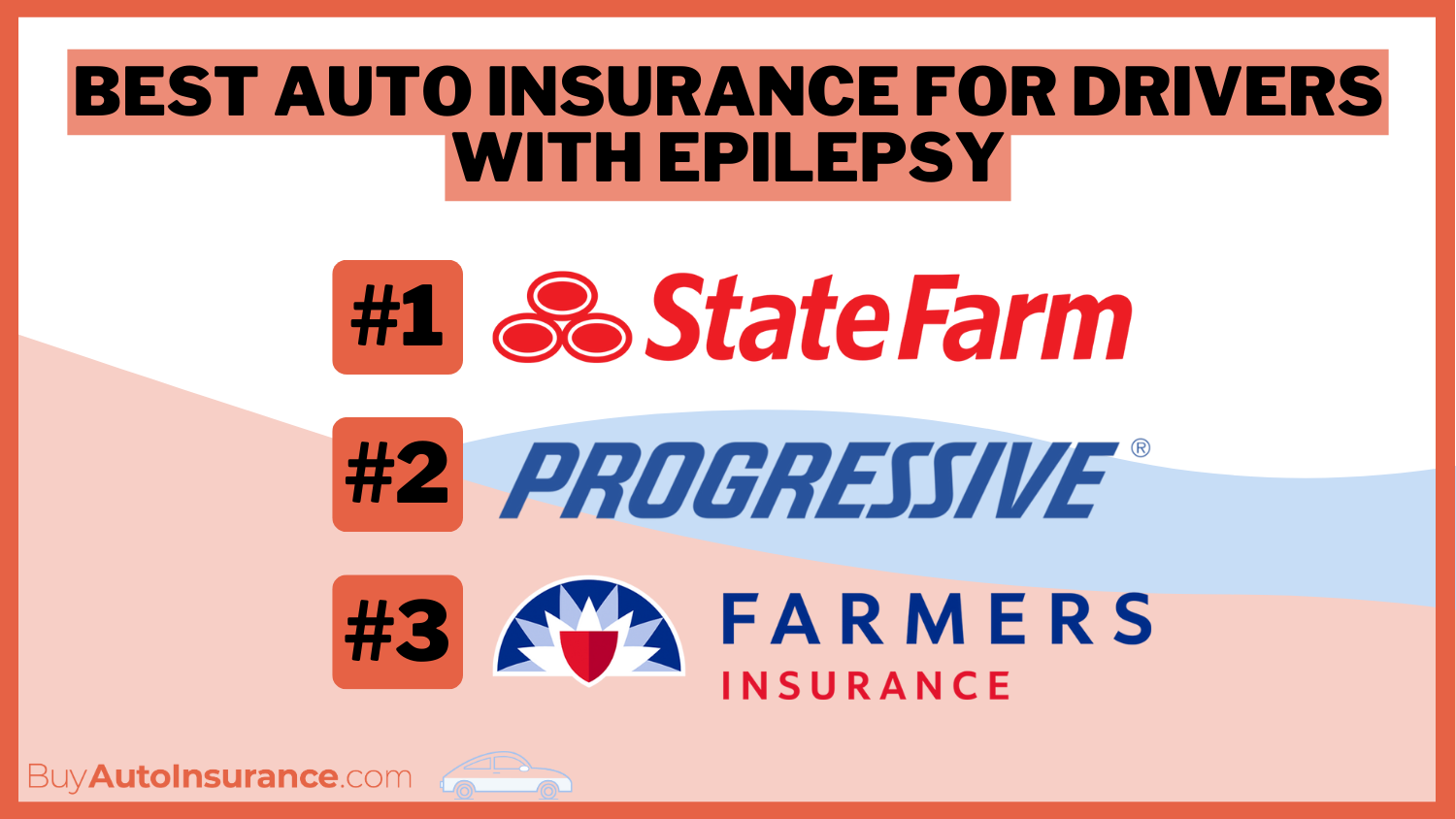

Best Auto Insurance for Drivers With Epilepsy in 2025 (Check Out the Top 10 Companies)

State Farm, Progressive, and Farmers offer the best auto insurance for drivers with epilepsy, starting at $80 per month. These companies provide comprehensive coverage options, understanding the unique needs of drivers with epilepsy, ensuring affordable and reliable protection tailored to your health condition.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cynthia Lanctot

Licensed Agent

Cynthia Lanctot is an insurance professional with ten years of industry experience. Cynthia is licensed in several states, and holds an associate in claims law, as well as a bachelor’s degree in English. Cynthia’s experience includes the New England and Northeast states. She currently works as a liability claims professional and an occasional online contributor.

Licensed Agent

UPDATED: Jul 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Drivers With Epilepsy

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Drivers With Epilepsy

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsThe top pick overall for the best auto insurance for drivers with epilepsy are State Farm, Progressive, and Farmers, offering rates starting at $80 per month. These companies provide comprehensive coverage tailored to the unique needs of drivers with epilepsy, ensuring affordable and reliable protection.

State Farm stands out for its overall excellence, while Progressive and Farmers excel in online convenience and local agent availability, respectively.

Our Top 10 Company Picks: Best Auto Insurance for Drivers With Epilepsy

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | B | Many Discounts | State Farm | |

| #2 | 15% | A+ | Online Convenience | Progressive | |

| #3 | 10% | A | Local Agents | Farmers | |

| #4 | 15% | A++ | Cheap Rates | Geico | |

| #5 | 15% | A++ | Customizable Polices | Liberty Mutual |

| #6 | 10% | A+ | Add-on Coverages | Allstate | |

| #7 | 13% | A | Local Agents | AAA |

| #8 | 15% | A+ | Usage Discount | Nationwide |

| #9 | 12% | A++ | Accident Forgiveness | Travelers | |

| #10 | 10% | A++ | Military Savings | USAA |

Explore these options to find the best full coverage auto insurance suited to your health condition and driving history.

- State Farm offers the best auto insurance for drivers with epilepsy

- These companies ensure maximum protection and peace of mind

- Coverage options help mitigate risks and costs with seizures while driving

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage.

- Wide Coverage: State Farm offers various coverage options tailored for different business needs. Check out insurance savings in our complete State Farm auto insurance review.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

#2 – Progressive: Best for Online Convenience

Pros

- User-Friendly Online Tools: Progressive provides excellent online tools for easy policy management and quote comparisons.

- Snapshot Program: Offers a usage-based discount program that can lower premiums based on driving habits. Access comprehensive insights into our Progressive auto insurance review.

- Extensive Discounts: Progressive offers numerous discounts, including multi-policy, homeowner, and continuous insurance discounts.

Cons

- Customer Service: Some users report that Progressive’s customer service can be less personalized compared to local agents.

- Rate Increases: Rates may increase significantly after an accident or claim.

#3 – Farmers Insurance: Best for Local Agents

Pros

- Local Agent Support: Farmers provides personalized service through local agents who understand community needs.

- Claims Service: Farmers is known for its efficient and supportive claims process. Unlock details in our Farmers auto insurance review.

- Customizable Policies: Offers a wide range of add-ons and coverage options to tailor policies.

Cons

- Higher Rates: Premiums may be higher compared to some other national insurers.

- Limited Online Tools: Online policy management tools are not as advanced as some competitors.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – Geico: Best for Affordable Rates

Pros

- Competitive Rates: Geico is known for offering some of the lowest rates in the industry.

- Easy Online Quote System: Provides a quick and efficient online quote and policy management system.

- Strong Customer Satisfaction: High ratings for customer satisfaction and service. Delve into our evaluation of Geico auto insurance review.

Cons

- Limited Local Agents: Primarily online, with fewer local agents available for personalized service.

- Coverage Options: May have fewer customizable options compared to other insurers.

#5 – Liberty Mutual: Best for Customizable Policies

Pros

- Flexible Coverage: Liberty Mutual offers highly customizable policy options. Read up on the Liberty Mutual auto insurance review for more information.

- Discounts: Provides numerous discounts, including for bundling, safe driving, and new vehicle purchases.

- Accident Forgiveness: Offers accident forgiveness to prevent premium increases after the first accident.

Cons

- Higher Premiums: Customization options can lead to higher premiums.

- Mixed Customer Reviews: Some customers report inconsistent service experiences.

#6 – Allstate: Best for Add-On Coverages

Pros

- Comprehensive Add-Ons: Offers a wide range of add-on coverages such as roadside assistance and rental reimbursement.

- Local Agent Network: Strong network of local agents providing personalized service. More information is available about this provider in our Allstate Milewise review.

- Drivewise Program: Usage-based insurance program that rewards safe driving habits.

Cons

- Premium Costs: Generally higher premiums compared to some other insurers.

- Rate Increases: Rates can increase significantly after an accident.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – AAA: Best for Local Agents

Pros

- Strong Local Presence: Known for excellent local agent support and personalized service.

- Membership Benefits: Offers additional benefits through AAA membership, including travel discounts and roadside assistance.

- Multi-Policy Discounts: Provides good discounts for bundling multiple policies. For more information, read our guide titled “AAA Rental Car Insurance Review: How good is the coverage?“

Cons

- Membership Requirement: Insurance is often tied to AAA membership, which includes an annual fee.

- Higher Rates: Premiums may be higher compared to some direct insurers.

#8 – Nationwide: Best for Usage Discount

Pros

- Vanishing Deductible: Offers a vanishing deductible program that rewards safe driving.

- SmartRide Program: Usage-based discount program that can lower premiums based on driving behavior.

- Wide Coverage Options: Provides a variety of coverage options and endorsements. Discover insights in our Nationwide auto insurance review.

Cons

- Online Tools: Some users find the online tools less intuitive compared to other insurers.

- Premium Costs: May have higher premiums for certain coverage levels.

#9 – Travelers Insurance: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Provides accident forgiveness to prevent rate increases after the first accident.

- Intellidrive Program: Usage-based insurance program that rewards safe driving habits. See more details on our Travelers auto insurance review.

- Wide Range of Discounts: Offers numerous discounts, including multi-policy, safe driver, and new car discounts.

Cons

- Mixed Customer Service Reviews: Some customers report inconsistent customer service experiences.

- Higher Premiums: Can have higher premiums compared to some other insurers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#10 – USAA: Best for Military Savings

Pros

- Exclusive Military Benefits: Provides exclusive benefits and discounts for military members and their families. Discover more about offerings in our USAA SafePilot review.

- High Customer Satisfaction: Consistently high ratings for customer satisfaction and service.

- Comprehensive Coverage Options: Offers a wide range of coverage options and add-ons.

Cons

- Membership Limitation: Only available to military members, veterans, and their families.

- Premium Costs: Premiums may be higher for non-military specific policies.

Understanding for Auto Insurance for Drivers With Epilepsy

When applying for car insurance, it is essential to declare any medical conditions to your insurance provider. Failing to disclose epilepsy can lead to policy invalidation if an accident occurs and the insurer discovers the condition later. Finding car insurance for people with epilepsy can be challenging, but major companies like State Farm, Progressive, and Farmers offer specialized policies tailored to the unique needs of these drivers.

When considering car insurance and epilepsy, it’s crucial to compare quotes from different providers, as insurers take various factors into account, including driving history and seizure frequency, which can affect premiums. Epilepsy and car insurance are closely linked, and while having epilepsy might not automatically increase rates, a history of seizures and related accidents can impact premiums.

Securing car insurance with epilepsy involves finding a provider that offers comprehensive coverage at an affordable rate. Full coverage is often recommended due to the increased risk of accidents from seizures. Epilepsy car insurance coverage should include comprehensive and collision coverage to protect against potential accidents caused by seizures.

Some insurers specialize in epilepsy-friendly car insurance, offering policies designed to meet the unique needs of drivers with epilepsy, including additional support and considerations for managing the condition while driving. By understanding these aspects of epilepsy and driving insurance, drivers with epilepsy can find suitable coverage that provides peace of mind on the road.

Cost of Auto Insurance for Drivers With Epilepsy

The cost of auto insurance for drivers with epilepsy varies by coverage level and provider. Minimum coverage rates range from $80 with State Farm to $101 with USAA. Full coverage rates range from $160 with Farmers to $205 with Liberty Mutual. These variations highlight the importance of comparing quotes to find the best deal.

Auto Insurance for Drivers With Epilepsy: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $83 | $182 |

| Allstate | $90 | $177 |

| Farmers | $88 | $160 |

| Geico | $92 | $196 |

| Liberty Mutual | $98 | $205 |

| Nationwide | $87 | $197 |

| Progressive | $100 | $194 |

| State Farm | $80 | $185 |

| Travelers | $96 | $202 |

| USAA | $101 | $201 |

Full coverage is recommended for drivers with epilepsy due to the higher risk of accidents from seizures. State Farm offers the lowest rates for both minimum and full coverage at $80 and $185 per month, respectively. See more details on our “Minimum Auto Insurance Required by State.”

Farmers provides a competitive full coverage rate of $160, making it a cost-effective option. Balancing cost with coverage is crucial for drivers with epilepsy to ensure adequate protection without overspending.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

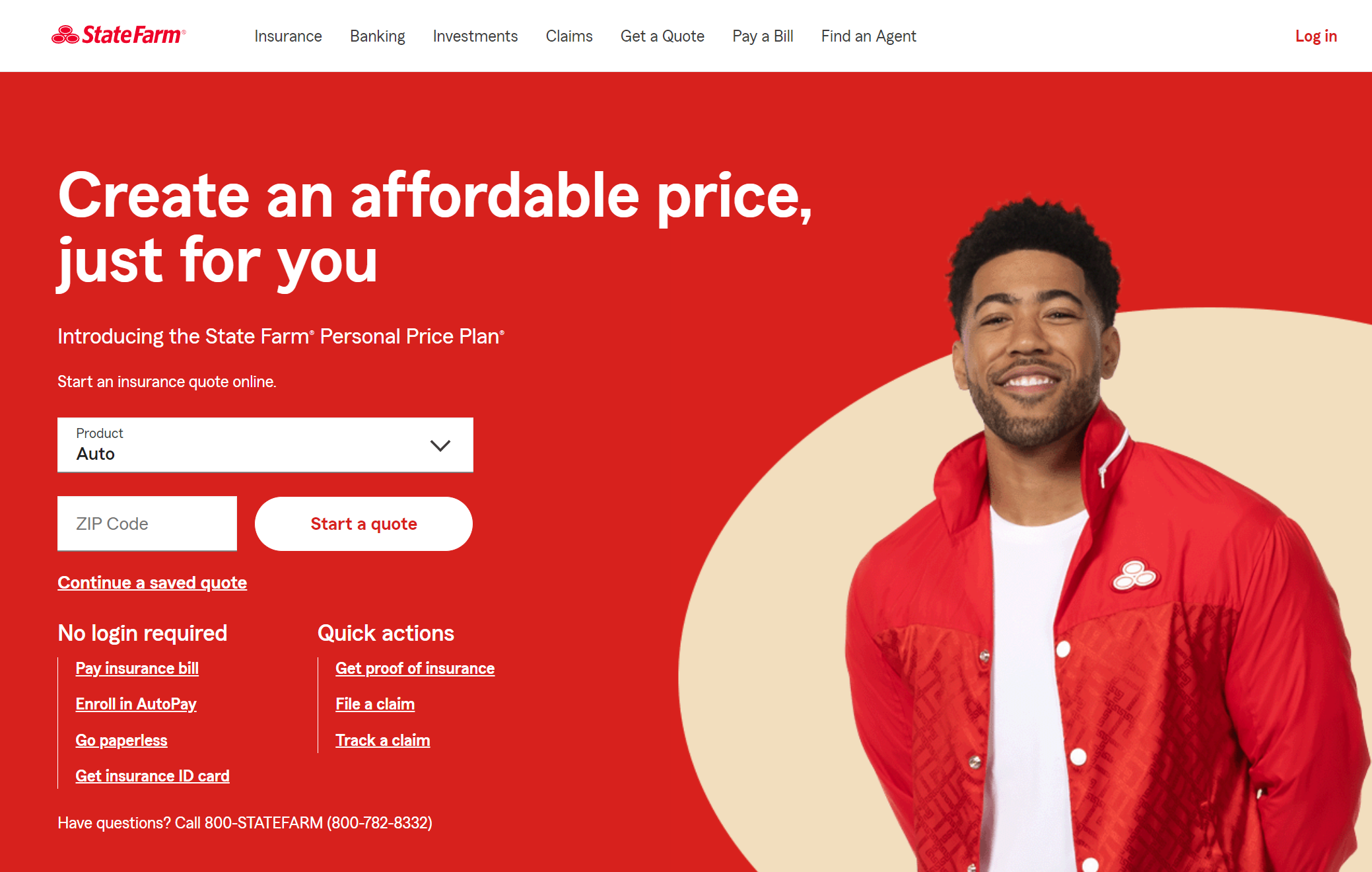

Obtaining Online Quotes for Auto Insurance for Drivers With Epilepsy

Obtaining online quotes for auto insurance is a convenient and efficient way for drivers with epilepsy to find the best coverage options tailored to their needs. Most major insurance providers, including State Farm, Progressive, and Farmers, offer online quote tools that allow users to input their personal and medical information to receive accurate quotes (Read more: State Farm’s Drive Safe & Save).

These tools typically require details such as driving history, vehicle information, and specifics about the driver’s epilepsy condition, including treatment plans and seizure frequency. Using online quote tools can save time and provide a clear comparison of different insurance plans and rates.

Drivers can quickly see how different levels of coverage and providers stack up against each other in terms of cost and benefits. Additionally, many insurers offer the option to adjust coverage levels and see the impact on premiums in real-time. This flexibility helps drivers with epilepsy find the most affordable and comprehensive policies that meet their specific needs, ensuring they are adequately protected on the road.

Auto Insurance Rates Increase With Epilepsy

Insurers analyze the level of risk in each and every one of their policyholders when setting rates. However, disabilities and medical conditions on their own are not often factors that will raise rates. In short, the answer to “How much can your auto insurance go up if you have epilepsy?” is none. Epilepsy in and of itself will not hike your rates.

Epilespy and Insurance Facts

| Facts | Source |

|---|---|

| 40% to 60% of patients with epilepsy do not report their condition to authorities. | epilepsy.va.gov |

| Predicting Factors for Seizure Recurrence: recent history, type of seizures, total number of seizures, EEG abnormalities, MRI/CT lesions | epilepsy.va.gov |

| Seizure-related crashes are predictable and preventable | epilepsy.va.gov |

| 10 states have a three-month seizure-free requirement to drive | epilepsy.va.gov |

| 15 states have a six-month seizure-free requirement to drive | epilepsy.va.gov |

However, you still may be charged high-risk auto insurance rates. Let’s take a look at nationwide average rates for collision insurance. This is the form of coverage that individuals with epilepsy would want to purchase, as a seizure would cause loss of control over their vehicle, substantially increasing the risk of a collision.

Collision Auto Insurance Monthly Rates by State

| State | Rates |

|---|---|

| Alabama | $32 |

| Alaska | $32 |

| Arizona | $27 |

| Arkansas | $31 |

| California | $40 |

| Colorado | $28 |

| Connecticut | $34 |

| Delaware | $29 |

| Florida | $30 |

| Georgia | $34 |

| Hawaii | $30 |

| Idaho | $22 |

| Illinois | $28 |

| Indiana | $24 |

| Iowa | $21 |

| Kansas | $24 |

| Kentucky | $26 |

| Louisiana | $41 |

| Maine | $25 |

| Maryland | $35 |

| Massachusetts | $37 |

| Michigan | $40 |

| Minnesota | $22 |

| Mississippi | $31 |

| Missouri | $26 |

| Montana | $24 |

| Nebraska | $23 |

| Nevada | $31 |

| New Hampshire | $27 |

| New Jersey | $35 |

| New Mexico | $26 |

| New York | $38 |

| North Carolina | $29 |

| North Dakota | $23 |

| Ohio | $25 |

| Oklahoma | $29 |

| Oregon | $23 |

| Pennsylvania | $31 |

| Rhode Island | $40 |

| South Carolina | $27 |

| South Dakota | $20 |

| Tennessee | $30 |

| Texas | $37 |

| United States average | $31 |

| Utah | $26 |

| Vermont | $27 |

| Virginia | $26 |

| Washington | $26 |

| Washington, D.C. | $45 |

| West Virginia | $29 |

| Wisconsin | $21 |

| Wyoming | $25 |

The risk of collision is important to consider. While having epilepsy will not affect your rates, having an increased amount of crashes on your record will. The following table compares rates for those with a clean record to those with one accident on their record.

Auto Insurance Monthly Rates by Provider With Clean Record vs. One Accident

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| Allstate | $318 | $416 |

| American Family | $224 | $310 |

| Farmers | $288 | $377 |

| Geico | $179 | $266 |

| Liberty Mutual | $398 | $517 |

| Nationwide | $229 | $283 |

| Progressive | $283 | $398 |

| State Farm | $235 | $283 |

| Travelers | $287 | $357 |

| USAA | $161 | $210 |

As you can see, having one accident on your record can increase your annual rate upwards of $1,500. This is why it is important to have as much collision coverage possible.

Now that we know you cannot be denied auto insurance due to epilepsy, use our tool to find car insurance quotes for epilepsy.

Epilepsy-Friendly Auto Insurance

Just as an insurer cannot discriminate in the form of increased car insurance rates for epilepsy sufferers, they also don’t have policies specifically for epileptics. If you get into an at-fault accident because of a seizure, you will want to maintain your policy. Having an at-fault accident on your record makes it difficult to jump ship to another company.

You can also tell your insurer that your vehicle will not be used for a few months and potentially get a decreased rate. As stated by Webmd.com, most states require you to be seizure-free for about six months to a year before you’re allowed to drive again.

Here is a video from the Epilepsy Foundation of North Carolina that provides further insight into the increased risk of driving with epilepsy.

It is best to err on the side of caution if you have epilepsy. Don’t drive any more than you need to and, if you feel a seizure coming, exercise preventative measures similar to those found in senior safe driving (Read more: Buy Cheap Auto Insurance for Senior Citizens).

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Auto Insurance for Drivers With Epilepsy

Understanding the unique needs of drivers with epilepsy, several top auto insurance companies have tailored their policies to offer comprehensive coverage and peace of mind.

- Case Study #1 – Comprehensive Coverage: John, a driver with epilepsy, sought affordable and reliable auto insurance. State Farm offered John a policy starting at $80 per month, providing extensive coverage tailored to his needs. This gave John peace of mind knowing his policy covered potential risks associated with seizures while maintaining affordability.

- Case Study #2 – Convenience and Flexibility: Emily, managing her epilepsy, required a convenient way to handle her insurance. Progressive provided Emily with an online platform for hassle-free policy management and competitive rates starting at $80 per month. This allowed Emily to effortlessly manage her insurance needs online, ensuring she stayed covered without added stress.

- Case Study #3 – Personalized Support and Guidance: Mark, a driver with epilepsy, valued personal support and guidance. Farmers connected Mark with a local agent who crafted a policy starting at $80 per month, addressing his specific requirements. Mark received tailored coverage and ongoing support from his agent, providing him with confidence and security on the road.

These case studies demonstrate how State Farm, Progressive, and Farmers have successfully addressed the unique insurance needs of drivers with epilepsy (Learn more: Auto Insurance Coverage Types: What You Need To Know).

State Farm is the best auto insurance for drivers with epilepsy, offering comprehensive, affordable coverage starting at $80 per month.

Michelle Robbins Licensed Insurance Agent

Each company’s approach highlights their commitment to providing comprehensive, affordable, and accessible coverage, ensuring drivers with epilepsy can drive with confidence and peace of mind. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

Can I buy auto insurance if I have epilepsy?

Yes, individuals with epilepsy can generally purchase auto insurance. While having epilepsy may affect your rates or policy options, it does not typically disqualify you from obtaining coverage. Discover insights in our “Best Auto Insurance Companies.”

Will having epilepsy affect my auto insurance rates?

Epilepsy may impact your auto insurance rates. Insurers consider various factors when determining premiums, including your driving history, type of vehicle, location, and health conditions. Epilepsy may be considered a risk factor due to the potential for seizures while driving, which could increase your rates.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

What information do I need to provide when applying for auto insurance with epilepsy?

When applying for auto insurance with epilepsy, you will typically need to provide information about your medical condition. This may include details about your diagnosis, treatment plan, medication usage, frequency of seizures, and any restrictions recommended by your healthcare provider.

Can an insurance company deny coverage based on my epilepsy?

In some cases, an insurance company may decline coverage if they consider your epilepsy a significant risk factor. However, it’s important to note that insurance laws and regulations vary by jurisdiction. Some countries or states have laws that prevent insurance companies from denying coverage solely based on a medical condition.

Learn more by reading our guide titled “Shopping for Auto Insurance.”

Are there any specialized insurance companies that cater to individuals with epilepsy?

There may be specialized insurance companies or brokers that cater to individuals with specific health conditions, including epilepsy. These insurers might have a better understanding of the condition and may offer coverage options tailored to your needs. Researching and reaching out to such providers can help you find suitable options.

What type of coverage is best for drivers with epilepsy?

For drivers with epilepsy, comprehensive and collision coverage are recommended to protect against the increased risk of accidents due to seizures.

How can I find affordable auto insurance with epilepsy?

Comparing quotes from multiple insurance providers, maintaining a clean driving record, and opting for policies that match your specific needs can help find affordable auto insurance. Access comprehensive insights into our guide titled “How much does auto insurance cost?“

Does having epilepsy require special considerations when choosing an insurance policy?

Yes, individuals with epilepsy should consider policies that offer strong collision coverage and look for providers experienced in handling medical conditions.

Can I get a discount on auto insurance if I have epilepsy?

While specific discounts for epilepsy are uncommon, maintaining a good driving record, using a vehicle with safety features, and participating in safe driving programs can help secure general discounts.

To find out more, explore our guide titled “Safe Driver Auto Insurance Discount.”

What should I do if my insurance company raises my rates because of my epilepsy?

If your insurance rates increase, consider shopping around for quotes from other providers, discussing your medical management plan with your insurer, or consulting with a broker who specializes in high-risk drivers to find better options.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Do you have to declare epilepsy to insurance?

Yes, when applying for car insurance, you generally need to declare any medical conditions, including epilepsy, to your insurance provider. This is crucial because not disclosing epilepsy can lead to policy invalidation if an accident occurs and the insurer finds out about the condition later.

Can you drive a car if you have epilepsy?

Yes you can drive a car insurance for epilepsy, but it depends on your individual circumstances and local regulations. It’s also important to have car insurance for epilepsy to ensure you are properly covered. Many places require drivers with epilepsy to be seizure-free for a certain period before obtaining a license. Always check with your local DMV for specific rules and requirements.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cynthia Lanctot

Licensed Agent

Cynthia Lanctot is an insurance professional with ten years of industry experience. Cynthia is licensed in several states, and holds an associate in claims law, as well as a bachelor’s degree in English. Cynthia’s experience includes the New England and Northeast states. She currently works as a liability claims professional and an occasional online contributor.

Licensed Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.