10 Cheap Auto Insurance Companies That Don’t Monitor Your Driving in 2025

Nationwide, Farmers, and Geico are the top cheap auto insurance companies that don’t monitor your driving, with rates beginning at just $60 monthly. These providers offer competitive rates and privacy, ensuring no tracking of driving habits, ideal for those seeking discretion and affordability.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: May 31, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 31, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,072 reviews

3,072 reviewsCompany Facts

Min. Coverage for Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe top picks among cheap auto insurance companies that don’t monitor your driving are Nationwide, Farmers, and Geico.

These companies stand out for their commitment to privacy and competitive pricing without relying on usage-based insurance programs.

Our Top 10 Picks: Cheap Auto Insurance Companies That Don't Monitor Your Driving Data

Company Rank Multi-Policy Discount Monthly Rates Best For Jump to Pros/Cons

#1 25% $60 Affordable coverage Nationwide

#2 24% $61 Comprehensive discounts Farmers

#3 22% $62 Competitive rates Geico

#4 20% $64 Customizable policies Progressive

#5 18% $66 Military rates USAA

#6 16% $69 Robust coverage State Farm

#7 14% $71 Flexible policies Liberty Mutual

#8 12% $74 Coverage variety Allstate

#9 11% $78 Competitive pricing Travelers

#10 10% $81 Affordable discounts American Family

Opting for these insurers means you won’t have to compromise on cost or your personal data security. Such choices are particularly valuable for drivers who prioritize both budget and privacy in their auto insurance needs.

- Nationwide is the top pick for non-monitoring auto insurance

- Ideal for drivers valuing privacy over tracking discounts

- Suited for straightforward, surveillance-free insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

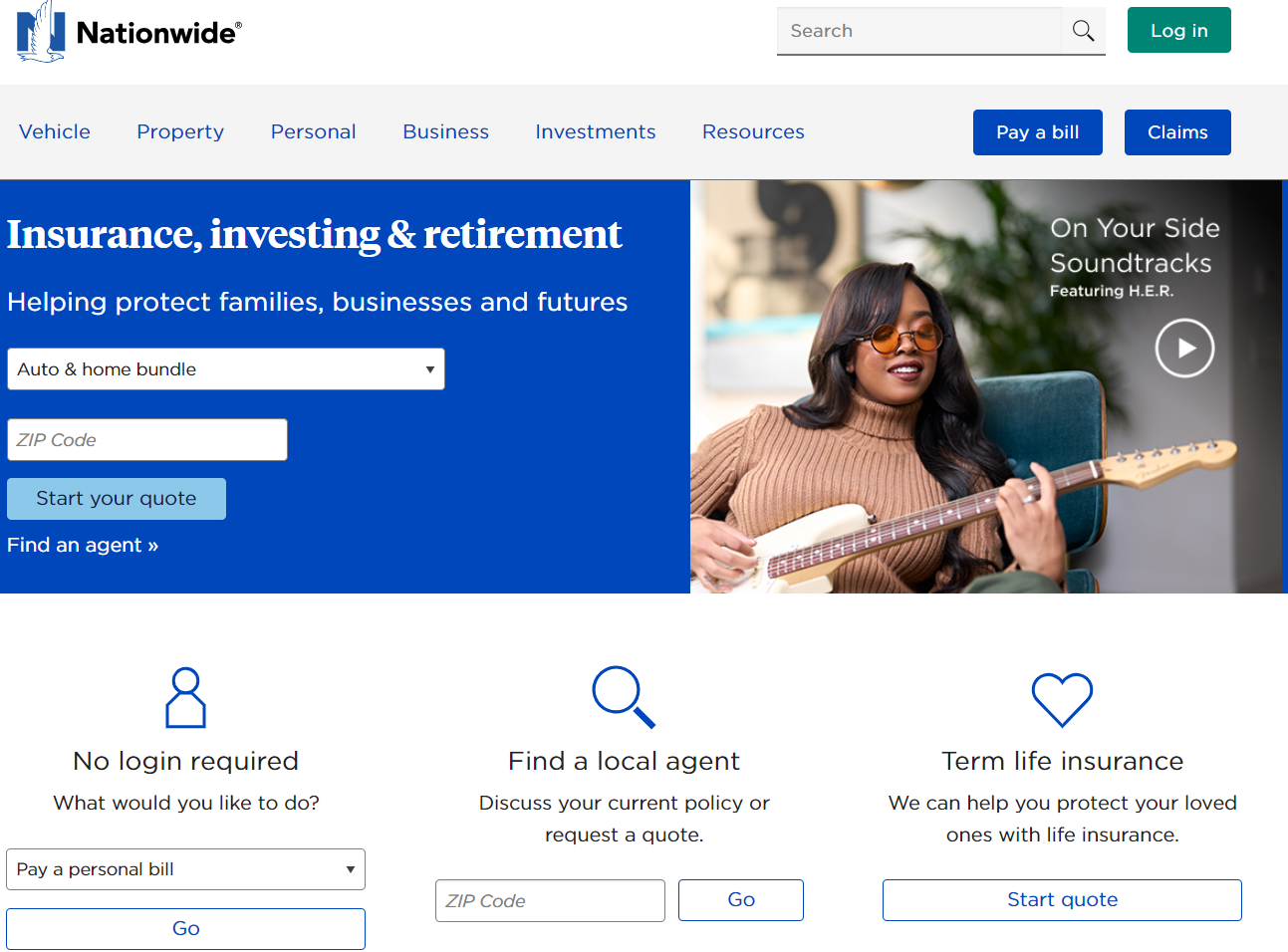

#1 – Nationwide: Top Overall Pick

Pros

- High Multi-Policy Discount: Nationwide offers a 25% discount for bundling multiple insurance policies.

- Low Starting Rates: Monthly premiums start at just $60, making it highly affordable. Discover insights in our Nationwide auto insurance review.

- Broad Coverage Options: Nationwide provides a wide range of coverage options to meet diverse needs.

Cons

- Variable Discounts: Discounts can vary significantly based on the policyholder’s details and location.

- Customer Service Variability: Service quality may differ regionally, affecting customer satisfaction.

#2 – Farmers Insurance: Best for Comprehensive Discounts

Pros

- Competitive Multi-Policy Discount: Farmers provides a 24% discount for multiple insurance policies.

- Extensive Coverage Offerings: Farmers offers extensive coverage options that cater to a wide range of needs.

- Specialized Policies Available: Unique insurance options for specific requirements are available. Unlock details in our Farmers auto insurance review.

Cons

- Slightly Higher Rates: Monthly rates start at $61, which can be higher compared to some competitors.

- Complex Policy Options: The range of options can be overwhelming and confusing for some customers.

#3 – Geico: Best for Competitive Rates

Pros

- Affordable Pricing: Geico’s rates are competitive, with monthly premiums starting at $62.

- Efficient Claim Processing: Known for quick and efficient handling of claims. Delve into our evaluation of Geico auto insurance review.

- Strong Financial Stability: Geico has a robust financial background, ensuring reliability.

Cons

- Limited Personalization: Fewer options for tailoring policies to individual needs.

- Customer Service Issues: Some customers report inconsistent service experiences.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – Progressive: Best for Customizable Policies

Pros

- Tailored Policy Options: Progressive offers highly customizable policies to suit various needs.

- Dynamic Pricing Models: Innovative pricing models that can benefit safe drivers.

- Strong Online Presence: Excellent digital tools for managing policies and claims. Access comprehensive insights into our Progressive auto insurance review.

Cons

- Higher Base Rates: Starting at $64, their rates can be higher than some competitors.

- Complexity in Discounts: Discounts and savings are highly dependent on specific qualifications and behaviors.

#5 – USAA: Best for Military Rates

Pros

- Exclusive Military Benefits: Specialized rates and discounts for military members and their families.

- Exceptional Customer Loyalty: High customer satisfaction and loyalty among military families. Discover more about offerings in our USAA SafePilot review.

- Comprehensive Coverage: Broad coverage options that cater to the unique needs of military personnel.

Cons

- Limited Eligibility: Services are only available to military members, veterans, and their families.

- Less Competitive for Non-Military: Non-military individuals cannot access these benefits and rates.

#6 – State Farm: Best for Robust Coverage

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage.

- Wide Coverage: State Farm offers various coverage options tailored for different business needs. Check out insurance savings in our complete State Farm auto insurance review.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Flexible Policies

Pros

- Adaptable Coverage Options: Liberty Mutual offers flexibility in policy adjustments to meet individual needs.

- Diverse Discount Opportunities: A range of discounts is available, enhancing affordability.

- Strong Support Network: Extensive customer support options are available nationwide. Read up on the Liberty Mutual auto insurance review for more information.

Cons

- Higher Starting Rates: Starting rates are at $71, which may be higher than some competitors.

- Policy Complexity: The wide array of options can sometimes complicate the selection process.

#8 – Allstate: Best for Coverage Variety

Pros

- Wide Range of Coverage Types: Allstate offers a diverse array of insurance products. More information is available about this provider in our Allstate Milewise review.

- Multiple Discount Options: Various discounts are available that can reduce premiums significantly.

- Strong Local Agent Network: Extensive network of local agents providing personalized service.

Cons

- Higher Premiums: Base monthly rates start at $74, which are higher than many competitors.

- Inconsistencies in Service: Service quality can vary significantly depending on the region and agent.

#9 – Travelers Insurance: Best for Competitive Pricing

Pros

- Competitive Pricing Models: Travelers offers competitive pricing with rates starting at $78.

- Comprehensive Protection: Provides a broad spectrum of insurance coverages. See more details on our Travelers auto insurance review.

- Innovative Risk Management Solutions: Offers advanced solutions for risk assessment and management.

Cons

- Higher Base Rates: Their rates start higher compared to some key competitors.

- Complex Discount Structures: Navigating the discounts and offers can be challenging for new customers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#10 – American Family Insurance: Best for Affordable Discounts

Pros

- Aggressive Pricing: Competitive rates with significant car insurance discounts, starting at $81.

- Customizable Coverage Options: Offers tailored policies to meet diverse insurance needs.

- Strong Customer Engagement: Notable for proactive customer service and engagement.

Cons

- Niche Market Focus: Primarily serves a specific market, which might not appeal to all consumers.

- Limited Availability: Services and coverage options are not available in all states.

Monthly Auto Insurance Rates: Minimum vs. Full Coverage Comparison

The table below presents a detailed breakdown of monthly rates for auto insurance providers that do not monitor driving habits, categorized by minimum and full coverage levels.

Auto Insurance That Don't Monitor Your Driving: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $74 $140

American Family $81 $145

Farmers $61 $124

Geico $62 $126

Liberty Mutual $71 $137

Nationwide $60 $120

Progressive $64 $129

State Farm $69 $133

Travelers $78 $142

USAA $66 $132

The data shows Nationwide offering the most affordable minimum coverage at $60, closely followed by Farmers at $61 and Geico at $62. See more details on our “Minimum Auto Insurance Required by State.”

For full coverage, Nationwide remains the least expensive at $120, with Farmers and Geico slightly higher at $124 and $126, respectively. On the higher end, American Family and Travelers present the priciest options for full coverage, at $145 and $142 monthly.

This range demonstrates the variation in costs depending on the provider and the extent of coverage, highlighting important considerations for consumers seeking both privacy and financial efficiency in their auto insurance choices.

Do All Car Insurance Companies Monitor Your Driving

Many insurance providers, especially the big names in car insurance, offer usage-based insurance options, or telemetrics-based car insurance, as a way for policyholders to save money when they drive safely.

The table below shows insurance companies and whether they offer a UBI plan to policyholders.

Usage-Based Auto Insurance Discounts by Provider

Insurance Company Discount Percentage

21st Century NA

AAA NA

Allstate 20%

American Family 40%

Ameriprise NA

Amica NA

Country Financial NA

Esurance 25%

Farmers NA

Geico NA

Liberty Mutual 30%

MetLife 15%

Nationwide 40%

Progressive 20%

Safe Auto N/A

Safeco NA

State Farm 50%

The General NA

The Hanover NA

The Hartford 10%

Travelers 30%

USAA 5%

While some UBI programs, like State Farm’s Drive Safe & Save, allow policyholders to save as much as 50% on coverage, you could be sacrificing your privacy and lower rates depending on the nature of your driving.

Still, no insurance company is allowed to monitor your driving without your expressed consent. So if you’re worried about your insurance company knowing how far or how fast you drive, that information won’t be available to them unless you sign up for UBI.

Telemetrics-based car insurance typically monitors the distance you drive and how you operate your car concerning speed, stopping and starting, and more. Your insurance company may offer you a device that you insert into your vehicle, or the company may track you using a UBI app.

According to NAIC, UBI is often powered by in-vehicle telematics technology that is self-installed using a plug-in device or already integrated into original equipment by car manufacturers. You should know more about the specifics if you are interested in participating in a UBI program with your insurance company. Learning more about UBI options will help ensure you would benefit from the program before enrolling.

Read more:

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of Usage-Based Insurance

UBI programs with insurance companies offer some positives and negatives. Depending on your unique situation, you could land in either camp regarding whether a UBI insurance plan would work for you.

The table below highlights some significant benefits and drawbacks of a telemetrics-based insurance plan.

Pros and Cons of Usage-Based Auto Insurance

Pros Cons

Good drivers can get cheaper rates due to safe driving habits. If you have a longer commute and are a safe driver, you may not be eligible for lower rates.

Usage-based plans partially justifies auto insurers pricing quotes based on non-driving factors. Driving at night could put you at risk for higher-than-expected insurance rates.

You may be encouraged to use your car less, helping the environment and reducing the likelihood of a collision. Insurance companies can track your location and your usual routes in terms of commutes.

While the benefits could include cheaper car insurance rates and eco-friendly commute options, the drawbacks may include higher rates and a lack of privacy.

How to Do Usage-Based Insurance Plans Impact Insurance Claims

While a UBI has benefits and drawbacks, allowing an insurance provider to monitor and retrieve data related to your driving habits could have severe risks regarding collisions and naming the at-fault driver. Unlock details in our “Buying Collision Auto Insurance Coverage.”

If you are involved in a car accident, your car insurance provider might utilize data from your car insurance monitoring device to assess your role in the incident. This information could lead to you being held partially or fully accountable for the crash.

As a result, drivers who are found to have influenced the accident might face increased premiums and a greater portion of the blame. This process is part of how can insurance companies track your vehicle and evaluate claims.

If relevant, auto insurance companies might distribute data concerning your driving and any incidents to other insurers. In such cases, using an insurance driving monitoring device might lead to higher out-of-pocket costs for accidents, regardless of whether law enforcement officials deem you at fault or not.

Do Usage-Based Programs Get Good Reviews

If you’re considering taking part in a UBI program, you may want to read some reviews that other policyholders have posted online. Car insurance tracking device reviews can be negative and often cite that insurance companies use a driver’s specific commute data and personal information to force them to pay higher rates for coverage.

Nationwide leads the pack with unbeatable rates and a commitment to privacy that sets the industry standard.

Daniel Walker Licensed Insurance Agent

UBI plans only help around 45% of participants save money on insurance premiums, with the rest paying the same rates or higher rates for the same coverage. Additionally, while most participants state they are satisfied with their UBI program, the majority of UBI participants also say they do not know whether they have experienced much of a benefit from switching to a telemetrics option.

Learn more: Auto Insurance Coverage Types: What You Need To Know

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Bottom Line: Car Insurance Companies That Monitor Your Driving

You may want to steer clear altogether if you’re on the fence about participating in a UBI plan. While there’s a chance you could pay lower rates, there’s also a chance you could pay higher rates and be penalized for accidents that would otherwise not be considered your fault.

Big-name insurance companies may be able to offer you as much as 50% off your insurance premium, but this will likely only apply if you drive infrequently and are incredibly conservative behind the wheel. Discover insights in our “Best Auto Insurance Companies.”

You may be able to get cheaper car insurance in other ways, like asking your insurance provider if you’re eligible for any discounts on coverage. Another great way to save on auto insurance rates is to shop online and compare quotes from multiple providers.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

What is meant by “monitoring your driving” in auto insurance?

“Monitoring your driving” refers to the practice of using telematics devices or smartphone apps to track and assess your driving habits, such as speed, acceleration, braking patterns, and overall driving behavior.

For additional details, explore our comprehensive resource titled “The Best Auto Insurance Mobile Apps.”

Why would someone prefer auto insurance companies that don’t monitor their driving?

There are several reasons why someone might prefer auto insurance companies that don’t monitor their driving, including concerns about privacy, reluctance to share personal driving data, or the desire to avoid potential premium increases based on driving habits.

Are there auto insurance companies that don’t monitor your driving?

Yes, there are auto insurance companies that don’t monitor your driving habits. However, availability may vary depending on your location and the specific insurance market in your area.

Will I get cheaper rates with auto insurance companies that don’t monitor my driving?

It’s possible to find affordable rates with auto insurance companies that don’t monitor your driving. However, insurance premiums are determined by various factors, and while driving monitoring is not a factor with these companies, other criteria may still affect your rates.

Are there any disadvantages to choosing auto insurance companies that don’t monitor driving habits?

While auto insurance companies that don’t monitor your driving habits can offer privacy and potentially avoid rate increases based on driving behavior, there may be some disadvantages. These could include limited access to potential discounts based on safe driving habits or the lack of personalized premium adjustments based on individual driving performance.

To find out more, explore our guide titled “Safe Driver Auto Insurance Discount.”

How does a car insurance monitoring device affect my premiums?

A car insurance monitoring device can affect premiums by potentially lowering them if the data shows safe driving behaviors, but may also raise privacy concerns.

What is car insurance without a tracker?

Car insurance without a tracker offers coverage without the need to install a device that monitors driving behavior, allowing for greater privacy.

What are the pros and cons of using an auto insurance tracking device?

Pros of an auto insurance tracking device include potential discounts for safe driving; cons include privacy concerns and the possibility of higher rates for poor driving habits.

Can I remove a car insurance driving monitor if I change my mind?

Yes, you can usually remove a car insurance driving monitor, but it may affect your premiums or benefits that come with the program.

To learn more, explore our comprehensive resource on “How To Switch Auto Insurance Companies.”

What data does a car insurance monitoring device collect?

A car insurance monitoring device typically collects data such as speed, braking force, time of day driven, and sometimes location to assess driving habits.

What should I consider before agreeing to use an insurance driving monitoring device?

Before using an insurance driving monitoring device, consider how it will impact your privacy, what data it collects, how that data is used, and the potential changes to your insurance rates based on the collected data.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

What is an auto insurance monitoring device?

An auto insurance monitoring device is a tool that tracks driving behavior such as speed, acceleration, and braking, which insurers use to assess risk and potentially adjust premiums.

How does an auto insurance tracking device work?

An auto insurance tracking device is installed in a vehicle to collect data on driving habits and patterns, which is then transmitted to the insurer for analysis.

Learn more by reading our guide titled “Shopping for Auto Insurance.”

Can insurance companies track your car?

Yes, insurance companies can track your car if you agree to install a tracking device or use an app that allows monitoring as part of a policy agreement.

What is a car insurance device?

A car insurance device, often referred to as a telematics device, is a piece of hardware installed in your vehicle to monitor driving behaviors for insurance purposes.

What is car insurance without tracker?

Car insurance without a tracker provides coverage without requiring the installation of any devices to monitor driving habits, offering more privacy.

What is an insurance app that tracks your driving?

An insurance app that tracks your driving is a smartphone application used by insurance companies to gather data on your driving behavior, which can influence your insurance rates.

Access comprehensive insights into our guide titled “How much does auto insurance cost?“

How do insurance companies monitor driving?

Insurance companies monitor driving through devices installed in vehicles or smartphone apps that record driving behavior and transmit this data back to them.

What is an insurance monitoring device?

An insurance monitoring device is a gadget used by insurance companies to track driving behaviors such as speed, distance traveled, and time of day, which helps in risk assessment and pricing policies.

What are the risks of using car insurance tracking devices?

Risks of using car insurance tracking devices include potential privacy concerns, the possibility of higher premiums based on adverse driving data, and reliance on technology that may have errors or inaccuracies.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.