10 Cheapest Auto Insurance Companies That Don’t Use CARFAX Reports in 2025 (Save With These Providers)

Geico, Farmers, and Safe Auto are the cheapest auto insurance companies that don’t use CARFAX reports with monthly rates starting as low as $47. These companies excel with competitive rates, flexible coverage, and generous discounts for affordable, CARFAX-independent policies.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Sep 5, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Sep 5, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage With No CARFAX Report

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage With No CARFAX Report

A.M. Best Rating

Complaint Level

Pros & Cons

The cheapest auto insurance companies that don’t use CARFAX reports are Geico, Farmers, and Safe Auto. Geico excels with its broad range of coverage options and discounts, making it a standout choice for budget-conscious drivers.

Farmers impresses with its flexible plans and tailored discounts for safe driving and multi-car policies.

Our Top 10 Picks: Cheap Auto Insurance Companies That Don't Use CARFAX Reports

Company Rank Monthly Rates Bundling Discount Best For Jump to Pros/Cons

#1 $47 15% Budget-Friendly Geico

#2 $48 18% Personal Service Farmers

#3 $49 10% Budget Drivers SafeAuto

#4 $50 12% Flexible Plans Progressive

#5 $51 10% Family Plans Liberty Mutual

#6 $52 12% Comprehensive Plans Travelers

#7 $54 10% Nationwide Reach State Farm

#8 $56 13% Non-Standard Dairyland

#9 $58 15% Full Coverage Nationwide

#10 $65 20% Coverage Options Allstate

Safe Auto provides reliable, cost-effective coverage with minimal CARFAX impact, catering perfectly to those seeking straightforward and affordable insurance solutions.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code above.

- Geico excels with extensive coverage options and discounts

- Farmers provides flexible plans and discounts for safe drivers

- Safe Auto offers affordable insurance with minimal CARFAX impact

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Competitive Monthly Rates: Geico offers some of the lowest rates, starting at $47, making it an ideal choice for those looking for affordable auto insurance without CARFAX reports.

- Generous Bundling Discount: Customers can enjoy a 15% discount when bundling multiple policies, further reducing costs and enhancing value for those who prefer companies that don’t use CARFAX.

- Extensive Coverage Options: Geico provides a broad range of coverage options, ensuring flexibility to meet various insurance needs without relying on CARFAX reports. Explore insurance savings in our full guide titled, “Geico Auto Insurance Review.”

Cons

- Limited Customization: Geico’s policy options may lack the depth of customization available from other insurers not using CARFAX reports, potentially leaving some specific needs unmet.

- Potential for Higher Premiums: Despite competitive rates, certain drivers may still experience higher premiums if they have unique or extensive coverage requirements, even with CARFAX-free options.

#2 – Farmers: Best for Personal Service

Pros

- Significant Bundling Discount: Farmers offers an 18% discount for bundling multiple policies, providing substantial savings for clients who avoid CARFAX reports and prefer comprehensive coverage options.

- Personalized Service: Known for its high level of customer service, Farmers excels in delivering personalized insurance solutions tailored to individual needs, beneficial for those seeking a more hands-on approach without CARFAX.

- Flexible Coverage Plans: Farmers provides a wide range of coverage plans that can be customized to fit specific requirements, catering well to drivers who choose not to use CARFAX reports. Learn more about the offerings in our guide titled, “Farmers Auto Insurance Review.”

Cons

- Higher Premiums: Farmers’ premiums might be relatively higher compared to competitors, which could be a drawback for those looking for budget-friendly options and avoiding CARFAX reports.

- Less Advanced Digital Tools: Farmers’ digital tools and online resources might not be as advanced or user-friendly, potentially impacting convenience for tech-savvy clients.

#3 – SafeAuto: Best for Budget Drivers

Pros

- Affordable Monthly Rates: SafeAuto’s rates start at $49 per month, offering cost-effective insurance solutions for drivers who prefer not to use CARFAX reports. Access detailed insights in our guide titled, “SafeAuto Auto Insurance Review.”

- Basic and Accessible Coverage: SafeAuto specializes in straightforward, no-frills insurance coverage, ideal for budget-conscious drivers who need essential protection without CARFAX involvement.

- Bundling Discounts: The 10% discount on bundled policies provides additional savings, making SafeAuto a viable option for those looking to economize while avoiding CARFAX reports.

Cons

- Limited Coverage Options: SafeAuto may offer fewer coverage choices compared to other insurers not using CARFAX reports, which could be a limitation for those needing more comprehensive protection.

- Basic Service Offerings: The level of customer service and additional features provided by SafeAuto might be minimal, which may not meet the expectations of drivers seeking extensive support and customization.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – Progressive: Best for Flexible Plans

Pros

- Adaptable Coverage Options: Progressive offers a range of flexible coverage plans tailored to diverse needs, catering well to drivers who prefer companies that don’t use CARFAX reports. Dive into our article called, “Progressive Auto Insurance Review.”

- Discount Opportunities: With a 12% bundling discount, Progressive allows clients to save more by combining multiple insurance policies, benefiting those who avoid CARFAX reports.

- Innovative Tools: Progressive provides various digital tools and resources, such as the Name Your Price® tool, which helps clients find coverage within their budget without needing CARFAX reports.

Cons

- Potential for Higher Costs: Despite flexibility, Progressive’s premiums might be higher for some drivers, particularly those with extensive or specialized coverage needs, even when avoiding CARFAX.

- Complex Policy Structure: The range of options and discounts can make navigating Progressive’s policies complex, which might be overwhelming for customers seeking straightforward insurance without CARFAX.

#5 – Liberty Mutual: Best for Family Plans

Pros

- Family-Centric Discounts: Liberty Mutual offers discounts and coverage tailored specifically for families, providing substantial savings and protection without the use of CARFAX reports.Obtain detailed insights by reading our guide titled, “Liberty Mutual Auto Insurance Review.”

- Customizable Coverage: Liberty Mutual allows for extensive customization of policies, catering to various family needs and ensuring adequate coverage for those who prefer not to use CARFAX.

- Bundle Savings: With a 10% discount for bundling multiple policies, Liberty Mutual provides a cost-effective solution for families looking to consolidate their insurance without relying on CARFAX reports.

Cons

- Higher Starting Rates: Liberty Mutual’s premiums begin at $51, which might be higher compared to other providers, potentially affecting affordability for those avoiding CARFAX.

- Service Variability: The quality of customer service can vary, and some clients may experience less consistent support, which could be a drawback for families needing reliable service without CARFAX reports.

#6 – Travelers Insurance: Best for Comprehensive Plans

Pros

- Extensive Coverage: Travelers excels in providing extensive insurance plans that cater to a variety of needs without relying on CARFAX reports, ensuring comprehensive protection.

- Attractive Bundling Discount: With a 12% discount for bundling multiple policies, Travelers offers significant savings for those who require a broad range of coverage.

- Competitive Rates: The monthly rates for Travelers are competitive, particularly for customers seeking comprehensive insurance options without the reliance on CARFAX reports. Access detailed insights in our guide titled, “Travelers Auto Insurance Review.”

Cons

- Limited CARFAX Utilization: The lack of CARFAX report integration may result in higher premiums for high-risk drivers or those with unusual vehicle histories.

- Potentially Higher Premiums: Despite attractive bundling discounts, premiums might still be on the higher side for certain coverage levels compared to more specialized competitors.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – State Farm: Best for Nationwide Reach

Pros

- Wide Availability: State Farm provides extensive nationwide coverage, making it an ideal choice for those needing reliable insurance across different states without using CARFAX reports.

- Beneficial Bundling Discounts: Customers can take advantage of a 10% discount when bundling policies, which helps lower costs while ensuring broad coverage. Read the article called, “State Farm Auto Insurance Review” for additional insights.

- Strong Local Presence: State Farm’s extensive network of local agents ensures personalized service and effective handling of claims and coverage adjustments.

Cons

- Lower Bundling Discount: The 10% bundling discount, while helpful, is lower compared to some competitors, potentially reducing overall savings for customers.

- Potential Premium Costs: Premiums may remain relatively high for certain coverage levels, even with bundling discounts, particularly if CARFAX reports could offer more tailored pricing.

#8 – Dairyland: Best for Non-Standard Coverage

Pros

- Specialized Non-Standard Coverage: Dairyland shines in offering non-standard insurance options, catering to drivers with unique or high-risk profiles without the use of CARFAX reports.

- Generous Bundling Discount: With a 13% discount for bundling multiple policies, Dairyland provides substantial savings for those needing specialized coverage. Uncover details in our guide titled, “Dairyland Auto Insurance Review.”

- Affordable Monthly Rates: Monthly rates are competitive, especially for those seeking non-standard insurance solutions, making it a cost-effective choice in this category.

Cons

- Niche Market Focus: Dairyland’s emphasis on non-standard coverage may not suit drivers seeking standard or traditional insurance options.

- CARFAX Report Impact: The exclusion of CARFAX reports may limit the ability to adjust rates or coverage based on detailed vehicle histories, affecting high-risk or unique insurance needs.

#9 – Nationwide: Best for Full Coverage

Pros

- Comprehensive Full Coverage: Nationwide provides robust full coverage options, ensuring extensive protection without the dependency on CARFAX reports, ideal for drivers seeking thorough insurance solutions.

- Attractive Bundling Savings: Offers a 15% discount for bundling policies, which is advantageous for customers requiring full coverage and wanting to save on insurance costs.

- Reliable Financial Stability: Known for its strong financial stability and reliable service, Nationwide is a trusted provider for comprehensive insurance needs. Gain insights from our guide titled, “Nationwide Auto Insurance Review.”

Cons

- Higher Premiums: Full coverage premiums may be higher compared to some other providers, which could impact affordability despite bundling discounts.

- Limited CARFAX Integration: The lack of CARFAX report usage might limit the ability to fine-tune premiums and coverage based on detailed vehicle data, affecting high-risk drivers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#10 – Allstate: Best for Coverage Options

Pros

- Varied Coverage Options: Allstate excels in offering a wide range of coverage options, catering to diverse insurance needs without using CARFAX reports, ensuring flexibility for customers.

- Significant Bundling Discount: Provides a substantial 20% discount for bundling multiple policies, making it a cost-effective choice for those seeking extensive coverage.

- Extensive Agent Network: Allstate’s broad network of agents offers personalized service and efficient management of claims and coverage adjustments. Dive into our article called, “Allstate vs. State Farm Auto Insurance.”

Cons

- Higher Monthly Rates: Despite offering extensive coverage options, Allstate’s monthly rates can be higher compared to other providers, which may impact affordability.

- CARFAX Report Limitations: The absence of CARFAX reports might limit the ability to adjust rates and coverage based on detailed vehicle histories, potentially affecting pricing for certain drivers.

Monthly Auto Insurance Rates: No CARFAX Report Companies

When comparing auto insurance rates from companies that don’t use CARFAX reports, significant variations emerge based on coverage levels. For minimum coverage, Geico leads with the lowest rate of $47, making it the most affordable option among providers.

Auto Insurance Monthly Rates Without a CARFAX Report by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $65 $145

Dairyland $56 $139

Farmers $48 $132

Geico $47 $130

Liberty Mutual $51 $136

Nationwide $58 $140

Progressive $50 $135

SafeAuto $49 $134

State Farm $54 $138

Travelers $52 $137

In the full coverage category, Geico also offers a competitive rate of $130, again positioning itself as a top choice for cost-conscious consumers. Travelers Insurance follows closely with a monthly rate of $52 for minimum coverage and $137 for full coverage, reflecting its commitment to balancing affordability with comprehensive protection.

Each provider’s rate varies, highlighting the importance of comparing options to find the best fit for individual needs. To discover more about the company, visit our guide titled, “Auto Insurance Coverage Types.”

Insurance Claims Reported to Carfax

Not every single accident will be reported to Carfax, though most do. Some auto insurance companies don’t report all accidents to Carfax. In fact, Carfax has reported that thousands of accidents go unreported each day.

There are a few reasons why every car accident doesn’t get reported to Carfax. This could be because the insurer doesn’t want to change your car’s value, the claim wasn’t filed correctly, or the accident wasn’t reported at all.

In most cases, a claim that is submitted to your insurer will likely result in an adjustment to your vehicle’s Carfax report. If you were to have repairs done privately, the information wouldn’t be adjusted via Carfax.

While many vehicle dealers rely on Carfax to promote a car’s safety, Carfax vehicle history data sources have quite a few limitations that aren’t ideal for consumers, as identified above.

Read more: How to File an Auto Insurance Claim

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Impact of Reporting an Accident to Carfax

To keep it simple, your vehicle’s accident history will cost you money. Your driving history is one of the first factors considered when determining your auto insurance rates.

Even if you weren’t at fault for your accident, your monthly rates could increase. How far back do auto insurance companies look? Some companies look just three years back while others look up to seven.

Beyond a steep increase in your auto insurance rates, an accident on your Carfax report can decrease the value of your vehicle. If you plan to sell your vehicle, this is obviously negative.

Your Carfax value can give dealerships or private buyers the ability to negotiate a lower price. As a consumer, you’re also limited on what information you can find with a Carfax VIN check.

In most cases, you’ll be informed of an accident but not of the nature and severity of that accident. Sadly, a fender bender and a totaled vehicle could potentially be marked the same on a Carfax report.

The same is true of Carfax if damage is reported vs. an accident being reported. You’ll know something happened, but not exactly what. If you’re concerned about a Carfax report, a CLUE report can help to confirm some of the details regarding accidents or claims.

CLUE, or Comprehensive Loss Underwriting Exchange, can provide information reported to insurance companies, according to the Washington State Office of the Insurance Commissioner.

Removing Accidents from Carfax

If you’re looking to sell your car, you might want to review your Carfax report and dispute any negative remarks on your vehicle. While this won’t have much effect on your auto insurance, it can help you sell your vehicle for more.

Travelers Insurance combines affordable monthly rates and extensive coverage, ensuring top-tier protection without the need for CARFAX reports.

Jimmy McMillan Licensed Insurance Agent

To have an accident or damage removed from your Carfax report, you’ll need to compile evidence and visit the Carfax claims center online. You should be able to submit everything there to dispute negative remarks.

There are some auto insurance companies that don’t penalize you for small accidents despite a change in your vehicle’s Carfax report. For more information, check out our complete guide titled, “Does auto insurance cover DUI accidents?”

Auto Insurance Companies and Carfax Accident Reporting

Auto insurance companies may or may not report an accident to Carfax. In most cases, your insurer will report an accident to Carfax unless you pay for repairs privately.

By now, you should know the basics about the auto insurance companies that don’t count accidents reported on Carfax. Before you go, enter your ZIP below to get free quotes in minutes.

Frequently Asked Questions

What is CARFAX?

CARFAX is a widely used vehicle history reporting service that provides information about a vehicle’s past, including accidents, damage, mileage, and other important details. Insurance companies often refer to CARFAX reports when assessing the risk associated with a vehicle.

Dive into our article called, “Best Auto Insurance Companies.”

Why do insurance companies consider CARFAX reports?

Insurance companies rely on CARFAX reports to evaluate the risk of insuring a particular vehicle. Accidents reported on CARFAX can indicate previous damage, repairs, or other issues that may impact the safety and reliability of the vehicle.

Are there auto insurance companies that don’t count accidents reported on CARFAX?

Yes, there are some auto insurance companies that may not consider accidents reported on CARFAX when determining insurance rates or coverage eligibility. These companies may have their own evaluation methods or criteria for assessing risk.

Do insurance companies that don’t count CARFAX accidents offer cheap rates?

While insurance companies that don’t count CARFAX accidents may offer more lenient coverage options, it does not guarantee cheap rates. Insurance premiums are influenced by various factors, including your driving record, location, vehicle type, and personal details. Comparing quotes from multiple insurers remains crucial to finding the most affordable coverage.

Can I hide accidents reported on CARFAX from insurance companies?

It is important to note that providing false information or deliberately hiding accidents from insurance companies is considered insurance fraud and is illegal. It is always best to be honest and transparent when providing information to insurance companies.

Uncover details in our guide titled, “10 States With the Fewest Auto-Related Scams.”

Does a fender bender count as an accident on Carfax for insurance purposes?

Yes, if the fender bender is reported to your insurance company and they submit the claim to Carfax, it will appear on your Carfax report and may affect your car insurance rates.

Does Geico report insurance claims to Carfax?

Yes, Geico can report insurance claims, including accidents, to Carfax. This means that any claims you file with Geico could appear on your Carfax report and potentially impact your car’s insurance history.

Does my car insurance report to Carfax?

Yes, many car insurance companies report accidents and claims to Carfax. This means incidents covered by your insurance can appear on a Carfax report, affecting your vehicle’s insurance history and potentially influencing future insurance premiums.

What is the cheapest car insurance for a bad history with CARFAX Reports?

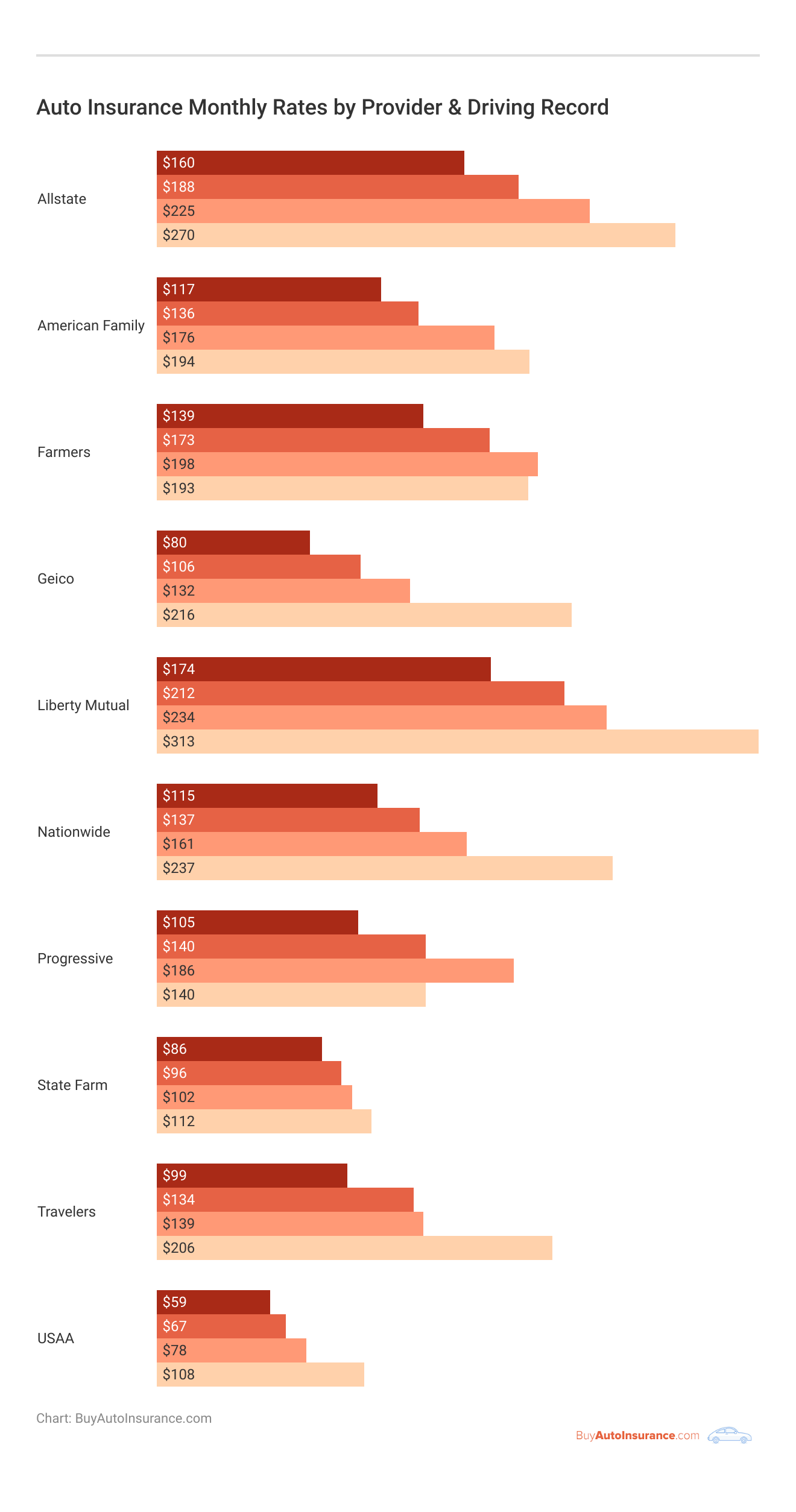

After an accident, State Farm offers rates that are 38% lower than average, making it a budget-friendly option even with negative CARFAX Reports. For drivers with a ticket, State Farm costs about one-third less than average. Progressive is often the most affordable after a DUI, at 30% less than the average rate, while Erie and USAA can also offer competitive rates despite a poor CARFAX Report.

To discover more about the company, visit our guide titled, “Affordable No Down Payment Auto Insurance.”

Which insurance company is most reliable according to CARFAX Reports?

The best car insurance companies of September 2024 include Nationwide as the best overall, USAA for military members and veterans, Travelers for drivers with a speeding ticket, Erie for drivers who have caused an accident, Progressive for drivers with a DUI, and Geico for drivers with poor credit, regardless of their CARFAX Reports.

What is the best car insurance company for a bad driving record with CARFAX Reports?

For drivers with violations such as tickets and negative entries on their CARFAX Reports, State Farm, USAA, Nationwide, Geico, Progressive, and Travelers are considered the best high-risk auto insurance companies. Compare rates to see if you are overpaying for car insurance.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Who is the cheapest car insurance provider for those with negative CARFAX Reports?

For drivers with a poor driving record reflected in their CARFAX Reports, State Farm often emerges as the cheapest provider, especially after an accident. However, comparing quotes from multiple companies like Progressive, Erie, or USAA can help find the best deal.

At what age is car insurance cheapest, as seen on CARFAX Reports?

Experienced drivers with clean CARFAX Reports are generally cheaper to insure. Insurance premiums decrease significantly for drivers aged 19-34 and then stabilize or slightly decrease from 34-75. At age 75, premiums usually start to increase again.

For additional details, explore our comprehensive resource titled, “How to Lower Your Auto Insurance Rates.”

What is the credit limit for insurance and how does it relate to CARFAX Reports?

The “Credit Limit” in insurance refers to the maximum amount the insurer will pay in indemnity in the event of a claim. This limit can be influenced by your risk profile, which might include details from your CARFAX Report.

Which type of insurance is best for an old car with CARFAX Reports?

For older vehicles, especially those with clean CARFAX Reports and lower values, you might save on premiums by opting out of comprehensive and collision coverage. However, if you have a loan or lease on the vehicle, comprehensive coverage is often required.

What is the lowest form of car insurance noted in CARFAX Reports?

The minimum car insurance typically required by states is liability coverage, which covers injuries and damages you’re liable for in an accident. Standard limits include $25,000 per person for bodily injury, $50,000 per accident, and $25,000 for property damage.

Which insurance is the cheapest after an accident, according to CARFAX Reports?

State Farm is generally the cheapest car insurance provider for drivers with accidents reported on their CARFAX Reports. Comparing quotes from multiple insurers can help you find the best deal, even with a less-than-ideal driving history.

To find out more, explore our guide titled, “Buying Liability Auto Insurance Coverage.”

Do I really need fully comprehensive car insurance if it’s on my CARFAX Report?

While no state mandates collision and comprehensive coverage, these types of insurance are valuable and often required if you have a car loan or lease, to protect the lender. Having these coverages on your CARFAX Report can indicate comprehensive protection of your vehicle.

What is the lowest level of car insurance, and how does it appear on CARFAX Reports?

The lowest level of car insurance typically required by law is state minimum liability coverage, which might not be enough in case of a severe accident. CARFAX Reports don’t usually display insurance details, but minimum coverage may not provide adequate financial protection.

Which type of insurance is best for an old car, especially when considering CARFAX Reports?

For older vehicles with a clean CARFAX Report and low market value, skipping comprehensive and collision coverage could lower your premium. However, if your vehicle is financed or leased, you may still need these coverages as required by the lender.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.