Buying Full Coverage Auto Insurance: What You Need To Know in 2026

Full coverage auto insurance rates average at $1,477/yr, but GEICO costs significantly less at $983/yr.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura Gunn

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Insurance and Finance Writer

UPDATED: Aug 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Full coverage insurance rates average at $1,477 per year ($123/mo)

- Geico, State Farm, and USAA are the cheapest full coverage auto insurance companies

- Full coverage policies include liability, comprehensive, and collision coverage, but your state may also require uninsured/underinsured motorist insurance and personal injury protection

Full coverage auto insurance isn’t required by law but can offer better protection after an accident or collision. Policies include comprehensive and collision coverage on top of the minimum liability insurance you need to carry in most states.

Additional coverage means higher insurance rates, but it’s easy to find cheap full coverage auto insurance when you shop online.

The best car insurance for cheap full coverage is State Farm. USAA offers the lowest rates overall, but coverage is only available to military members and their families. Geico offers teens and young drivers the best prices, but you may find better rates with a local company.

This guide discusses where to find the best full coverage auto insurance companies by state and driving record. We explore full coverage rates by age and gender so you can find the best company for the kind of full coverage policy you need.

The Cheapest Full Coverage Auto Insurance

The cheapest companies for full coverage car insurance are USAA, Geico, and State Farm. USAA coverage is exclusively available to veterans, active military, and their immediate families, but Geico and State Farm are available to any driver.

Compare annual full coverage rates from the top 5 insurance companies in the table below:

Most car insurance companies sell full coverage insurance cheap at or below the national average, but only USAA and Geico offer average rates of less than $1,000/yr.

Read more: Buying Annual Auto Insurance: What You Need To Know

Overall Best Car Insurance for Full Coverage – State Farm

State Farm offers consistently low rates to drivers of all ages with more positive customer reviews and higher claims satisfaction than its main competitor, Geico. State Farm also has low quotes for high-risk drivers with multiple accidents. Check out our State Farm auto insurance review for more information.

Best Full Coverage Car Insurance for Young Drivers – Geico

Geico offers the best full coverage rates to drivers under 21, especially teen males who historically pay the most for car insurance. On average, 16-year-old males can save $3,000-$4,000 a year with Geico. Visit our Geico auto insurance review for more information.

Best Full Coverage Car Insurance for Claim Satisfaction – Farmers

Drivers are more satisfied with their claims experiences than ever, and Farmers Insurance scored higher on the J.D. Power Auto Claims Satisfaction Survey than other top 10 car insurance companies. USAA scored the highest, but coverage is limited. Farmers is available to all drivers in all 50 states. You can visit our Farmers auto insurance review to learn more.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare the Cheapest Full Coverage Car Insurance Rates

If you want to find the cheapest full coverage car insurance, start shopping online for auto quotes from multiple companies. Comparing insurance companies side-by-side is the only way to see which one actually offers the cheapest insurance for full coverage.

Start here with the average annual full coverage rates by age:

These rates are just averages; you could pay more (or less) depending on where you live and how much full coverage insurance you need.

For example, no-fault states require more insurance, which means more expensive rates. Check local laws and compare auto rates by state to find the most affordable coverage.

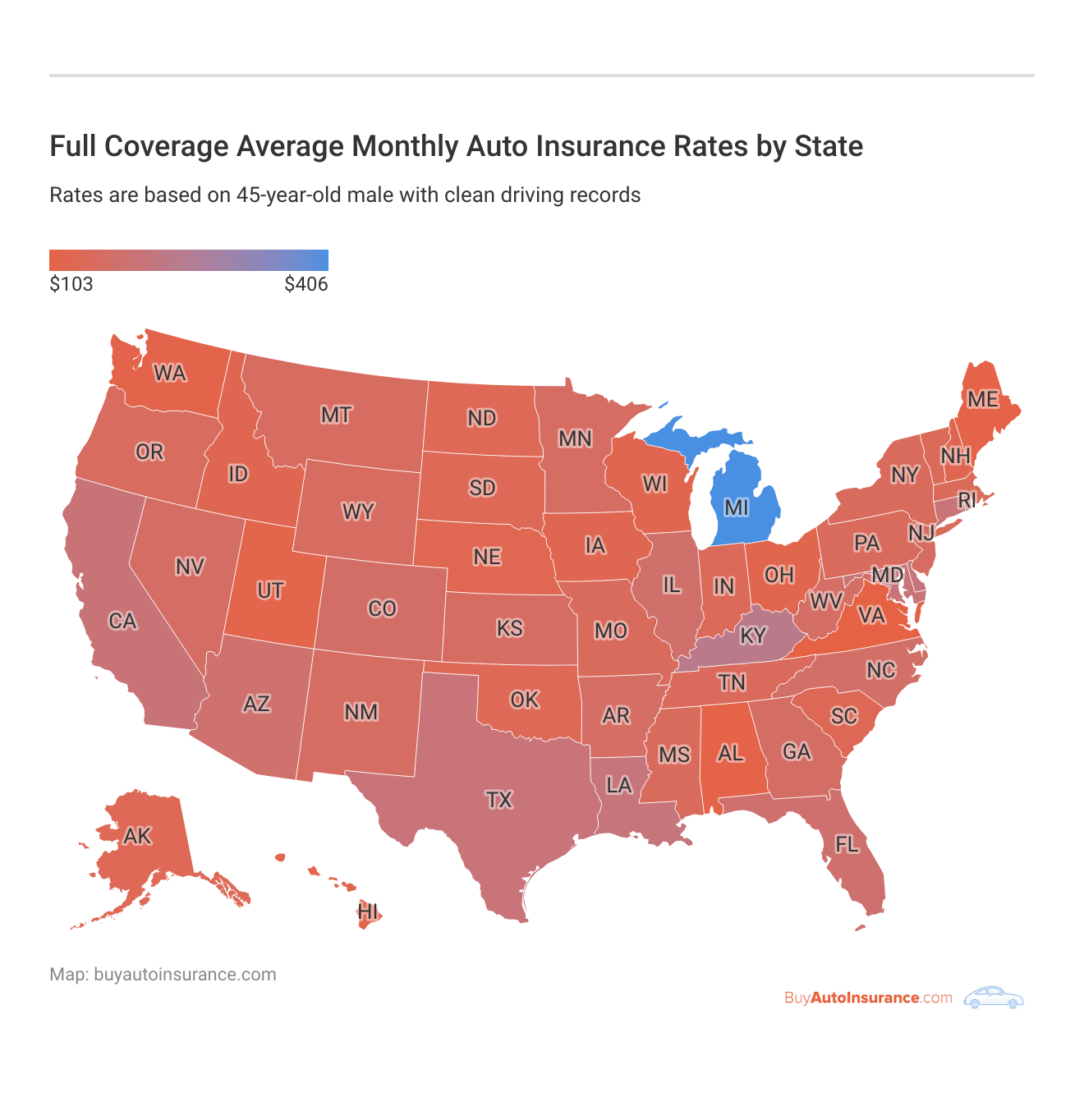

Cheapest Full Coverage Car Insurance by State

The minimum car insurance required in each state varies. State insurance laws impact how much you pay for car insurance, as do local traffic and auto theft rates. If you live in a densely-populated area with a lot of traffic, expect to pay more for car insurance than your suburban neighbors.

USAA and Geico offer the cheapest full coverage insurance in most states, including Michigan, which has the highest car insurance rates in the country.

Read more:

Cheapest Full Coverage Car Insurance for Teens

Age and gender play a major role in full coverage insurance costs, and male drivers under 21 pay the most for coverage. Geico and State Farm offer the lowest rates for auto insurance for teenage drivers, but you’ll still pay high-risk prices until you turn 25.

Teens pay the most for insurance due to inexperience, which may tempt you to buy less insurance coverage to save money. We don’t recommend it. (For more information, read our “Buy Cheap Auto Insurance for 18-Year-Olds“)

While most states only require minimum liability auto insurance, the policy will not protect you or your vehicle if you’re involved in an accident. Full coverage auto insurance for teens assures you’re financially covered for personal injuries, property damage, and liability costs every time you get behind the wheel.

Full Coverage Auto Insurance Rates Based on You Driving Record.

One of the best ways to save on your car insurance is to keep your driving record clean. Here’s a look at how much DUIs, accidents, and tickets can increase your car insurance rates.

As you can see, being a safe driver can help keep your auto insurance rates low.

Cheapest Full Coverage Car Insurance After a Ticket

Along with age, your driving record can also make you need high risk auto insurance. Speeding tickets will raise your full coverage insurance rates by as much as 25% with some companies.

State Farm and USAA won’t raise your rates nearly as high. Geico remains competitive for full coverage after a ticket, but it raises rates three times more than State Farm, USAA, and American Family.

Cheapest Full Coverage Car Insurance After an Accident

Insurance companies will automatically consider you high-risk if you have auto accidents in your claims history. One accident will raise your rates, and multiple accidents could cost your insurance coverage and driver’s license.

USAA and State Farm are the best companies for full coverage auto insurance after an accident. Both are insurance companies that accept drivers with multiple accidents and charge thousands less for annual full coverage.

What is a full coverage policy?

Full coverage auto insurance policies typically include three types of car insurance:

- Liability coverage

- Collision coverage

- Comprehensive coverage

It meets all the minimum insurance requirements needed in your state but provides additional coverage for your own injuries and property damage that go beyond liability only.

No-fault states require personal injury protection (PIP) as part of minimum insurance, and you will be required to carry this coverage with your full coverage policy. You can add other cheap insurance to full coverage, but your rates will still be higher than liability-only.

Liability Auto Insurance

Liability car insurance pays for damages you cause in an at-fault accident. This insurance policy will cover another driver’s injuries and property damage, but coverage does not extend to your injuries or personal property.

Collision Auto Insurance

Collision car insurance covers damage to your vehicle in an accident or collision. This part of your full coverage policy will apply whether you’re at fault for the accident or not. You must meet the deductible before your insurance company pays. Most collision deductibles average between $500 and $1,000.

Comprehensive Auto Insurance

Comprehensive car insurance covers situations that aren’t auto accidents, including collisions with animals, weather-related damages, and vandalism. Policies also come with glass damage coverage.

Before coverage applies, you must meet a deductible of $500-$1,000. Comprehensive coverage can also come with other limitations, so read your policy carefully to know when you’re covered.

Other Coverages Included with Full Coverage

Depending on where you live, state laws may require you to carry additional coverage. The most common coverages included with full coverage auto insurance are:

- Personal injury protection insurance (PIP). Covers medical bills, lost wages, and more if you’re injured or worse after an accident.

- Uninsured/Underinsured Motorist Bodily Injury (UMBI). Covers medical bills and pain and suffering costs for those injured in an accident where the at-fault driver was uninsured/underinsured or a hit-and-run accident.

- Uninsured/Underinsured Motorist Property Damage (UMPD). Covers repair costs for vehicles and other property damage in a hit-and-run or an accident caused by an uninsured/underinsured driver.

Remember, some or all of these coverages might be required if you live in a no-fault state. So check your local laws before you buy full coverage auto insurance to guarantee you have the right policies.

How to Find Cheap Full Coverage Car Insurance

You know which national auto insurance companies have the cheapest full coverage insurance, but how do you find cheap full coverage car insurance near you?

Start by getting free quotes and comparing auto insurance companies online. You’ll need some information upfront, so follow the steps below to get the most affordable full coverage car insurance:

- Determine your coverage limits. You must meet state minimums for liability and PIP and UMBI/UMPD minimums if required. Minimum auto insurance will get you the cheapest rates, but higher limits offer better protection in an accident.

- Raise your deductibles. Raising your collision or comprehensive car insurance deductibles to $1,000 or more will lower your monthly rates, but don’t go higher than you can afford out of pocket.

- Ask for discounts. Earning auto insurance discounts for safe driving, paying auto bills in full, and bundling policies will reduce your rates, so research which discounts you’re eligible to earn. Farmers Insurance offers the most discounts on full coverage.

- Shop around. You can start shopping around for free auto insurance quotes when you know how much coverage you need, what deductibles you can afford, and which discounts you qualify for.

Comparing auto insurance quotes online is a free and easy way to get affordable coverage and guarantee you aren’t overpaying for car insurance.

Compare Full Coverage Auto Insurance Companies Online

Getting car insurance quotes online is easy with our free comparison tool below. You just need your ZIP code, the make, and model of your vehicle, and answer a few questions about your insurance history.

We provide insurance quotes from multiple local companies so you can find cheap full coverage insurance no matter where you live.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Full Coverage Auto Insurance: The Bottom Line

Full coverage car insurance costs more than liability-only but provides financial protection for you and your vehicle in an accident or collision. It includes liability coverage as well as comprehensive and collision insurance.

You’ll pay higher rates for full coverage insurance, but State Farm and Geico consistently offer competitive rates to drivers. USAA has the cheapest rates, but coverage is limited to military members and their families.

You’ll find the cheapest full coverage auto insurance when you shop around and compare local insurance quotes against these top companies. Then, determine how much coverage you need and adjust your deductibles to get the best rates on full coverage car insurance.

Frequently Asked Questions

What does full coverage car insurance cover?

Full coverage auto insurance covers bodily liability, property damage liability, collisions, and comprehensive damages caused by weather, fire, or vandalism. It meets the minimum insurance required by law while providing additional coverage for your injuries and personal property damage.

Do I need full coverage on a financed car?

Yes, lessors generally require full coverage insurance until the loan is paid in full. After you make your final payment and own the vehicle outright, you can drop any coverage you don’t want or need. (read our “Buying No-Down-Payment Auto Insurance: What You Need To Know” for more information.)

Does full coverage car insurance replace your car?

Full coverage insurance will not replace your car with a new vehicle. It covers your vehicle’s actual cash value (ACV) when it’s totaled in an accident. This means the insurance company will write you a check for the current value of your car, not the amount you paid for it.

What’s the average cost of Full Coverage Auto Insurance?

Full coverage car insurance rates average $123/mo ($1,477/yr). Your full coverage quotes will be more expensive if you have accidents in your claims history.

Is Full Coverage Auto Insurance mandatory?

No state requires full coverage car insurance, but the policy might be mandatory if you have an auto loan or lease your vehicle. Check your loan or lease agreement to ensure you don’t need full coverage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura Gunn

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Insurance and Finance Writer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.