and Secretaries because there was no information for these categories.

| RACE | PERCENTAGE FOR MANAGER |

|---|---|

| Asian | 7% |

| White | 9.6% |

| Black | 12% |

| Two or more races | 12.4% |

| Other | 17% |

As we’ve previously stated, the average premium for Philadelphians is $9,302. If we want to show the percentages of salaries that each race spends on their premiums if they are managers, we can see that Asians spend the lowest amount at 7 percent, and races that are unidentified spend the highest amount at 17 percent.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Wage by Gender for Common Jobs in Philadelphia

In Philadelphia, men earn an average of $69,779 for their salary, and women earn an average of $52,119 for their salary. As for jobs, men earn more for every career listed (managers, secretaries, nurses, teachers, and drivers).

The career where men earn the most is as a manager, as they earn an average of $105,124 in this position. Women earn an average of $87,816 in this position. This is also the position in which women earn the most money.

This table shows the premiums as percentages of income for each of the job families for men and women.

| OCCUPATION | PREMIUM AS A % OF INCOME (MALE) | PREMIUM AS A % OF INCOME (FEMALE) |

|---|---|---|

| Miscellaneous managers | 8.5 | 11.4 |

| Registered nurses | 11.6 | 13.8 |

| Elementary and middle school teachers | 14.1 | 16.1 |

Read more: Buy Cheap Auto Insurance for Nurses

As you can see, males pay a lower percentage of their salaries for their car insurance. The occupation in which males pay the highest percentage is teaching, and they pay 14.1 percent if they have this job. Women pay the highest percentage if they are in the educational field, too. Car insurance for women who are teachers is 16.1 percent of their salary.

Poverty by Age and Gender in Philadelphia

DataUSA shows us that the largest group living in poverty in Philadelphia is women aged 25-34. There’s also a high level of poverty for all demographics, as Philadelphia has a poverty percentage of 25.8 percent. The other two groups with the greatest number of people who live in this 25.8 percent are females aged 18-24, followed by men aged 18-24.

Of these groups, 9.06 percent of women aged 25-34 make of the total poverty percentage, and 7.25 percent of women aged 18-24 and 6.4 percent of men aged 18-24 constitute the total poverty percentage.

Poverty by Race and Ethnicity in Philadelphia

As for poverty in Philadelphia, the highest percentage of people who live in poverty are African Americans. Forty-one percent of the people in Philadelphia who live in poverty are African American.

The group that makes up the next highest percentage of Philadelphia’s poverty are white Philadelphians, at 24.7 percent. Lastly, the group that makes up the third-largest percentage of Philadelphia’s poverty are Hispanics, at 18 percent.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Employment by Occupations in Philadelphia

The last part in this section analyzes the different types of employment by occupation. We can start this section with some great news: employment grew 6.01 percent from 2017 to 2018, which is an increase from 674 thousand employees to 714 thousand employees.

If we break down the employment numbers, we can see the majority of Philadelphia’s workforce works in Office and Administrative Support Occupations, 85,916 people work in this field. This is equivalent to 12 percent of the workforce. The second-largest chunk of Philadelphia’s workforce is made up of those who work in Management Occupations (58,604 people; 8.21 percent of the work).

The smallest part of Philadelphia’s workforce consists of those who work as farmers, fishers, or employees in forestry occupations. Only 902 people work in this field. It’s so small there isn’t even a percentage available.

Driving in Philadelphia

Now that we’ve looked at some of the numbers for employment, earning, and education, let’s get to some stuff that affects your driving more directly. We know that driving in a major city can be a bit of a pain, so that’s why we’re going to give you some helpful information and advice that will make your driving in Philadelphia as smooth as possible.

Find out how to qualify for safe driver insurance discounts.

Below, we’re going to look at some information about roads, highways, popular destinations, road conditions, and much more. You’ll be an expert on driving in Philly after this section.

What are major roads in Philadelphia?

Here, we’re going to look at the major roads in Philadelphia, which is essential to know if you want to navigate the City of Brotherly love.

Some of the major roads in Philadelphia include Columbus Boulevard, Fairmount Park Roads, Front Street, Passyunk Avenue, and South Street. Knowing these particular roads is a good start, but if you really want to be a master of driving in Philadelphia, you’ll have to know the major highways, too.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Major Highways

As promised, here is some crucial information about the major highways in Philadelphia.

There are seven active routes in Philadelphia, and there are 360 miles of highway in Philadelphia, as well as 2,575 miles to 2,180 miles of regular city streets. Here are some of the major, active highways in Philadelphia:

- Schuylkill Expressway: I-76

- Delaware Expressway: I-95

- Pennsylvania Turnpike: I-276

- Mid-County Expressway / PA Turnpike Northeast Extension: I-476

- Vine Street Expressway: I-676

- Interstate 295

- Roosevelt Expressway: US 1

Next, we have a video to help give you a visual aid so you can see what Philadelphia’s traffic is like.

Though these highways are important for traveling and commuting, Philadelphia puts a major emphasis on maintaining its historic streets and repairing or replacing them if necessary. Philadelphia knows how important its history is.

However, Philly also knew that despite their past’s importance, they needed a way to create a better future for their city. That’s why in 1966, the Philadelphia City Planning Commission recommended the construction of an expressway network for the city and immediate suburbs, which led to the creation of major highways like the Schuylkill and Delaware Expressways.

In addition to these major highways, I-95 is an important highway as it provides access to Pennsylvania as well as parts of New Jersey and Delaware via connections with other interstates and state routes.

It also is home to a lot of regional destinations such as sports, recreational, and entertainment venues, employment centers like Center City Philadelphia, and major transportation and port facilities like the Philadelphia International Airport and several port terminals.

However, despite the fact that the highways in Philadelphia are awesome and make traveling much easier, they have a necessary evil: tolls. But while you may dislike tolls, they’re essential to keeping highways functional and in good condition.

Here is a list of all the toll roads in Philadelphia:

- Amos K. Hutchinson Bypass

- Beaver Valley Expressway

- Benjamin Franklin Bridge

- Besty Ross Bridge

- Burlington-Bristol Bridge

- Commodore Barry Bridge

- Delaware Water Gap (I-80) Toll Bridge

- Dingman’s Ferry Bridge

- Easton-Phillipsburg (Route 22) Toll Bridge

- I-78 Toll Bridge

- Milford-Montague Toll Bridge

- Mon-Fayette Expressway

- New Hope-Lambertville (Route 202) Toll Bridge

- Northeast Extension

- Pennsylvania Turnpike

- Portland Columbia Toll Bridge

- Southern Beltway

- Tacony-Palmyra Bridge

- Trenton-Morrisville (Route 1) Toll Bridge

- Walt Whitman Bridge

Toll Total: 20

The cost from toll to toll varies depending on the toll road, the direction in which you travel, and the time. The lowest one can pay for a single toll pass cost is $1, and the highest amount is $5.

If you want to be more efficient and use a transponder, it costs $35 to buy your transponder plus a $3 annual fee. For each transponder on an individual account after the first, it costs $38. You can have a pre-paid option that requires you to have money on your account and maintain money on your account in order to pay for tolls as you incur them.

You can also use this toll calculator to see how much the tolls on your journeys cost.

Popular Road Trips/Sites

One of the purposes of taking these roads are to go to fun destinations, so we’ll share some of these places with you to make your driving on the highway worthwhile.

#1 — Check out the Liberty Bell

The Liberty Bell is one of Philadelphia’s best-known attractions, and for a good reason. It’s a symbol of the liberty of our great nations, and one of the most important parts of our nation’s history. Plus, it’s free, and there are absolutely pictures allowed.

#2 — Get an Authentic Philly Cheesesteak

I mean, come on — Philly is in the name of this famous dish, so you have to get it if you’re in Philadelphia. If you want to munch on one The City of Brotherly Love’s finest delicacies, visit Geno’s Steaks or Pat’s King of Steaks on the corner of South 9th Street and Passyunk.

If that video doesn’t make you want a Philly cheesesteak, we’re not sure what will.

#3 — Check out the Famous LOVE Sculpture

The City of Brotherly Love has this iconic sculpture created by Robert Indiana and located in John F. Kennedy Plaza. The sculpture was recently restored and repainted, and more green areas and a high-tech water feature were added to the park in which the LOVE sculpture resides.

#4 — Tour the Birthplace of the United States

Lastly, while you’re in Philly, you must tour Independence hall, which is considered the birthplace of America. You can order free tickets ahead of time to see where the Declaration of Independence was signed, but get them quick: they go fast.

This video is great, but it doesn’t do the place justice. See the real thing.

Road Conditions

While Philadelphia has a lot of roads and attractions, many of Philly’s roads and highways are unfortunately in poor or mediocre condition.

| Condition | Percent |

|---|---|

| Good | 17% |

| Fair | 11% |

| Mediocre | 28% |

| Poor | 43% |

Based on these numbers, we can see that 43 percent of Philadelphia’s roads are in poor condition, and 28 percent are in mediocre condition. The Vehicle Operating Cost (V.O.C.) — which are the costs that vary with vehicle usage, including fuel, tires, maintenance, repairs, and mileage-dependent depreciation costs — is an average of $732 per person.

It’s a shame Philadelphia’s roads are in this condition because it’s such a great city. Perhaps in the near future, there will be some improvement.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does Philadelphia use speeding or red-light cameras?

It is highly dangerous to speed and run red lights. In 2017, 890 were killed running red lights, and 9,717 were killed from speeding. But while speeding is pretty clearly defined, red-light running is a bit more vague.

The exact definition of red-light running is if a car enters an intersection any time after the signal light has turned red.

Then, the driver would get a ticket. However, motorists who are inadvertently in an intersection when the signal changes (like when they are waiting to turn left) are not red-light runners.

It is also illegal if a driver fails to make a complete stop before turning right on red if they’re at a light where it is legal to turn right on red.

There are, indeed, red-light cameras in Philadelphia; there are 31, to be exact. If you are caught by a red-light camera, it is a $100 fine, but you do have the right to dispute it within 30 days of receiving your Notice of Violation. You can see the locations here.

Philadelphia will soon have speeding, cameras, too. Very soon, there will be 32 cameras installed at eight intersections along Roosevelt Boulevard, which is considered to be one of the most dangerous roads for drivers and pedestrians. The cameras spread across the nearly 12-mile stretch of roadway will record drivers going 11 mph or more over the speed limit, and these drivers will receive a $150 fine.

Philadelphia’s Mayor, Jim Kenney, hopes that the speeding cameras will help eliminate speeding deaths from Philadelphia by the year 2030.

What type of vehicles are in Philadelphia?

In addition to knowing about the roads Philadelphians drive on, it’s also important to know about the cars that Philadelphians drive. Let’s take a look at these vehicles in the City of Brotherly Love.

Most Popular Vehicles Owned

The most popular car in Philadelphia is the Nissan Maxima.

The Nissan Maxima has built-in door-to-door navigation and seamlessly connects with your smartphone so you can get your direction as easily as possible. It also has USB connectors, so you don’t need adapters. It even has drive assist that has turn-by-turn directions, safety alerts, and signals for when you need to break.

The Nissan Maxima has pretty good fuel mileage, as it gets 20 MPG in the city and 30 MPG on the highway and a combined city/highway 24 MPG.

Lastly, it is very safe, with a 9.9 safety rating (U.S. News Scorecard), a five-star rollover rating, and strong safety ratings in every category that measures car safety.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Many Cars Per Household

We know that the Nissan Maxima is the most popular car in Philadelphia, but how many cars does the average household in Philadelphia own?

According to Data USA, most Philadelphian households (40 percent) own one car. This is different from the rest of the country, as most other households in America own two cars. However, the second-largest percentage of Philadelphian households own two cars, as 28.2 percent of Philadelphian households own this number of cars.

Households Without a Car

Because Philadelphia is a major city, many households actually don’t own cars at all. In fact, in 2015, 31.1 percent of households did not own cars. That number dropped slightly in 2016, as 29.5 percent of households didn’t own cars. We ranked Philadelphia as one of the United States’ most walkable cities, which speaks to the potential to live here without a car. Check out our Streets Built for People post about walkability benefits.

Speed Traps in Philadelphia

It’s common knowledge that speeding when driving is highly dangerous and causes many fatalities every year. This is why you must always follow the speed limits and drive defensively.

As previously mentioned in this article, Philadelphia is planning on installing speeding cameras in an effort to end speeding-related deaths by 2030.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Vehicle Theft in Philadelphia

It’s important to know about vehicle theft in your city because it helps you be more aware so you can keep your car safe, and insurance companies calculate your rates based on vehicle thefts, too.

It’s unfortunate, but Philadelphia has a high amount of vehicle thefts. According to the FBI, there were 5,680 vehicle thefts in 2018. While there are a lot of car thefts in Philadelphia, if you live in Cherokee St/W Hartwell L, the chance of your car getting stolen is lower, as this is considered the safest neighborhood in Philadelphia.

But, regardless of what your neighborhood is, it’s important to know that the violent crime rate for every 1,000 people in the entire city of Philadelphia is 9.12. This is three times higher than the rest of Pennsylvania, as the state of Pennsylvania’s violent crime rate per 1,000 people is 3.06.

This number, 9.12, means that you have a one in 110 chance of becoming a victim in Philadelphia, compared with a one in 327 chance in the rest of the state, If you compare Philadelphia’s number of 9.12 to 3.81, which is the United States number of violent crimes per 1,000 people, you’ll see that Philadelphia has considerably more violent crimes than the rest of America.

This means Philadelphia is less safe than the rest of the United States.

Here are some tables that illustrate the specifics of crime in Philadelphia.

| CRIME | TOTAL | RATE PER 1,000 |

|---|---|---|

| Murder | 355 | 0.22 |

| Rape | 1,097 | 0.69 |

| Robbery | 5,262 | 3.32 |

| Assault | 7,730 | 4.88 |

This table shows the number of violent crimes in Philadelphia by each kind of crime. As you can see, the most common violent crime is assault, with a total of 7,730 assaults.

Violent crime is important to know about, but it’s also important to be aware of property crimes, which this table shows.

| CRIME | TOTAL | RATE PER 1,000 |

|---|---|---|

| Burglary | 6,499 | 4.10 |

| Theft | 36,972 | 23.34 |

| Motor Vehicle Theft | 5,682 | 3.59 |

The data from this table indicates that the most common property crime in Philadelphia is theft, with 36,972 total thefts.

Finally, here are some general crime statistics in Philadelphia that you should know about. Neighborhood Scout shows there is an average of 446 crimes per square mile. Philadelphia’s crime index is eight, which means it’s only safer than 8 percent of the rest of America’s cities. This 8 percent is a result of 63,597 total annual crimes.

How is traffic in Philadelphia?

After reading about crime, reading about traffic might actually seem cheerful. In the sections below, we’re going to take a look at some traffic statistics in Philadelphia.

Traffic Congestion in Pennsylvania

Based on INRIX’s data, Philadelphians spent an average of 112 hours sitting in traffic in 2018. TomTom shows us that the congestion percentage during a Philadelphian’s morning peak is 39 percent, and it is 51 percent during the evening peak. The overall congestion level in Philly is 24 percent.

The percentage of congestion on highways is 21 percent, and the percentage of congestion for non-highways is 26 percent. The traffic costs for each driver in Philadelphia are, on average, $1,568 per year, and traffic adds 12 minutes of extra travel time in the mornings and 15 minutes in the evenings.

Numbeo reveals that Philly’s traffic index is 184.87. A traffic index is a composite index of time spent in traffic due to job commutes, estimation of time consumption dissatisfaction, CO2 consumption estimation in traffic, and overall inefficiencies in the traffic system.

The time index, which is an average one-way time needed to get somewhere, is 40.0 minutes in Philadelphia. Finally, the inefficiency index for Philly is 274.07.

If you’re not sure what an inefficiency index is, it can be defined as an estimation of inefficiencies in the traffic. High inefficiencies are usually caused by an excess of people driving instead of using public transportation, or long commute times. It can also be used as a traffic component measurement in economies of scale.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Transportation

The average commute time for a Philadelphian worker is 33 minutes, which is more than the U.S. average of 25.7 minutes. As for Philadelphians’ means to get to work, the majority of Philadelphia’s workers (49.5 percent) drive alone. The second-most popular way for Philadelphians to get to work is by public transit (26.4 percent), and the third-most-popular way for Philadelphians to get to work is by walking.

Although about half of Philadelphia drives to work, it’s great that more than a quarter take public transportation, and almost 10 percent whowalk. These stats show that Philadelphia is a surprisingly environmentally friendly city.

Because Philadelphia is a major city, it makes sense that many commuters walk and take public transportation to work. Not a commuter? Check out how to save with telecommuting auto insurance coverage.

Busiest Highways

Roosevelt Boulevard is the highway with the most lanes in Philadelphia, as it has 12 lanes.

Based on Texas A&M’s data, Philadelphians lose 62 hours in traffic each year. Philly ranks 10th in travel delays for all U.S. cities. The City of Brotherly Love’s travel time index (that’s the ratio of the peak-period travel time to the free-flow travel time) is 1.25. That means that if it takes 20 minutes to drive somewhere during free-flow traffic, it will take 25 minutes to drive during peak times.

Philadelphia drivers used 26 more gallons of fuel sitting in traffic than they did while driving in free-flow traffic; this places them at 15th out of all U.S. cities for this category. Philly drivers also spent an average of $1,203 annually on congestion costs (which the value of travel time delay), and this ranks them 22nd in this category among other U.S. cities.

Lastly, Philadelphians’ total delays measured in person-hours are 194,655 hours, and their total fuel consumed is 80,817 gallons. As you can see from this data, traffic really takes a toll on our resources and our time.

How safe are Philadelphia’s streets and roads?

Regardless of how annoying and wasteful traffic is, the most important part of driving is safety. Thus, we’re going to spend a good amount of time showing you some important statistics from the NHTSA that will help you drive safely on Philadelphia’s roads. If you drive in Philly, you need to be aware of how car insurance rates change after an accident.

This table shows the total road fatalities in 2018 in Philadelphia County and the counties that surround Philadelphia County.

| COUNTY | FATALITIES |

|---|---|

| Philadelphia | 103 |

| Bucks | 54 |

| Montgomery | 50 |

| Delaware | 19 |

As you can see, Philadelphia County has the highest amount of road fatalities, with 103 fatalities. Delaware County has the least amount of road fatalities, with 19.

| 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| 26 | 31 | 23 | 22 | 27 |

This next table shows the total DUI deaths in Philadelphia County from 2014-2018. According to this data, most DUIs happened in 2015 (31), and then they started to decrease in 2016 (23) and 2017 (22). Unfortunately, there was a higher number in 2018 (27).

Below, we’re going to look at a table that shows the number of fatalities related to single-vehicle crashes in Philadelphia County.

| 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| 65 | 66 | 57 | 55 | 65 |

A single-vehicle crash is pretty self-explanatory: it’s an accident where only one car is involved in a crash. In Philadelphia County, the year where the most single-vehicle crash fatalities occurred is 2015, with 66 fatalities. The year with the least amount of single-vehicle crash fatalities was 2017, and there were 55 fatalities in that year.

As we’ve previously mentioned, speeding is incredibly dangerous and even results in deaths. The table below shows the numbers of how many fatalities speeding caused in Philadelphia County.

| 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| 34 | 32 | 22 | 29 | 24 |

You can see that the highest amount of speeding-related fatalities occurred in 2014, as 34 fatalities happened that year. The rest of the statistics are better, though, because they are in the twenties, which shows improvement in how the county deals with speeding. Hopefully, the numbers will be even lower when the speed traps are installed.

| 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| 711 | 772 | 669 | 642 | 680 |

A roadway departure crash is defined as a crash that occurs after a vehicle crosses an edge line or a centerline, or otherwise leaves the traveled way. These types of crashes are particularly dangerous and result in many fatalities. This table shows these high numbers in Philadelphia County, and you can see that the most fatalities from this type of accident occurred in 2015 (772).

Intersection crashes are especially dangerous, too. You can see the numbers for the fatalities that were the result of intersection crashes in Philadelphia County below.

| 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| 257 | 241 | 272 | 252 | 268 |

The year 2016 was a particularly dangerous year for intersection crashes, and 272 people died from this type of accident that year.

| 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| 31 | 28 | 29 | 24 | 35 |

There’s a reason why the front passenger seat is called “the death seat:” it’s highly dangerous to sit there. The data above shows the number of deaths of Philadelphians from sitting in the passenger seat from the years of 2014-2018.

The most dangerous years for sitting in the front seat in Philadelphia were 2018 and 2014, as there were 35 fatalities from this in 2018, and 31 fatalities from this in 2014.

In the driving world, pedestrians are at risk, too. Whether you’re walking or driving, you must always be aware and vigilant.

| 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| 161 | 151 | 170 | 147 | 197 |

The most dangerous year for pedestrians in Philadelphia County was 2018, with 197 fatalities, and the least dangerous year was 2017, with 147 fatalities.

Like pedestrians, cyclists must be aware and have their eyes open, too. The numbers below show the deaths of cyclists in Philadelphia County.

| 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| 19 | 16 | 16 | 22 | 18 |

The most dangerous interstate in Philadelphia is Roosevelt Road, with 63 deaths for all types of driving-related fatalities. In addition to interstates, there can be other road types that are dangerous, too.

The table below shows the deaths by different road types in Philadelphia.

| RURAL INTERSTATE | URBAN INTERSTATE | FREEWAY/EXPRESSWAY | OTHER | MINOR ARTERIAL | COLLECTOR ARTERIAL | LOCAL | UNKNOWN | TOTAL |

|---|---|---|---|---|---|---|---|---|

| 3 | 11 | 1 | 38 | 8 | 4 | 26 | 0 | 91 |

Based on these numbers, we can see that the most dangerous road type is the “other” road type, with 38 fatalities out of the total 91 road fatalities for all road types.

There are also a fair amount of accidents that involve railroad crashes. Here is a table that details the accidents and other relevant statistics that surround these crashes as well as highway-related accidents.

| CALENDAR YEAR | HIGHWAY | HIGHWAY USER TYPE | HIGHWAY USER SPEED | RAIL EQUIPMENT TYPE | NON SUICIDE FATALITY | NON SUICIDE INJURY |

|---|---|---|---|---|---|---|

| 2012 | DELAWARE AVENUE | Automobile | 0 | Yard/Switch | 0 | 0 |

| 2013 | DELAWARE AVE EAST | Automobile | 50 | Freight Train | 0 | 0 |

| 2013 | PRIVATE | Automobile | 3 | Freight Train | 0 | 0 |

| 2013 | MILNOR BLEIGH | Automobile | 25 | Yard/Switch | 0 | 1 |

| 2015 | GREENWICH YARD | Truck-trailer | 5 | Light Loco(s) | 0 | 0 |

| 2015 | MAIN STREET | Pedestrian | Freight Train | 0 | 1 | |

| 2016 | 58TH ST | Truck-trailer | 5 | Freight Train | 0 | 0 |

Based on these numbers, we can see that there were injuries relating to railroad collisions in 2013 and 2015. The cause in 2013 was yard/switch-related, and in 2015 it was freight train-related.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate America’s Best Drivers Report

After all that information about fatalities and accidents, let’s lighten the mood with some info about America’s best drivers.

According to Allstate’s Best Drivers Report, there was an average of 6.33 years between claims for Philadelphia drivers. The likelihood of a claim being filed in Philadelphia compared with the national average is .67, and there were 43.88 hard-breaking events per every 1,000 miles.

Ridesharing

You don’t always have to do the driving, right? Sometimes it’s better to take it easy and let someone else take you to your destination. Here’s our list of auto insurance companies that accept rideshare. According to RideGuru, these are the ridesharing services available in the City of Brotherly Love.

- Blacklane

- Carmel

- Curb

- Jayride

- Limos.com

- Lyft

- Taxi

- Uber

An average rate for taking a ridesharing service is from the Liberty Bell to Independence National Historical Park is $15.63. This average is perhaps higher than it should be because when we calculated the average, we included Carmel, which is limo rideshare. However, it is still a ridesharing option, so we felt it was necessary to include it.

If you want to take Carmel, it is the most expensive and costs $60. The cheapest is a taxi at $4, and for the most popular ridesharing services, Curb is $5, Lyft is $7, and Uber is $7.

Read more: Buy Cheap Taxi Cab Auto Insurance

E-star Repair Shops

E-star is one of the best ways to get your car fixed in the City of Brotherly Love. If you’re having auto troubles, make sure to visit one of these 10 locations listed below.

| ADDRESS | CONTACT |

|---|---|

| CALIBER - CINNAMINSON 811 ROUTE 130 S CINNAMINSON NJ 08077 | email: [email protected] P: (856) 829-1982 F: (856) 829-6290 |

| CALIBER - NORTHEAST PHILADELPHIA 1225 COTTMAN AVENUE PHILADELPHIA PA 19111 | email: [email protected] P: (215) 742-2241 F: (215) 742-2263 |

| CALIBER - OXFORD VALLEY 124 LINCOLN HIGHWAY FAIRLESS HILLS PA 19030 | email: [email protected] P: (215) 943-9600 F: (215) 943-2346 |

| CALIBER - PHILADELPHIA - GRANT AVE 2034 GRANT AVE PHILADELPHIA PA 19115 | email: [email protected] P: (215) 676-7400 F: (215) 464-8977 |

| CALIBER - WARMINSTER 565 WEST STREET RD WARMINSTER PA 18974 | email: [email protected] P: (215) 443-3363 F: (215) 443-9046 |

| CARSTAR AUTOCRAFTERS COLLISION 2659 BRISTOL PIKE BENSALEM PA 19020 | BENSALEM PA 19020 email: [email protected] P: (215) 638-2322 |

| CARSTAR GUS'S QUALITY COLLISION SERVICES 9412 BUSTLETON AVE PHILADELPHIA PA 19115 | email: [email protected] P: (215) 673-5654 |

| CARSTAR PETE'S COLLISION 213 HORSHAM RD HORSHAM PA 19044 | email: [email protected] P: (215) 675-1879 |

| FAULKNER COLLISION SPECIALISTS_CF 9916 HALDENMAN AVE. PO BOX 6148 PHILADELPHIA PA 19115 | email: [email protected] P: (215) 698-8700 F: (215) 698-1076 |

| SERVICE KING HUNTINGDON VALLEY 105 Buck Road HUNTINGDON VALLEY PA 19006 | email: [email protected] P: (215) 322-3000 F: (215) 322-9168 |

Once you’ve given your beloved ride over to E-star, you can view the process of your car getting fixed, so it’s certain they’ll do a good job. And, as you can probably tell by this awesome service, E-star is just as renowned for their customer satisfaction as they are for their service. Entrust your car with them to get the best repair results.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the weather like in Philadelphia?

The weather clearly has a major impact on driving. Thus, we should take a look at some of these numbers that show what Philly’s weather is like.

| WEATHER TYPE | MEASUREMENTS |

|---|---|

| Annual high temperature: | 64.7°F |

| Annual low temperature: | 47°F |

| Average temperature: | 55.85°F |

| Average annual precipitation - rainfall: | 41.45 inch |

| Average annual snowfall: | 23 inch |

As you can see, Philadelphia is a bit on the colder side for its averages. The average high is only 64.7°F, and the average low is 47°F. The average total temperature was 55.85°F. As for precipitation, the average rainfall is 41.45 inches, and for snow, Philly gets 23 inches of snow.

Surprisingly, there are quite a few natural disasters that happen in Philadelphia. In fact, Philadelphia has more natural disasters (21) than the U.S. average (13). The following are the causes of natural disasters:

- Hurricanes: 6

- Winter Storms: 5

- Floods: 3

- Snowstorms: 3

- Tropical Storms: 3

- Storms: 2

- Blizzard: 1

- Snowfall: 1

- Tropical Depression: 1

- Water Shortage: 1

It’s important to note that some of these disaster types may be assigned to more than one category.

Is public transit available in Philadelphia?

Public transit is a major part of any major city, so let’s take a look at Philadelphia’s public transportation. In Philadelphia, public transportation is about as affordable as in other major cities in the United States.

If you want to take a quick trip on the subway, bus, or trolley, it costs $2.50 per ride. You can also purchase a weekly pass for $25.50, which allows you access to all forms of public transportation. You can also get a monthly pass for $96.00.

You can use these passes on any of Philadelphia’s public transportation systems, which include the following: Bus, Trolley, Trackless Trolley, Market Frankford Line, Broad Street/Broad Ridge Spur Line, and the Norristown High-Speed Line.

Are other alternate transportation options available in Philadelphia?

Lime, which is a dockless electric scooter that has growing popularity throughout the U.S., is still not legal in Philadelphia because electric scooters are not legal on Philadelphia’s streets. However, there have been closed-circuit events during which people can ride Lime Scooters. The spokesperson for Lime Bike is “cautiously optimistic” about them becoming legal.

Bird, another major electric scooter company, has spent $30,000 in lobbying in order to change Philadelphia’s law that bans electric scooters on streets.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is parking easy in Philadelphia?

If you want to park in the street in Philadelphia, it costs two dollars per hour to park on the street. Meter parking is also two dollars an hour, and meters accept coins and SmartCards as payment. The Philadelphia Parking Authority (PPA) has also been installing meter kiosks throughout the city, and these kiosks accept coins, bills, credit cards, and SmartCards. You can also use debit cards on these kiosks.

There are also mobile parking apps like Parkmobile, which tells you where parking is available in Philadelphia and how much it costs. You can also use PaybyPhone Parking, which lets you pay with your phone (so you don’t need cash), lets you know when your time is running low, and lets you pay remotely, so you don’t have to run back to the meter.

Philadelphia is an electric-car friendly city, with charging stations throughout the city. There are three levels of charging that you can use, and you can find the location and how many charging stations are in your state with a quick search.

If you want not to park on the street and use a parking garage, the cheapest parking garage option is with The Philadelphia Parking Authority (PPA). PPAs cost around $18.50 for 12 hours, or $20.50/day (24 hours), which isn’t bad for a major city. You’ll want to be prepared for what to do if your car gets hit in a parking lot.

If you want to do satellite parking at the Philadelphia Airport, it costs $4 for 30 minutes in the parking garages to $11 per day in the Economy Lot. If you need long-term parking, the terminal parking garage costs $24 per day, and the Economy Parking Lot charges $11 per day. There are also private off-site parking facilities that charge only $8 per day and provide shuttle service.

Because Philadelphia is a large, populated city, it is notoriously difficult to find parking in the City of Brotherly Love. However, if you do your research and follow some guidelines, you can actually find some free parking in Philadelphia. We’ve provided a link to a map of some affordable parking options in Philly here.

How is the air quality in Philadelphia?

It’s important to know about the air quality in Philadelphia. We’ll give you some info on the past three years. We’ve received this information from (and view it on) it on the EPA’s website.

For the past three years, the air quality was below the level of danger in most categories. However, for all three years, the Ozone levels were all in the red (dangerous). The numbers that indicate this are 0.079 for 2017, 0.084 for 2018, and 0.071 for 2019.

If an area is at .071 or higher, they are in violation. However, it’s good to see that there seems to have been a decrease in these numbers in the most recent year.

It’s without a doubt that Philly’s high population and use of many cars impact the ozone. Pollutants from cars react with nitrogen oxides in the presence of sunlight to form ground-level ozone, the main ingredient in smog.

These pollutants also form ground-level ozone and particulate matter. This is a harmful pollutant, too, and can cause lung irritation and weaken the body’s defenses against respiratory infections like pneumonia and influenza.

Military/Veterans

We know that veterans sacrificed an immense amount for our country, so we’d like to provide them with some information about the benefits they can receive regarding car insurance in this section.

We promise we’ll cover necessary information about veterans in Philly, and we’re going to cover some data about the troops who served and currently reside in Philadelphia, info about nearby military bases, and important info about military and veteran’s auto insurance discounts.

The largest number of veterans living in Philadelphia served in the Vietnam War, with 22,358 veterans having served in this war. The second-highest amount of veterans served in the Gulf War in this century (10,529). Lastly, the third-highest amount of veterans served in the Gulf War in the 90s (6,488).

The military bases that are closest to Philadelphia are the McGuire-Dix-Lakehurst Base, which hosts the 87th Air Base Wing, 305th Air Mobility Wing, USAF Expeditionary Center, and Carlisle Barracks Army Base.

The insurance companies below are the companies that give you a discount if you are a veteran in Philadelphia:

- Allstate

- Esurance

- Geico

- Liberty Mutual

- Metlife

- StateFarm

- The General

- USAA

Finally, we’re going to show you a table that shows the car insurance numbers in Philadelphia for veterans.

| COMPANY | DOLLAR AMOUNT | PERCENTAGE |

|---|---|---|

| Allstate | $3,984.12 | -1.25 |

| Geico | $2,605.22 | -35.43 |

| Liberty Mutual | $6,055.20 | 50.09 |

| Nationwide | $2,800.37 | -30.59 |

| Progressive | $4,451.00 | 10.32 |

| State Farm | $2,744.23 | -31.98 |

| Travelers | $7,842.47 | 94.39 |

| USAA | $1,793.37 | -55.55 |

As you can see, the three best companies for veterans are USAA, Geico, State Farm, and Nationwide. If you’re a veteran, get one of these companies to cover you for car insurance. For more information read our State Farm auto insurance review and our Geico auto insurance review.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Unique City Laws

We know that it’s tough to keep track of all the car-related laws in your city, so we’re going to show you all the necessary laws for driving in Philadelphia. In this section, we’re going to take a look at some driving laws in the city, hands-free laws, food truck laws, and other laws that are unique to the city of Philadelphia.

In Philadelphia, we have already stated that it’s illegal to ride electric scooters in the streets of Philadelphia. Philadelphia also practices no-fault insurance, which means insureds are indemnified for losses by their own insurance company, regardless of the fault in the incident that generates losses.

In Pennsylvania, it is illegal to text while driving, but you can still use your handheld phone for other purposes. However, in Philadelphia, it is illegal to use a handheld cellphone at all when driving.

Philadelphia is a big food city, so it’s no surprise that they have an abundance of food trucks. If you want to set up a food truck in Philadelphia, the city requires that you get many different types of permits. If you’re a food vendor in Philadelphia, you absolutely must be familiar with up-to-date health codes, and it is essential that you pass a food safety inspection.

If you really want to open a food truck and it’s your dream, you should definitely do it; however, it’s a very costly endeavor, so you have to save up for it.

Philadelphia is starting to build tiny houses, which is a great way to make more cost-efficient housing for residents. Proponents of a program that creates tine houses assert that “tiny house proposals are a way to increase the number of affordable units at a reduced cost,” and that “(it) is a viable option for keeping communities affordable as we continue to develop our neighborhoods.”

Now, let’s check out some laws about parking, shall we? There is not a lot of information about parking in the wrong direction in Philadelphia, but it is highly illegal to park improperly on a one-way and a two-way highway. If you do so, you will incur a $31 fine.

It is legal to reserve a parking spot if you use an app such as Spot Hero.

Philadelphia, PA Auto Insurance: The Bottom Line

On average, Philadelphians pay an average of $9,302 for car insurance premiums each year.

Of course, how much coverage you need and how much you will pay for it depends on personal factors, so it’s best to compare quotes.

To compare Philadephia, PA auto insurance rates make sure to enter your ZIP code in our free tool below. We’ll provide quotes from the best insurance companies near you.

Did we miss anything? Which part was most helpful for you? Please let us know. Hopefully, you know more about car insurance and driving in Philadelphia so you can be covered when you’re driving through the City of Brotherly Love.

Frequently Asked Questions

How can I buy cheap auto insurance in Philadelphia, PA in 2023?

To buy cheap auto insurance in Philadelphia, PA in 2023, you can consider the following steps:

- Compare quotes from multiple insurance providers: Obtain quotes from different insurance companies to find the most affordable option.

- Maintain a good driving record: Having a clean driving record with no accidents or traffic violations can help you secure lower insurance premiums.

- Opt for a higher deductible: Choosing a higher deductible means you’ll pay more out of pocket in the event of a claim, but it can lower your monthly premium.

- Bundle your insurance policies: If you have multiple insurance needs, such as auto and home insurance, bundling them with the same insurance company can often result in discounts.

- Explore available discounts: Ask insurance providers about any available discounts, such as safe driver discounts, multi-vehicle discounts, or discounts for completing driver’s education courses.

- Consider the type of car you drive: Certain cars are more expensive to insure due to factors such as their make, model, age, and safety features. Research insurance costs before purchasing a vehicle.

Are there any specific auto insurance providers in Philadelphia, PA that offer cheap rates in 2023?

While specific insurance providers offering cheap rates can vary, it’s recommended to obtain quotes from multiple insurers to find the most affordable option for your needs. Insurance rates can depend on various factors, including your driving record, the type of vehicle you own, and your location.

Can I qualify for any discounts to further reduce the cost of auto insurance in Philadelphia, PA?

Yes, many insurance providers offer discounts that can help reduce the cost of auto insurance. Common discounts include safe driver discounts, discounts for bundling multiple policies, discounts for completing defensive driving courses, and discounts for vehicles equipped with safety features. It’s recommended to inquire with insurance companies about the available discounts and whether you qualify for them.

Are there any government programs or initiatives in Philadelphia, PA that offer affordable auto insurance options?

While there are no specific government programs or initiatives in Philadelphia, PA that offer auto insurance, there may be programs aimed at assisting low-income individuals with their insurance needs. It’s advisable to check with local government agencies or non-profit organizations that may provide guidance or resources for affordable insurance options.

How does my credit score affect my auto insurance rates in Philadelphia, PA?

In many states, including Pennsylvania, insurance companies can consider an individual’s credit score when determining auto insurance rates. A lower credit score may result in higher insurance premiums, as insurers perceive individuals with lower credit scores as higher risk. It’s recommended to maintain good credit to potentially secure lower insurance rates.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.